Wealth of Possibilities

Download app

1 Million+

Active Customers

5000 Crores+

Assets Under Management

20 Million+

Transactions

Everything you need for building wealth

Stocks and F&O

Take advantage of our powerful, user-friendly platform to invest or trade in stocks

Learn moreOwn your financial future with our all-powerful app

One app, multiple products

An all-inclusive suite for investing, trading, retirement planning & tax filing

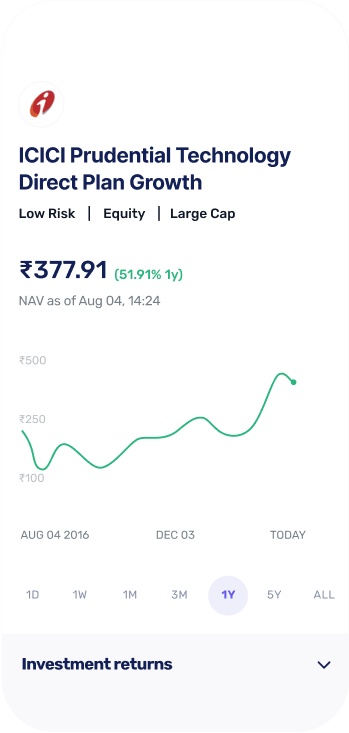

Dynamic & feature-rich

Pause/Restart SIP, smart withdraw, 15+ screeners, 3500+ expert-rated stocks, Equity SIP, Margin trading facility & more

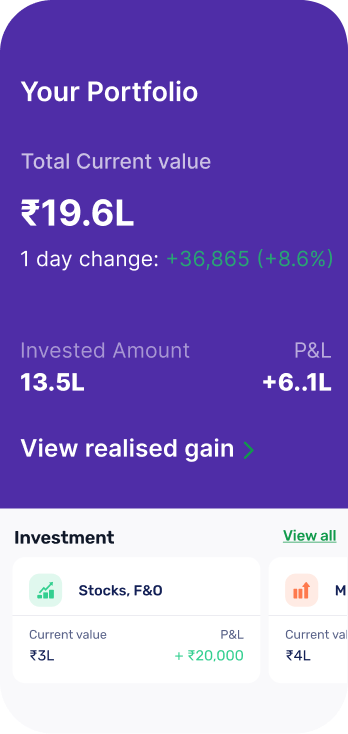

In-built intelligence at every step

Detailed portfolio analysis & insights to keep track of your investments

How it works

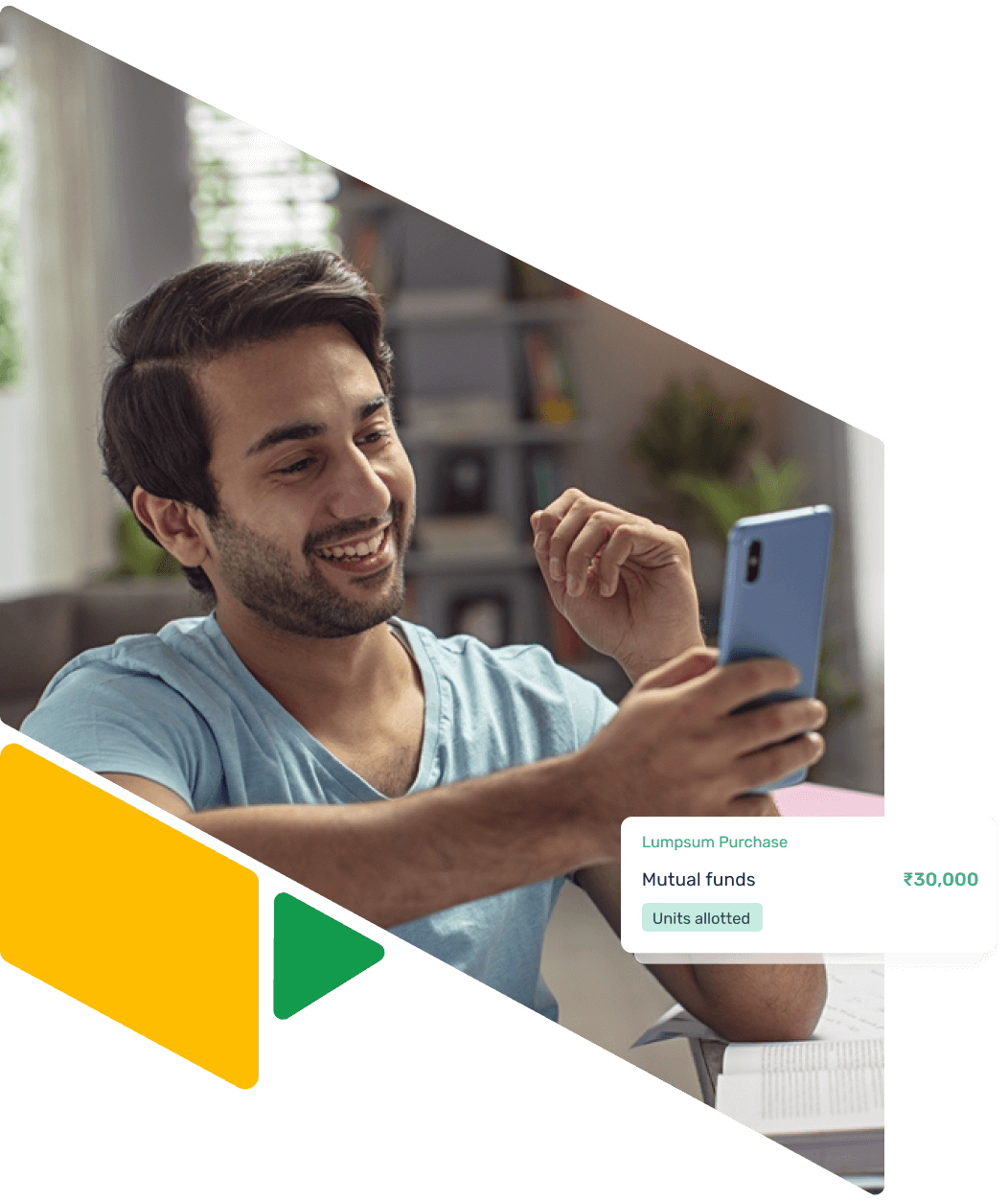

Do It Yourself

With the Fisdom app, you can trade, invest, and evaluate your portfolio with ease anytime and from anywhere With our comprehensive mobile app.

Download app

Personal Wealth Manager

Designed to cater to the needs of high networth individuals, businesses and families, Fisdom Private Wealth provides the advantage of deep research and comprehensive technology along with the luxury of a personal wealth manager.

Learn more

India's top banks trust Fisdom with their customers' wealth

Strong research to power the investor in you

Access premium research articles, fundamental analysis on stocks, analyst reports, commentary, and accurate and indepth market insights

Learn more

Learn better, invest smarter

Academy

Fisdom Academy

Join our curated learning programs & courses and unlock your potential in the stock market

Start Learning

Youtube

Keep up with the markets

Subscribe to our YouTube channel to stay in the know. Watch live videos, fireside chats, weekly Q&As & more

Visit our channel

Blog

Investment blogs on Fisdom

Read articles on personal finance, trading, mutual funds, alternative investments, market, economy and more created by the Fisdom content team.

Start ReadingPeople ❤️ Fisdom

Featured in

Download one of India's best wealth management apps

Join more than one million investors and take control of your wealth

Download app