What is a Windfall Gain?

A windfall gain is sudden gain in income, which is considerably abundant, and can be expected or unexpected in nature. It could be a result of unexpected events such as winning a lottery or contest, unforeseen inheritance or gains from sale of property or anticipated events such as gains by way of bonus or provident fund. Whatever be the reason behind such gains, many find themselves in a huge dilemma on how to utilise such gains in the most effective way.

What to do with Windfall Gain?

Debt Pay-Off: Good Loan v/s Bad Loan

Paying off debt or investing the money are the two major decisions which need to assessed after weighing all the pros and cons It is always a wise choice to pay off your debts and reduce the loan amount as not only does it reduce your liability but also gives you a sense of financial freedom. Loans like a personal loan or credit card dues are high interest bearing debts and can take a considerable toll on your income each month; hence it is always a good idea to pay-off such debts. Credit Card debt is a vicious cycle and needs to be paid off even without windfall gains. Personal loans or small asset or car loans can also be paid off as there is no benefit in continuing the loan. However, not all debts are bad debts.

If you have a housing loan or and educational loan then you can continue with such loans as these loans are affordable especially in today’s low interest rate regime. Not only are these loans cheap but also tax-efficient. If you foreclose such loans then you also lose out on the tax advantage that comes with such loans. Instead you can look at investing the surplus amount in investments which can help in generating additional income by way of higher returns than the interest cost of such loans.

Investment:

You can look at investing the surplus in stocks, real estate or mutual funds or any other high yielding products which provide you the opportunity to generate considerable capital appreciation in the long –run and at the same time provide additional income, like dividends in case of stocks and rentals in case of properties. However, while making such investments one must keep in mind their long and short-term financial goals and your overall asset allocation. You need to keep in mind your risk appetite as well while investing.

Sudden income does not mean that you can invest in riskier instruments. Your investments should be aligned to your investment objective. Likewise, if you are a conservative person and only looking to invest in FDs then you would be better-off investing in a debt fund instead as FD returns today are negligible and do not even beat inflation.

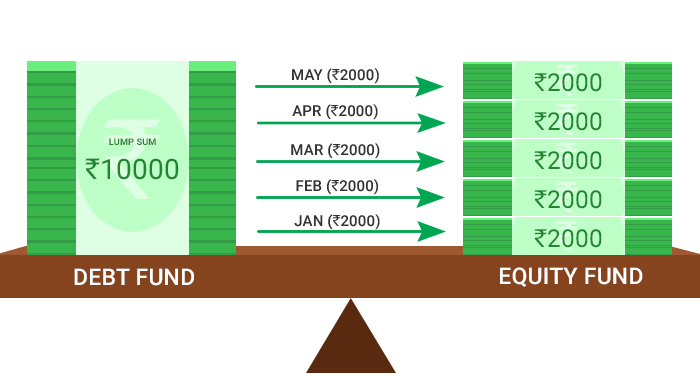

The ideal strategy to invest a lumpsum amount is through the systematic transfer plan (STP) route. An STP is a provision where a lumpsum amount can be invested into liquid funds (liquid funds are the safest type of debt mutual fund and yields returns close to 8% range). A small part of the amount invested in the liquid fund will be invested in equity mutual funds periodically (like an SIP).

Benefits of an STP:

Investing the lumpsum amount into a liquid fund instead of an equity fund ensures that you do not catch a high price point and at the same time, also ensures that you receive almost 4% higher than what you could get from a savings bank account.

The periodic transfer of smaller amounts in equity funds ensure a disciplined SIP-like approach to ensure that your investment is cost-effective and you gain exponential returns linked to the equity market.

After partial amount is transferred to the equity fund, the balance amount (still in liquid fund) would continue to yield safer returns.

Conclusion

Thus, the key to make the most of such windfall gains lies in carefully weighing all your options and taking a broader view of your financial situation and choosing the best fit for you.

A simple back-of-the-envelope calculation would be to determine if the expected returns from an investment is higher or the interest cost on debt- you must invest if the expected return is higher and pay the debt down if the interest cost is higher.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2Dwk2zB||target:%20_blank|” button_position=”button-center”]