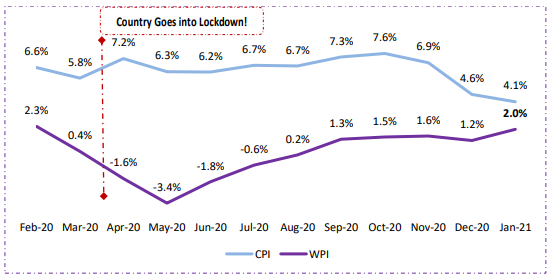

What is the latest WPI reading?

India’s wholesale inflation touched its highest figures in last 11 months, coming in at 2.03%. WPI Inflation increased again after seeing a fall post a 5-month rise in the month prior. WPI inflation stood at 1.22% in December 2020 and 3.1% in October 2019.

WPI maintained its record of positive figures, signaling producers regaining pricing powers. The rise in WPI is mainly due to price increases of manufacturing items as consumer demand, and industrial production marks a comeback.

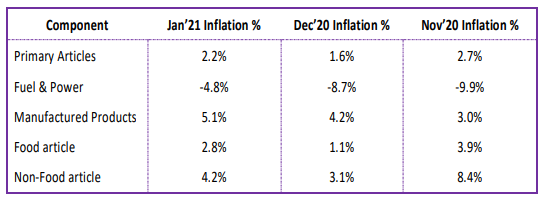

Element Inflations

It is not appropriate to compare WPI inflation in post pandemic months with months preceding the COVID 19 pandemic.

The rise in WPI recorded mild uptick due to high base-effect. Element study breakdown shown below:

❖ Primary Articles (Weight – 22.62%)

- Index value decreased to 143.9 from 146.5 in prior month, recording fall at 2.2%

- Fall in prices of vegetables, potatoes and, onions were key contributors in deflating Primary Article Inflation

- While Food article prices softened, Non-Food articles jumped significantly, recording inflation contributions at 4.2% from 3.1% last month

❖ Fuel & Power (Weight – 13.15%)

• Index value increased to 99.7 from 94.2 in prior month, with WPI element softening from -8.7% inflation of last month

• Price for crude petroleum and natural gas increased in January vis-à-vis last month figures

❖ Manufactured Products (Weight – 64.23%)

• Index value increased to 124.9 from 123.0 in prior month, with WPI element recording 5.1% inflation

• Majority of sub-elements witnessed an increase in prices, thus making category price key reason for WPI uptick

❖ WPI Food Index

• The Food Index consists of ‘Food Articles’ from Primary Articles and ‘Food Product’ from Manufactured Products

• While index value decreased from 154.4 to 151.8, WPI inflation rate fell to -0.3%

Investor Takeaway

WPI can see minimal lifts on the upside before normalization of “New Normal” as higher base effect comes into play.

Momentum of pick-up in vegetable prices, with higher demand and unlockings will keep core inflation at elevated levels.

The exceptionally low base related to the crash in fuel prices in January-March 2020 quarter, juxtaposed with the hardening of crude oil as well as other commodity prices in the ongoing month, can see the headline WPI inflation record large upticks over the course of the next few months

It is likely to remain on pause in next meet and consider rate-cuts only after efficacy in transmission of prior rate-cuts.

It is likely for RBI to lean towards out-of-the-norm practices to continue to channelize Demand-&-Supply behaviour in the country.

Click here If you want to read the complete WPI Inflation press release.