An anniversary and a quarter past the first sighting of the Covid-19 has Indian benchmark be crowned as the eight largest index of the world. Championing broader appetite and dynamic growth across market-caps has been key factor for the cumulative equity listing value to surpass the once unbelievable three trillion-plus mark.

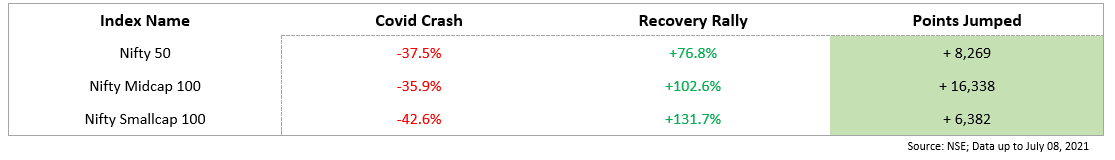

When markets fell last year, large-caps highlighted how to invest. Since then, mid/small caps have shown why you should invest, in the markets run-up to trading at its all-time high.

Today, rendering of unorganized under organized markets, incorporation of cost-efficient demand-smart forecasting, and a demographic-savvy economy, has levered markets to welcome risk capital and bid adieu to polarizations.

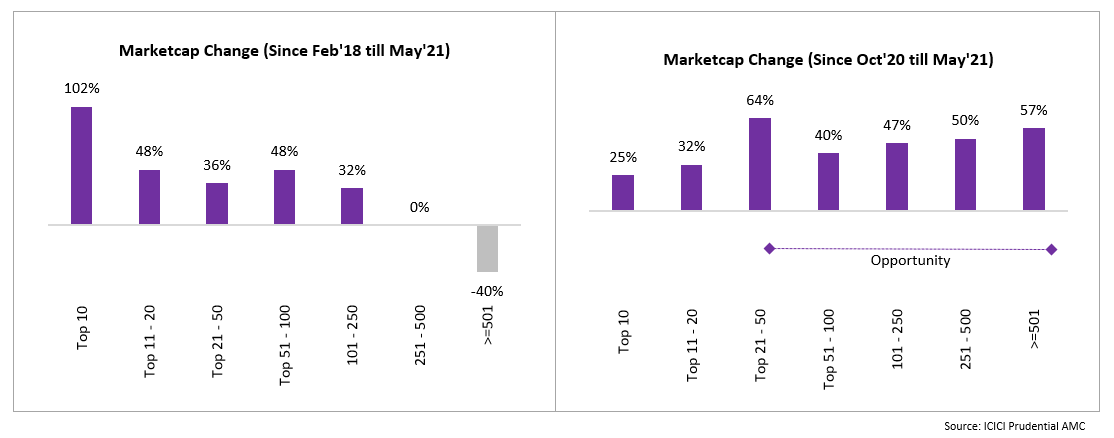

In hitting the ‘reset’ button, the graph below shows how markets have revived across the spectrum, as opposed to brandishing blinding favoritism to any particular segment.

The table below highlights the sentiments reflected above:

The broadening of market width comes at a time when macros and micros bear inclinations to pro-growth strategies via like-wise policies and practices. The results are immediately visible in emergence of new alphas with risk capital following suit.

The table below shows how quickly sans-large segments have not only recovered but also flourished in times of the virus continuing to be feature headlines:

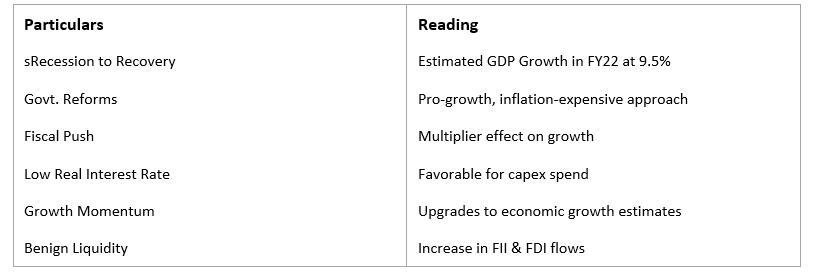

Recent developments have welcomed newer investor hesitancies questioning economic prospects and hence sustainability of market sentiments across market-caps.

In quelling these queries, shown below are factors which will keep the economy running and the spill-over positives of cross-cap participations:

The continuous push towards the formalization of the economy will augur greater inclusion of the broader universe of such companies. The less travelled path of this universe is proved to be rewarding many times before, and this time round, the story reads in the same manner.

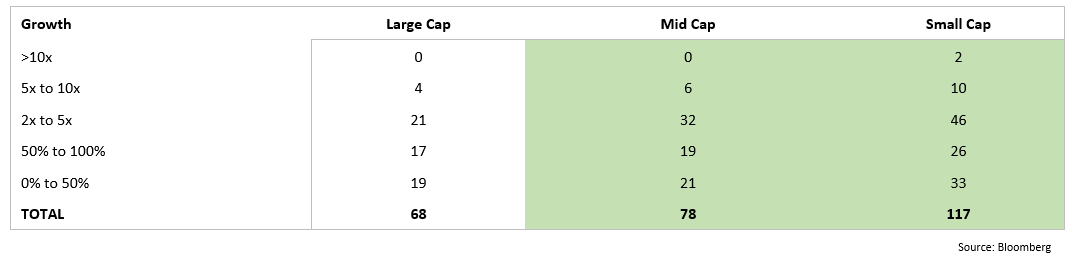

On time testing returns over periods of economic recoveries, small-caps show higher potential to outperform the country’s bluechips. The graph below shows the same:

The icing on the cake lies in the hidden potential of mid-&-small segments in their manifestation of the “bet big – win bigger” mentality.

This philosophy is especially clear when viewing the segment trends over the last five years, as the often-overlooked peers of the markets have beaten the ‘too big to fail institutions.

The table below highlights the count of out-performing mid/small-cap companies vs large market-cap in the Nifty 500 over the last 5 years:

Its clear where the opportunity is. Open the door and welcome it because it is mischievously known for not knocking twice.

Today, the markets are at an inflection point. Remember, the way to win in the markets is to participate first. Simple and smart is important but secondary.

As an investor, view every forthcoming market dip as an opportunity to participate in India’s growth story. Enter markets in a calibrated method while keeping your risk acumen and appetite in mind

If you carry any doubts or opinions, feel free to write to us. As always, we await an interaction with the likes of you.

Till then, wish you a happy weekend.