Key Insights

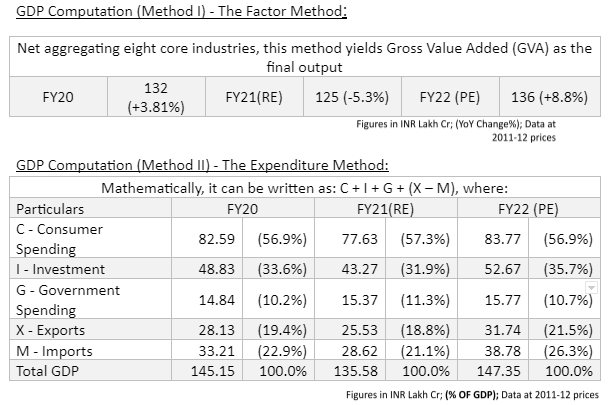

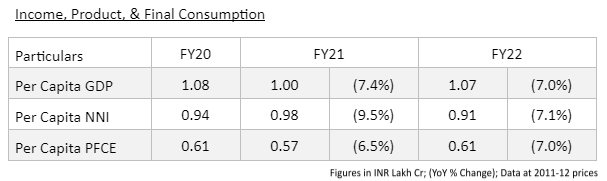

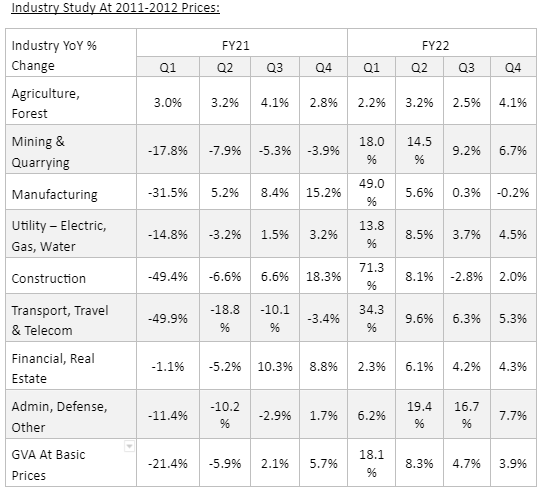

- GDP during FY22 is estimated at 8.7 percent as compared to a contraction of 6.6 percent in FY21.

- Q4FY2 GDP is showing a growth of 4.1 percent. It is estimated at INR.40.78 lakh crore, as against INR.39.18 lakh crore in Q4FY21.

- The GDP numbers broadly came in line with the market expectations. The outlook remains unclear with fate, especially with escalating crude oil prices. Further, the limited ability for additional fiscal spending, stressed corporate margins due to the rise in input prices, the Russia-Ukraine conflict, and softer global demand would remain a concern.

What is Gross Domestic Product (GDP)?

Gross domestic product (GDP) is the market value of all final goods and services produced within a country’s borders in a specific period. It functions as a comprehensive scorecard of a country’s economic health.

In the March 2022 estimated growth, the most significant blow has been to private final consumption expenditure (PFCE) growth. PFCE, i.e., consumption, grew by 1.7 percent against the market expectation of 3.9 percent losing its momentum. Y-o-y growth has slowed in the past four quarters from 14.4 percent in the first quarter to 10.5 percent, 7.4 percent, and 1.8 percent in the following three quarters. We expect high inflation, rising interest rates, and high unemployment will dampen the growth in the next few quarters.

Govt championed its aggressive CAPEX plans, reflected in investment growth of 5.15% (YoY) and 19.02% (QoQ). Signaling the re-birth of the CAPEX cycle, the buoyed investment demand in Infra/capital construction seeped into healthy IIP figures of 1.9% growth in March’22.

But still, a 5 percent GFCF growth is poor compared to what is required to propel the economy into a higher growth trajectory. In better times, the increase in GFCF has been in double digits, between 10 and 15 percent. A 5 percent growth is less than half the required growth rate.

The net exports pulled the growth down with a negative contribution.

Among the sectors, the agriculture sector, the only growing sector of the economy in the prior two quarters, continued its up-run, registering a 3.9% rise in Q3.

The outlook remains unclear with fates, especially with escalating crude oil prices. Further, the limited ability to additional fiscal spending stressed corporate margins due to the rise in input prices, the Russia-Ukraine conflict, and softer global demand would remain a concern.