The recent pandemic has thrown markets in a frenzy as fundamental expectations clash with extreme sentiments and desperate attempts to evaluate the economic impact on companies.

The past two months have been relatively easy for media houses covering the stock market as copywriters focus on creating sensational versions of doom-and-gloom. However, for a moment, let’s focus on a larger opportunity lurking behind gloom.

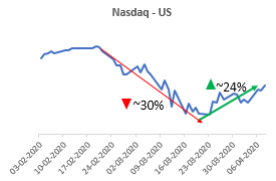

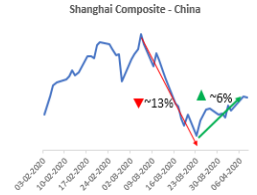

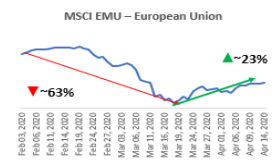

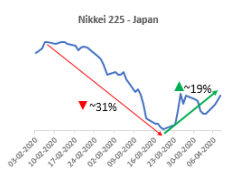

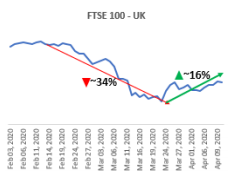

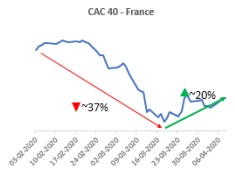

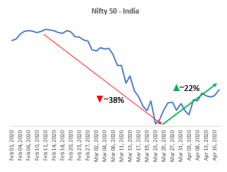

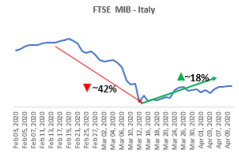

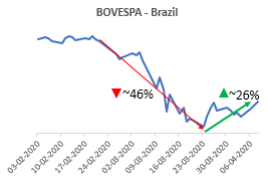

A closer look at recent performance of major global indices would reflect a marked improvement after what was touted as perhaps the worst crash since 2008 – and worse in some exchanges.

To a meaningful degree, the uptick reflects normalisation & rationalisation of investor expectations along with an acknowledgment of how collaborative efforts of global central banks will uphold the economies till we’ve won this battle against the pandemic.

In its meeting on 26 Mar’20, G20 committed to collectively inject over $5 trillion to contain job & income losses. The group also made a statement that went on to be the headlines of almost every pink newspaper the next day – they will “do whatever it takes” to tackle the pandemic.

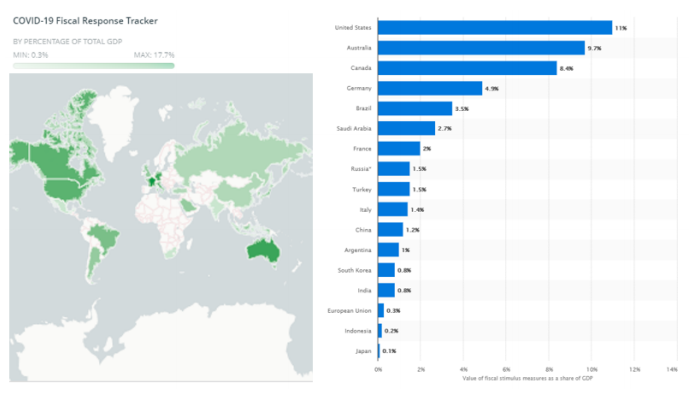

Ever since the onslaught of the pandemic, governments & central banks around the world have been rather proactive, collaborative & coordinated in unleashing unprecedented stimulus – fiscal as well as monetary. While this is happening globally, here’s a brief account covering the G20 – a group of the top 20 economies.

Let’s take a closer look at how central banks are being the economic superheroes today when economies need them the most. We’ve tried to include snippets of how stock markets are responding to the stimuli wherever applicable.

For the less curious, here’s an overview of G20’s fiscal stimulus response, courtesy CSIS & Statista.

