What is the latest RBI MPC Meet reading?

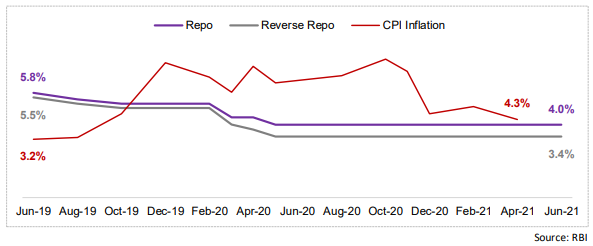

RBI keeps interest rates unchanged at 4.00%, maintaining accommodative stance. Reverse Repo also held at 3.35%.

This is sixth consecutive time, RBI has chosen to hold key rates. It comes in midst of Inflation coming back to 4% territory after aggressive patterns in shaky economic climate over past two months.

The inflation-targeting framework of 4(+/-2)% band is adopted for the next five years up to March 2026, ending speculation about adoption of interest-expensive stances to boost growth. Any further loosening can undermine the central bank’s ability to set effective monetary policy.

key reason for current flat-line inflation is the realization of the high base-effect. The base play can misguide real inflation figures in H1CY2021, courtesy of extraordinary inflation seen in comparison figures.

Addressing the accommodative stance, all four members of the MPC found merit in focusing on growth via polices and packages. RBI is to use arsenal of unique liquidity and similar supportive strategies to maintain current pace of expedited growth.

Inflation outlook is alterable for the near-term, being influenced by either the vaccine or the virus. Active monitoring and timely measures to prevent emergence of supply chain bottlenecks and build-up of retail margins will require special monitoring.

In giving estimates, MPC put forward following CPI print figures:

❖ 5.1% for FY22

❖ 5.2% for Q1FY22

❖ 5.4% for Q1FY22

❖ 4.7% for Q1FY22

❖ 5.3% for Q1FY22

On the growth front, rural demand remains strong and the expected normal monsoon bodes well for sustaining its buoyancy, going forward. Adoption of new COVID-19 compatible occupational models by businesses for an appropriate working environment may cushion the hit to economic activity.

In giving estimates, MPC put forward following GDP growth print figures:

❖ 9.5% for FY22

❖ 18.5% for Q1FY22

❖ 7.9% for Q1FY22

❖ 7.2% for Q1FY22

❖ 6.6% for Q1FY22

Speaking on liquidity, RBI governor maintained his voice and action on promoting easy access of liquidity across the credit system in the country. Liquidity window of Rs. 150 bn with tenors of up to three years at the repo rate till March 31, 2022 for certain contactintensive sectors, incentivizing moderating a separate Covid loan book, and special liquidity facility of Rs. 160 bn to SIDBI at repo for one year are key examples of this notion.

As of date, System liquidity remained in large surplus in April and May 2021 with average daily net liquidity absorption of Rs. 5.2 lakh crore

Acknowledging foreign flows, RBI said it will continue to formulate supportive policies with aim to directly benefit financial stability.

Key takeaways:

Monetary policy seems not leaving any stone unturned in helping support and revive the economy from the ongoing impact of Covid-19.

Upcoming govt. bond purchases under GSAP – 1&2, totalling $1.6 trillion will be recognised as supportive across growth verticals of economy, dampening Covid’s effect on demand-&-supply chains.

Click here If you want to read, “Monetary Policy Statement, 2021-22 Resolution of the Monetary Policy Committee (MPC) – Jun’21