“Oh no! It’s time to go!”

Markets have corrected to a new low.

But when markets touched a new high,

wasn’t it too expensive to buy?

There may be a hundred reasons to not;

But you lose each time you don’t take the shot.

Sadly, for some, there is no reason adequate;

They spend their life, standing at the gate

These days are so surreal.

Streets are abandoned, shops are shut, there’s a lot happening in the world yet not as much as a whisper to be heard in the alleys but at the same time, we are spending time with family that seemed like a life goal till a couple of days back, many are witnessing nature’s little surprises like peacocks walking free in a housing society, people are developing new skills, indulging in hobbies & being more considerate towards everyone around and more importantly, being grateful for the blessings we often took for granted.

It is important and high time we understood –

Quiet does not equal to dull.

Distancing does not mean aloof.

Staying home does not mean idle.

And importantly –

No action does NOT reflect indecision.

Hold on to these thoughts as we attempt to give you a fresh perspective into real investing.

Let’s get to the most important question today – “Markets have tanked; what do I do?”

There is a good chance you opened this email out of sheer excitement to take an action on your investments. But, here’s why you must take a step back and think!

Action bias, or in other words – the urge to do something when something happens even though it does not necessitate you to do anything, is turning out to be the biggest factor to wealth erosion.

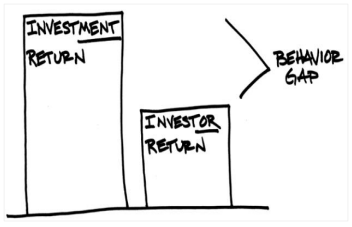

Given that the urge to take action is a typical behaviourdriven situation, I would like to quote a self- explanatory sketch from ‘The Behavior Gap’ by Carl Richards.

While this is a very crude sketch, it is perhaps the most powerful I’ve seen.

There is enough and more data to prove how profitable capital markets are, but the fact of life is that most investors haven’t experienced it first-hand and subsequently tilt towards believing that wealth creation by capital markets is actually a myth perpetuated by the industry.

But let me assure – YOU (read as: your actions) are more responsible for your investment performance than the markets are. Following are the behavioural fallacies that lead to a not-so-good wealth creation experience.

Gap #1: Nobody can time the market, but many try to do so – albeit unsuccessfully

Back to basics. Price of an equity share is determined by the demand-supply mechanics driven by billions of dollars, billions of investors, millions of algorithms. Also, every optimistic buyer at a price point has a pessimistic seller. And hence, it is difficult for anyone to predict the market accurately since that would require predicting the movement of the expansive range of participants.

Gap #2: You can’t wake a person who is awake!

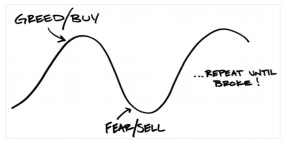

The number one rule for profitability is “buy low, sell high”. Now, I know this is common sense and you already know this.

But what you may not know is that most investors tend to do the exact opposite by succumbing to their own emotions.

The image alongside, again borrowing from Carl Richards, is how most investors manage their investments:

Gap #3: Time, and not timing, is your friend in the market

Wealth-creation is a long process requiring patience and persistence. It is best to try quick bets in the casino or at the race-tracks. Capital markets, contrary to popular belief, is a more of a wealth-building avenue than a money- minting machine.

Pick any index – perhaps Nifty for this case. In the short term, all you will see is high volatility across a chart reacting to various events. But, in the long term, you will notice an uptrend emerging! It is important to ride the uptrend and ignore the volatility. Be an investor, not a trader.

Volatility is a sign of life. And besides, how would anyone ever make money if there was never a low and never a high let alone having multiple opportunities between multiple lows & highs.

But then, what do we do? How far is the recovery?

Let me keep it simple.

Now is a great time to not touch your eyes, nose, mouth & existing portfolio.

We all know that the markets are battered because of the virus outbreak and by experience we know that every time there’s a pandemic, it causes panic and fairly so.

From this perspective, the market recovery is almost as far as collective health recovery is. In contrast to the 2008 crisis, global central banks are more prepared, proactive and coordinated which is expected to lead to a relatively quicker recovery as soon as we arrive at a solution to protect mankind from this virus outbreak.

Meanwhile, if you believe in the collective intelligence of mankind and have faith that we will overcome this pandemic and emerge victorious, there’s no reason to not believe that people will continue to engage in commerce, companies will continue to flourish and your investments in Indian equities will more than just compensate you for your endurance during the period.

If your goals are not due till perhaps the next five or more years, try to capitalise on the situation by stepping up your SIPs. Meanwhile, stay healthy & ensure that your actions are in line with staying wealthy.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2T7nyVU||target:%20_blank|” button_position=”button-center”]