Here’s an economy-wise account of key fiscal & monetary policy measures undertaken by central banks & a

peek into how respective stock exchanges have received it

An Account of Central Banks’ Key Measures to Support the World Economy

1. United States of America

Key Economic Measures:

• $2.2 trillion economic aid package released by the U.S. Fed

• The aid package includes $500 bn fund to assist most impacted industries & similar amount to be distributed to families as direct benefit

• Pledged $700 billion in asset purchases (quantitative easing program)

• Key policy rate cut to 0%-0.25%

• Promise of an unlimited quantitative easing program

2. China

Key Economic Measures

• Preparedness to spur public expenditure, especially into infrastructure backed by local government special bonds worth as much as 2.8 trillion Yuan

• Reserve requirement ratio cut for small banks by 100 bps; releasing 400 bn Yuan into the system

• Easier funding for SMEs through increased re-lending & rediscounting quotas up to 500 billion Yuan

• Increase in policy banks’ loan quota by 350 billion Yuan to spur credit to target business segments

3. Europe

Key Economic Measures

• EU’s total fiscal response to the tune of 3.2 trillion Euros

• Cut interest rates on TLTROs by 25 bps resulting in banks having increased access to cheap loans

• Suspension of limits on EU government borrowing

• European Stability Mechanism bailout fund will make 240 billion Euros worth of cheap credit available to EU governments

• European Investment Banks add 200 billion Euros for lending

4. Japan

Key Economic Measures

• Total economic package of over $1 trillion (20% of GDP)

• Package includes cash payouts of ~$55 billion to households & Small & Medium Enterprises

• Ramping up government purchase of ETFs & corporate bonds

• Working on creating a new loan programme to extend one-year, zerointerest loans to financial institutions

• Funding for upgradation of medical facilities

5. Germany

Key Economic Measures

• Agreed package worth up to 750 billion Euros

• 100 billion Euros earmarked for purchase of equity stakes in companies

• 400 billion Euros in loan guarantee to secure risk of corporate debt defaults

• 100 billion Euros in credit to public sector development bank for loans to focus sectors

6. United Kingdom

Key Economic Measures

•Policy rate cut to record low of 0.1%

•200 billion pounds worth of bond purchases; corporate bond purchase program to be worth 20 billion pounds

•Bank of England corporate financing facility to buy investment-grade corporate papers with maturity of 12 months

•Businesses allowed to temporarily hold onto VAT worth 30 billion pounds

•330 billion pounds in loan guarantees to businesses

7. France

Key Economic Measures

• 45 billion Euros aid package to support companies & workers

• Bank loans guaranteed up to 300 billion Euros

• 1 billion Euros set aside for small companies who lost >70% of revenue YoY in Mar’20.

• 8.5 billion Euros earmarked towards stabilising employment

8. India

Key Economic Measures

• Incremental liquidity infused in the system to the tune of INR 3.74 Lakh Crore through various monetary policy measures including the TLTRO and a combination of CRR, SLR, Repo, Reverse Repo, LCR cuts

• INR 1.7 Lakh Crore of fiscal stimulus including free food grains, cooking gas & direct benefit transfers to select cohorts of demography

• Three-month moratorium on loan repayment for retail as well as working capital loans

9. Italy

Key Economic Measures

• Over 425 billion Euros to be injected into the economy to support ailing businesses

• Suspension of select loan & mortgage payments for individuals and companies

• Assistance to firms to pay workers that have been laid-off

10. Brazil

Key Economic Measures

• Interest rates cut by 50 bps & capital requirements for financial institutions eased

• Purchase of bank loan portfolios worth 1.2 trillion reais

• Central bank intervention in forex markets & repurchase of dollar bonds

• 201 billion reais budget to support people & preserve jobs

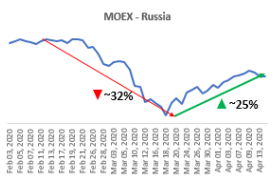

11. Russia

Key Economic Measures

• State payments of 12,130 rubles monthly to SMEs for every employee, provided they maintain 90% of workforce

• A package of 200 billion rubles towards regional budgets

• Government support of ~ 23 billion rubles for worst-hit airlines segment.

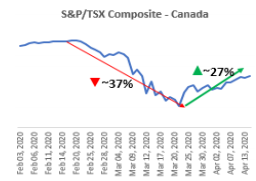

12. Canada

Key Economic Measures

• Overnight interest rate dropped to 0.25%

• Government to buy Canadian G-Secs worth C$5 billion every week across the curve

• C$150 billion insured mortgage purchase programme

• C$10 billion credit support programme for businesses

• C$72 billion for tax deferral & aid to low-income households

• 75% of wages of people working for SMEs covered

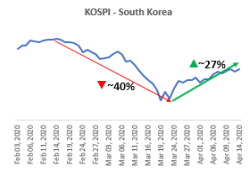

13. South Korea

Key Economic Measures

• Total economic rescue package of 100 trillion won

• 29 trillion won in loans to SMEs

• 20 trillion won to buy corporate bonds & commercial papers

• Additional 36 trillion won to be made available to exporters in the form of cheap credit

