In a response to contain panic-driven volatility & short-selling, SEBI has reduced the limit of positions that can be taken in the futures & option markets along with increasing margin requirements and capping derivative exposures and bringing down the market-wide position limit.

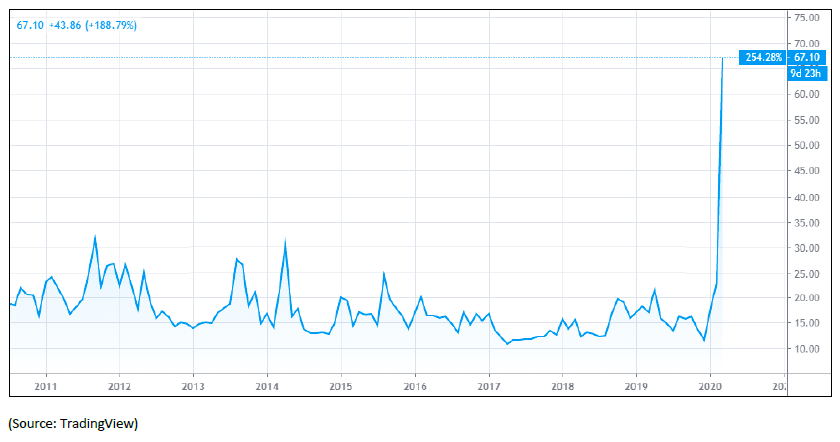

Illustration: India Vix (Volatility Indicator Index)

This move by SEBI is expected to help achieve the immediate goal of arresting the free-fall in stock markets till rational senses & sentimental stability prevails.

Glossary:

Short-selling:

This is a strategy used by traders who believe that a stock price will decline. A short sell implies that a trader (implicitly) borrows a certain number of shares of a company (typically from the broker) and sells it at the current price with a hope that he will be able to buy it back later at a lower price point and return the shares to the lender.

Margin:

A trader can put up some of his own money and borrow a larger sum from his broker to execute trades otherwise unaffordable to the trader. The money put up by the trader is called margin. With an increase in margin requirements, traders will have to put in more amount of own capital to execute the same trade.

Open Interest:

Open interest is the number of contracts (future & options; read as derivatives) open on any particular stock. These must be squared off either before or on the monthly expiry date.

Market-wide position limit (MWPL):

MWPL is the maximum number of open positions allowed across all future & option contracts in a particular stock.

Measures & expected impacts (Savvy investors read on beyond the summary for details):

- Market-wide position limits to be reduced to 50% from current 95% levels if it breaches prescribed thresholds. The threshold limits will be applicable on fresh positions developing 23rd March’20 onwards. Penalty on increasing positions beyond limit has been increased to 10x of the prevailing minimum and 5x of prevailing maximum amounts. This is expected to play the role of a speed-breaker in cases of a fast-accumulating positions on a particular stock or the index hence not letting it fall off the cliff.

- SEBI has prescribed a differential and higher margin requirement for stocks – traded in the futures & options market and the ones not traded in the futures & options market.

This increased requirement is expected to deter traders from making reckless trades on borrowed capital since they will have to now put up more of their own money into trades. - Foreign investors, members & institutional investors like mutual funds can participate in index derivatives subject to restrictive guidelines.

This will ensure that bulky institutional capital does not sway the already fragile markets further. - Additional to existing rules, SEBI has introduced flexing of dynamic price bands which can be flexed only after a cooling-off period of 15 minutes from the time of incremental conditions being met.

This would be helpful in breaking heavy momentum trades and minimising damage.

Takeaways for mutual fund investors

While mutual fund investors only stand to benefit from these initiatives, investors into the arbitrage segment (or categories like dynamic asset allocation which includes arbitrage positions) may see returns temporarily & negligibly deteriorate as an effect of the surprise regulation & increased volatility. This applies majorly to investors who have invested in these segments as recently as within the past one or two weeks. Investors in these segments with a horizon of three to six months are well-placed though.

Details for the savvy & inquisitive:

Market-wide position limits

MWPL will be reduced to 50% from 95% of the defined limit for the ban to kick in if:

- Avg daily price high-low variation percentage during the last five sessions is 15% or more (OR)

- Avg MWPL utilisation % during the last 5 trading days is >= 40%

MWPL, expressed in number of shares, is the lower of:

- 30x the average no. of shares traded daily in the previous calendar month in the cash segment

- 20% of the number of free float shares

Higher margin requirements

- Increased margin requirement to 40% in the cash market for F&O stocks with market wide position of 50% staggered as 10% from 23 Mar’20, 26 Mar’20 and 40% from Mar’20.

- For non-F&O stocks with a price band of 20% & price variation of >10% for 3 or more days in the last one month, the minimum margin rate will be revised to 30% from 23 Mar’20, and 40% or highest intraday variation (in the past month) whichever is higher from 26th Mar’20.

Ceiling on index derivative exposures

- Applicable limits for mutual funds, foreign investors & members for exposure to index derivatives:

- Short positions in index derivatives cannot exceed the notional value of stocks held in cash

- Long positions in index derivatives shall not exceed the notional value held in cash, government securities, Treasury Bills.

- Additional position limits beyond the above mentioned will be INR 500 crore in futures & options contracts each

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2WHxIPu||target:%20_blank|” button_position=”button-center”]