1. USA’s Banker (Fed Reserve) Charges On, Where World Bank Takes A Pause

Fed Reserve: In a landmark policy for prioritizing a strong labor market, the Fed is ready to bear faster price rises. Ushering an era of low interest rates, the fed is stimulating economic activity to revel in its longest economic expansion on record, rather than its sharpest downturn since Great Depression. But, by the way are a product of 2020!

World Bank Pause: World Bank has hit pause on “Ease Of Business” report, citing data irregularities. Like domestic businesses, global institutions too have succumbed to Covid 19. Corrupted inputs will always yield corrupted outputs.

Covid 19 is truly economically viral, proof of which lies in World Bank’s cries. But, from pain emerges winners! Here the heroes are the central banks, who are adapting today’s practices to fight today’s woes. If 1918 solutions tackled the 1918 pandemic, then the 2020 solution will too tackle the 2020 pandemic.

2. Winter Is Coming…With Stronger GDP Growth Aspects!

Moody’s Investors Service has estimated that economic outlook of EM countries is more challenging VS advanced economies. India is 1/3 G-20 country expected to post strong real GDP in H2CY20, and FY21 above pre-covid levels.

Emphasis on domestic productive capacities, will push Indian economy to grow 6.9% in FY21 VS 4.2% in FY20 (slowest pace in 11 years).

India’s economy has adorned the qualities of a phoenix, as it gears up to rise from the ashes. India’s potential and promises are just as alive as they were before the virus hit, albeit with a few hiccups! Think of it as a race, in which India tripped cause of untied shoelaces. But the laces are tied now, and the finishing line is coming in sight. Its all Go from here!

3. RBI Evolves From A Watch-Dog To A Guide-Dog

RBI has been creating new stones, for its left no stones unturned in generously applying oil onto India’s growth gears. Announcing moratoriums, declaring dividends, conducting OMO’s, standing accommodative and allowing loan restructuring are keyways the nation’s bank has been putting bite into its barks! The macho macros are added benefits.

RBI has been at the forefront in tackling the virus and teasing and testing the economy. As Covid breaks the long-standing economic shackles, so does RBI, by adopting a foot-loose approach. In bidding adieu to the old, RBI has donned a 2020 Meme, “Modern times require modern solutions”.

4. Covid 19 – The Virus Which Shrunk The Economy But Widened Debts

Government debt is set to record its highest data since such recording was initiated back in 1980, at 91%. The constant capital outlays have increased govt. debt since FY16, but still stood at 75% in FY20. Debt-ratio is likely to stay above 90% till FY23, and only touch target levels of 40% by FY40.

Covid 19 has the country’s accounts all out of balance. The country is racking up debt at startling rates to refurbish the current broken economy. However, form troughs come peaks, although the journey uphill is 1 tough battle. As we chant Buzz lightyear’s golden words of “Onwards and Upwards”, we must remember the merit debt financing brings! So, if the cards play out right, the current debt overhang can be a long-term blessing in disguise.

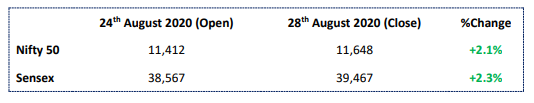

5. Markets And Covid 19 – An Affair As Connected As Is Disconnected

Indian Indices have breached their pre-covid 19 levels! Yay! Or is it? The Virus has gotten more viral, growth perimeters are signaling caution, and the RBI governor has not been shy in speaking of disconnect between markets and underlying economic fundamentals. I stress on the developed bad, cause the good is still developing. As Markets reflect the future, we see that there is room for Good to grow, while the Bad matures into its fainter stages.

Who knows what will happen tomorrow? But if you want to yield the benefits of tomorrow, you have to act today. The FIIs who went in March, came back the very next month, and have been coming back in larger numbers since! After 6 months of battling the virus, the market blood cells seemed to have found the anti-bodies. Is it effective? Who knows? For perspective, human vaccines are still in testing stages and we already betting so heavily on it! As we say at Fisdom, “Staying Invested is Staying Winning”