Markets worldwide are dancing to spikes, with equities and bond yields fighting to be the bigger bull. In a bid to capture the bigger slice of the return pie, many market participants are on the hunt to know if the 2 asset classes can grow in tandem.

The recent drum-up in debt followed with equity crash signals how the 2 avenues can grow off each other but not with each other.

Background:

Rising 10-year US and Indian gov securities triggered worries about impact on other asset classes, such as equities and gold. Rising US yields to ~1.61% for the 1st time after the pandemic caused Indian yields to rally from 5.76% to 6.20%, and Sensex to fall 2,000+ points – All in a week’s time.

The reasons for Indian equities to react to rising US yields are plenty and complicated. What really matters is how can it affect your portfolio or your investing approach.

Here’s some food for thought:

- India has delivered ~12% CAGR over the last 20 years. Parallelly, the last 20 years have been subject to multiple US and Indian bond yield hardenings. Meaning, those who exited equities in worry of yield hardening missed out on growing their investment by a multiple of 9x.

- Per a Morgan Stanley study, over last 20 years, there have been four major rising long bond yield cycles. Each was positively correlated to equity prices – i.e., rising yields led to rising share prices.

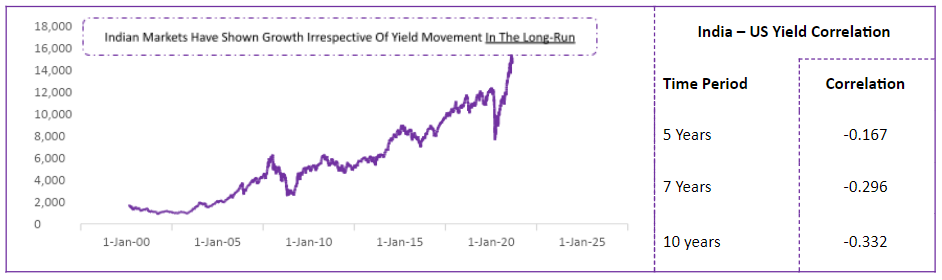

To further simplify the above statements, lets trace the Nifty 50’s trajectory over the last 2 decades, with correlation matrix with the US bond yields to fully understand the mathematical relation enjoyed between the 2:

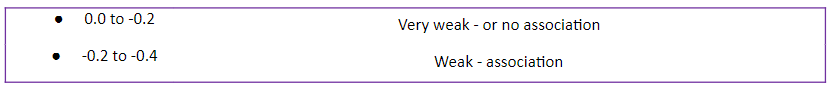

Correlation is a mathematical measurement tool to gauge the symbiotic relation between 2 elements. Inculcating a host of underlying principles, its reading is instrumental in reducing risks and promoting diversification.

Borrowing from a Boston University study, this is how the correlation between India & US yields are to be perceived:

As is observed, Indian markets enjoy weak correlation with Indian markets. However, in re-iterating, Indian equities can see short-term reactions to bouncing yields. It is imperative to hold equities in for the long-term to negate such downside pressures.

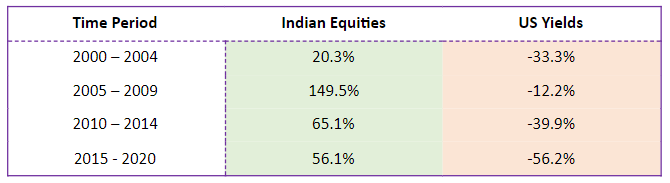

To further ease investor tensions, we back tested data over the last 20 years with 5-year windows to review performance (absolute return) of Indian equity markets and US yields. The regular interval monitoring helps gauge the true potential of Indian equities and the dampening effect of US yields at the same time.

The table below highlights the same:

As is observed, Indian equities have out-shined US yields consecutively over the last 2 decades. The same stands true on stretching time horizons, thus adding meat to the bone in adjudging holding equities to trump yield worries.

Investor Takeaway

Equities is touted as the best inflation-beating asset class in the long-run. Now, think of what increasing yields indicate. Yep, you guessed right, rising yields equates to rising interest rates, which is the textbook definition of inflation.

Voila, now you don’t need to worry about the why’s and what’s behind the market murmurs of rising yields. Think of it as inflation and do not resort to hasty actions to shudder its volatility in the interim on your portfolio. Let your time in the market take care of the same for you.

In summarizing technically, the move in yields since summer 2020 is not large, as the global economy is lifting. The assessment of last 2 recession cycles shows how 100 bps jump in US yield is ‘typical’ from their recession lows, in periods marking transition between recession and growth.

Given the magnitude of expansion at bay, neither the direction nor the magnitude of yield increases is odd. For as long as equities promise growth, there is not much to worry off (in the long run).

If you share differing opinions, do reach out to us to share your observations. As always, we excitedly await to hear from you.

Till then, Happy Weekend