• Additional 17.7 trillion won will be rolled out through measures to boost consumption7 support domestic demand

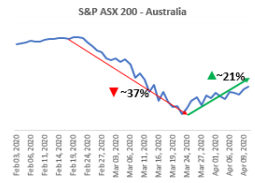

14.Australia

Key Economic Measures

• AUD 90 billion funding facility to banks at fixed rate of 0.25%; AUD 15 billion purchase of mortgage-backed securities

• AUD 715 million support to airlines

• AUD 66.1 billion in assistance for companies and additional welfare payments;

• AUD 17.6 billion in subsidies for apprentices, small businesses, pensioners, and others

• AUD 130 billion to subsidise wages of an ~ 6 mn people

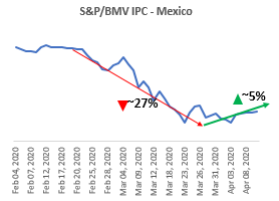

15. Mexico

Key Economic Measures:

• ~$16.6 billion available as reserves; to be spent as and when required

• Lending up to 25 billion Pesos to SMEs

• Front-loading social security & disability payments by 4 months

• public housing credit institute covering three months of workers’ debt (defer further six months for those let go)

16.Indonesia

Key Economic Measures

• ~$25 billion economic rescue package

• 3 percentage point reduction in corporate tax

• Reserve requirement ratio cut by 2% for banks and 50 bps for Islamic Banks

• Seven-day reverse repurchase rate cut by 25 bps

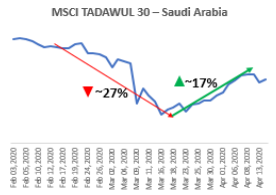

17. Saudi Arabia

Key Economic Measures

• Rolled out a 120-billion riyal ($32 billion) economic package

• Package includes 50 billion riyals ($13.3 billion) to help small and medium-sized businesses stay afloat.

• 9 billion riyal ($2.4 billion) earmarked to compensate 60% of those salaries for the next three months.

• 70-billion Riyal support to healthcare

• Suspension of government tax, fees

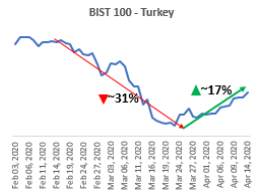

18. Turkey

Key Economic Measures

• 100 billion Lira economic stimulus package

• Tax subsidies & postponement

• Suspension of national insurance payments in select sectors for 6 months

• Benchmark interest rate reduced by 100 bps

• Minimum payment of credit cards reduced by 20%

• 3-month loan repayment moratorium for firms

• Turkey Wealth Fund given rights to buy stakes in firms

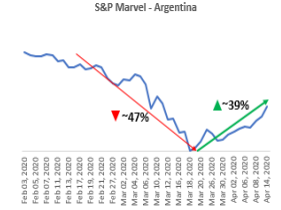

19. Argentina

Key Economic Measures

• Lower reserve requirements on bank lending to households and SMEs

• Regulations that limit banks’ holdings of central bank paper to provide space for SME lending

• Temporary easing of bank provisioning needs and of bank loan classification rules (i.e. extra 60 days to be classified as non-performing)

• A stay on both bank account closures due to bounced checks and credit denial to companies with payroll tax arrears.

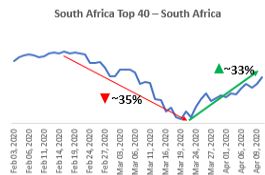

20.South Africa

Key Economic Measures

• 1.2 billion Rand earmarked to support farmers & food production segment

• The central bank (SARB) reduced the policy rate by 200 bps

• Increasing the number of repo auctions to two to provide intraday liquidity support to clearing banks at the policy rate

• Reducing the upper and lower limits of the standing facility to lend at repo-rate and borrow at repo-rate less 200 bps

• LCR reduced from 100% to 80% to afford liquidity

One must understand that the G20 (widely touted as the group of top twenty countries which have significant influence on global economic output) stimuli impact is not limited to only the country announcing it, but also benefits major trading partners indirectly.

So, an understanding of the economic measures undertaken by the G20 could be a decent indicator to how global economies are fortifying themselves in the wake of this crises and how stock exchanges are responding to these measures.

Key Takeaways:

Investors are requested to continue having faith in the fact that mankind will overcome this medical crisis while governments & central banks all around the world are working proactively, collaboratively & in a coordinated manner to protect your wealth. If you must take an action, it is to strategically buy into equities on declines with a long-term holding horizon; investments can be expected to benefit from the imminent recovery.