Investing activity is based on a positive outlook towards the future. Without this optimism, capital markets will not function as they do, entrepreneurship will not flourish, and human development will ultimately halt. Every time an investor purchases an asset, they express confidence in the prospects of that asset. Opportunities can be that companies will multiply their profits, borrowers will repay their loans, and the government will allow capital to flow too freely around the world.

Stock markets in India are hovering around record-high levels. Measures taken by the government, coupled with unabated inflows by foreign institutional investors and monetary actions taken by central banks, have pushed the benchmark indices to their all-time highs. Following this unprecedented rally in equity markets, retail investors have increased their participation through millions of investors opening demat accounts.

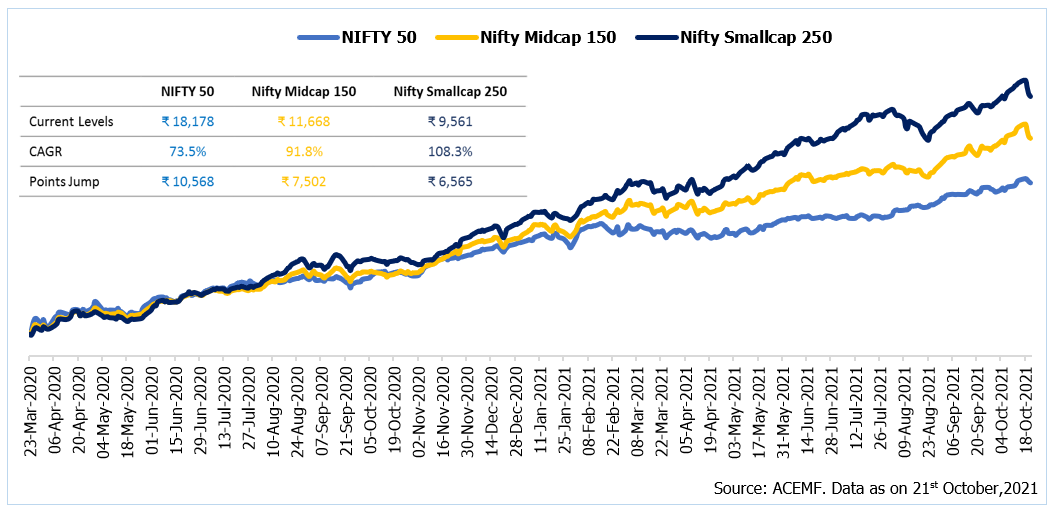

Let’s look at how domestic equity markets fared since March 2020:

Many investors have hit a fortune in the current market rally; some investor must have burnt their fingers or capped their gains despite the rally in the market.

Today, like every other day, we find ourselves not knowing what’s to come tomorrow. It is in these moments; we suggest investors avoid the below-mentioned mistakes while investing in a bull market:

- Exiting Mutual funds and investing in direct stocks:

After making money in the bull market, many retail investors think that they have the expertise to invest directly in stocks; hence they exit their mutual fund holdings and reinvest in direct stocks. It can be evident that there has been a sudden spurt in the number of Demat accounts in the country. However, one should keep in mind that a healthy correction follows every bull market, and hence here it is the skill of a fund manager to minimize portfolio drawdown when markets correct.

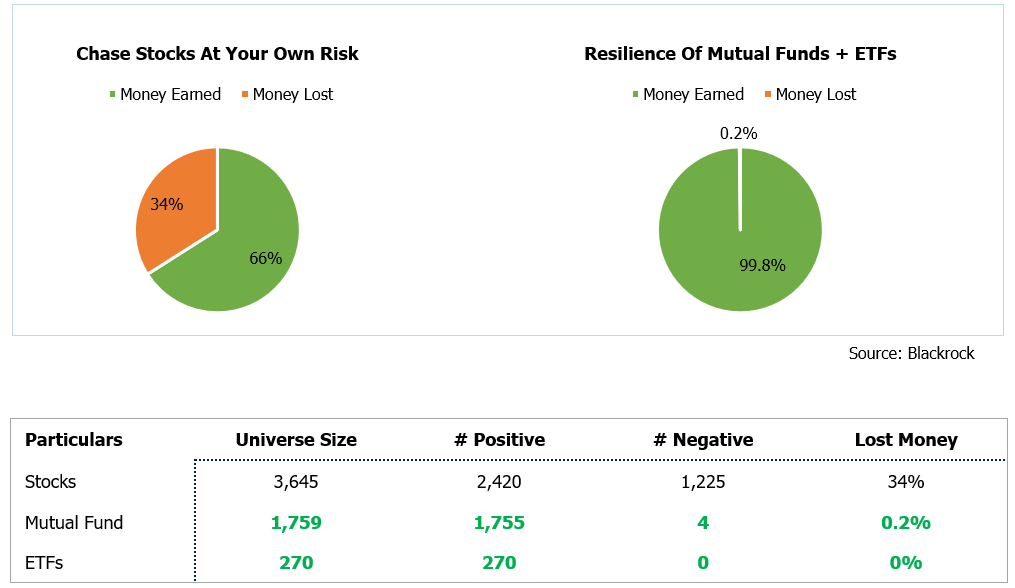

Mutual funds are smarter stock pickers as they spread their wings across a basket of stocks. As is said, “To diversify more is to risk less’. A key reason they can do this is that they have a seasoned team of experienced folks who have been living and breathing stocks for almost all of their professional careers. When pipped against the below-average knowledge of an average investor, it is effortless to note who will emerge the winner.

