Floater funds

Benefit from rising market rates

These funds invest 65% of their assets in floating rate instruments & make use of the fluctuation in interest rates to generate quality returns

For risk-averse investors wanting quality returns

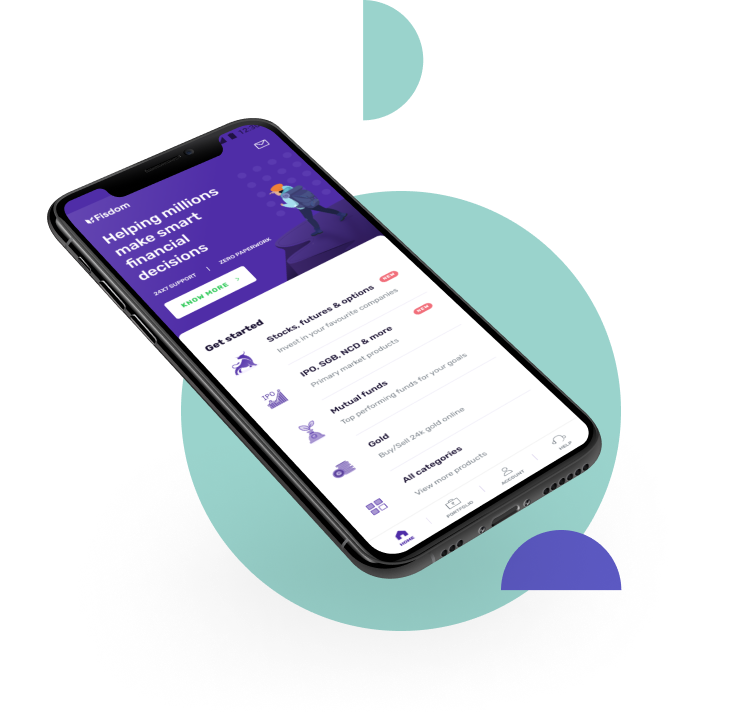

Withdraw your money anytime by placing a request on the Fisdom app

Start with a SIP of as low as Rs. 500 per month or lumpsum of Rs. 1000.

Invest your savings with ease, and trust our expertise to help build your wealth.

Get going digitally on our app with our paperless KYC, mandates and start investing online just in 5 minutes.

We evaluate and change your investments regularly in the right mix of mutual funds, to keep you on track.

Our research team works in your best interest to give you unbiased, studied and transparent advice.

Join over 20 cr Indians who have made Fisdom their wealth management partner.