Remember headlines like these? This is how the periodicals welcomed the new year in the midst of a raging bull run. For those don’t, let us refresh your memory.

The occurrence of the unprecedented market recovery rally by the end of last year set conversations ablaze with which investment avenue captured maximized investor wealth. Every adversary became an advisor, as Dalal street turned to ‘Dhamaal’ street.

All conversation carried one noise, voicing direct equity’s (stocks) out-performance vs mutual funds in capturing higher alphas. ‘Chai Pe Charch’ or ‘watercooler talks’ started to turn investment-expensive as whispers echoed ditching the latter completely, cause how does one lose money in this market.

This is where the problem began. Many fell victim to market’s classic learning in, “Bull markets make everyone an expert. Bear markets make everyone wise.” In expecting it sooner or later, we already have many investors writing to us to undo the damage done on their portfolios, courtesy of permanent actions printed by temporary emotions. This happens to come at just the right time. Here’s why!

Headlines like the one’s shown above are once again making their way to the front pages. Let us be wiser this time round.

How? By buying into mutual funds, and letting them buying stocks for you.

Why? Simply put, because they are better at it. This time, its facts speaking, not fallacies.

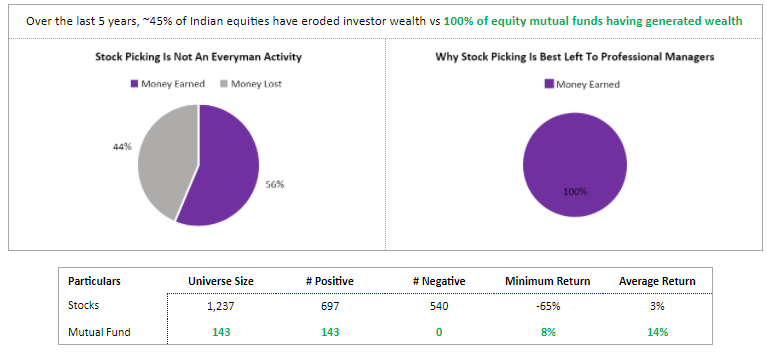

In drawing up evidence, the graph below shows how mutual funds were the smarter stock picker vs the average investor:

Mutual funds are smarter stock pickers as they spread their wings across a basket of stocks. As is said, “To diversify more is to risk less’. A key reason they can do this is because they have a seasoned team of experienced folks who have been living and breathing stocks for almost all of their professional careers. When pipped against the below-average knowledge of an average investor, it is very easy to note who will emerge the winner.

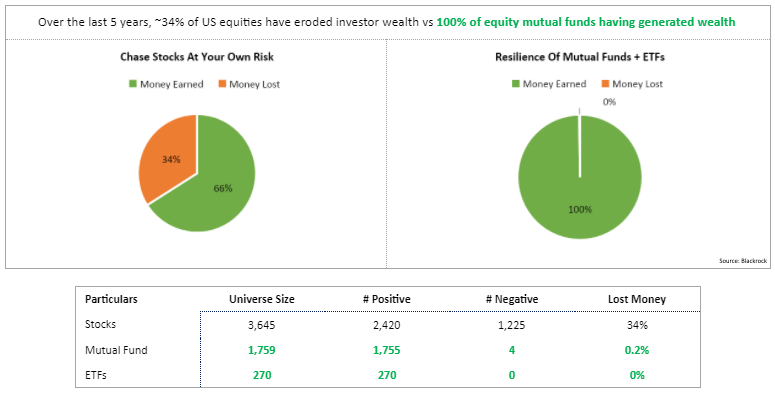

In fact, this phenomenon of individuals refraining from ‘outsourcing’ their stock picking needs to mutual funds is not only an Indian behavior, but one seen across even in the most developed markets. However, like is the case in India, USA markets (reason for considering it for this study is because it’s the largest and most nuanced market in the world) symbolized the same morals of Mutual funds being smarter stock pickers than the average individual.

The findings are presented below:

In a time where US broader markets delivered 15% CAGR (investment growth of 2x!), 34% of stocks have yielded capital loss for their suitors.

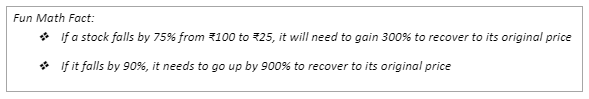

Direct equity is not for the faint-hearted as the loss of pain always trump the joy in gains. Math follows this emotion too as can be seen below:

The data points highlighted above clearly show that the education and regulation in mutual funds are sure to overwhelm direct equities when it comes to quality and quantity in all things buying.

Now, if you are worried that mutual funds can’t go ‘stock hunting’ to exploit market opportunities, well then worry not, its versatility has you covered here as well!

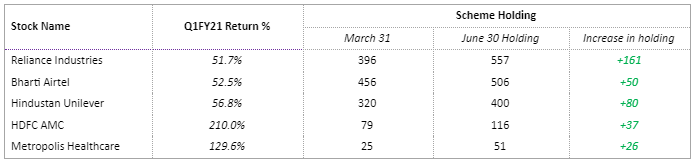

The table below highlights stocks bought by mutual funds during peak covid days, thus satiating your appetite for lucrative bargains:

As is evident, indulgence in mutual funds is indulgence in stocks. The key benefit is the ability of the former to do it in a financially savvy manner. With this new insight, let’s put down the perceptions and pick-up the receptions.

The next time you think of opting for Stocks over MFs, read yourselves this line below:

If you want to curate a ₹10 lakh portfolio with ₹5,000 monthly SIP in a single stock for 5 years, your stock exposure will amount to ₹3 lakh, or ~25% of your portfolio!

Be smart and act in per you risk appetite. If ever in doubt, fisdom is only a call away. As always, we eagerly await to hear from you. Wish you a happy weekend