This phenomenon of individuals refraining from ‘outsourcing’ their stock-picking needs to mutual funds is not only an Indian behaviour but one seen across even in the most developed markets. However, like is the case in India, USA markets (the reason for considering it for this study is because it’s the largest and most nuanced market in the world) symbolized the same morals of Mutual funds being smarter stock pickers than the average individual.

Case in point:

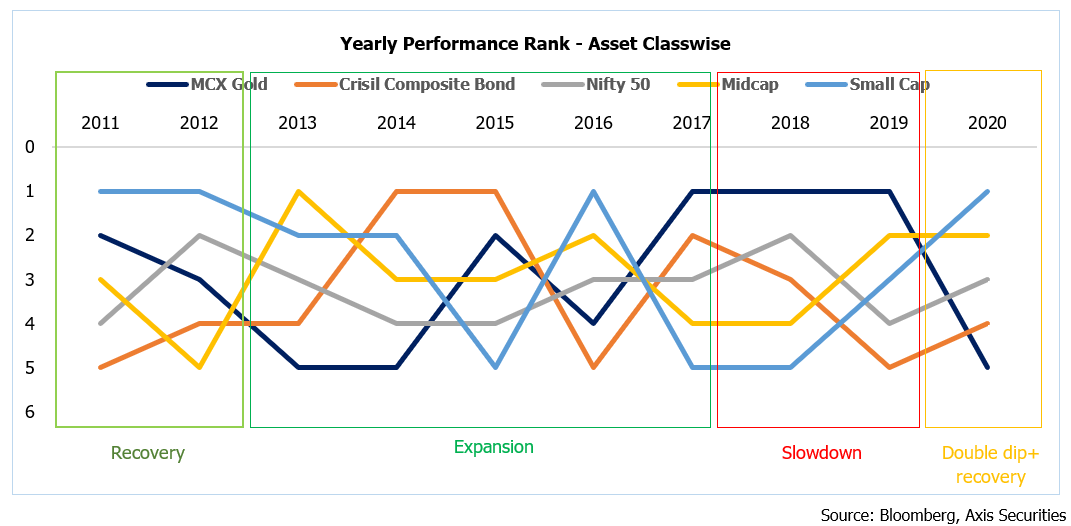

- Maintaining asset allocation:

Change in an investor’s risk profile during different phases of market cycles is a widespread phenomenon. An investor should focus on their risk-taking ability and willingness along with the holding period defined as their long-term goals. A prevalent mistake retail investors tend to make is not booking profits in a thriving bull market and maintaining their asset allocation. As per your risk profile and investment horizon, investors should keep the asset allocation to minimize risk while yielding the expected returns.

Investors should avoid churning the basis of the portfolio random market valuation; instead, they should focus on maintaining the proper asset allocation at every point in time. Cost needs to be taken care of while doing any portfolio rebalancing.

- Going heavy on cash

Conservative investors prefer to sit on cash when indices are at all-time highs. As a result, they miss out on opportunities available in the markets. Hence it is suggested to start a systematic investment plan (SIP) and stay invested in bull and bear markets. It will eventually help in rupee cost averaging.

- Investing in the so called ‘Hot IPOs’

In the current October-December quarter, IPOs worth INR 80,000 crore is expected to hit the primary market. Investors need to be extremely cautious while applying for IPOs. Recently among a few listed IPOs, the highest number of funds at 123 were holding Zomato stocks. Hence, the IPOs the retail investor is willing to participate in; there might be a high possibility that your mutual fund has already got the allotment through institutional quota.

- Day Trading and Leverage Trading

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for 10 minutes,” said Warren Buffet. Retail investors get into the risky arena of margin trading and derivatives trading. Margin trading is when an investor puts a small amount, and the broker allows the investor to take 4-5 times exposure on the investment value. If the price movement goes in favour of the traders, they make huge money. But if things go south, then the trader tends to lose entire capital.

Key Takeaway:

Investing is a continuous process. While investing in capital markets, your primary aim should be to grow capital from the up-trending market, hedge your portfolio against losses, and utilize the periods of volatility in markets to your benefit. Opportunities are there in both bull as well as bear markets and have their own set of risks and uncertainties. Investors who cannot make decisions under complex and uncertain circumstances need to reconsider their investing habits and see a financial advisor who can help them do so.

Happy investing!