Invest your savings with ease, and trust our expertise to help build your wealth.

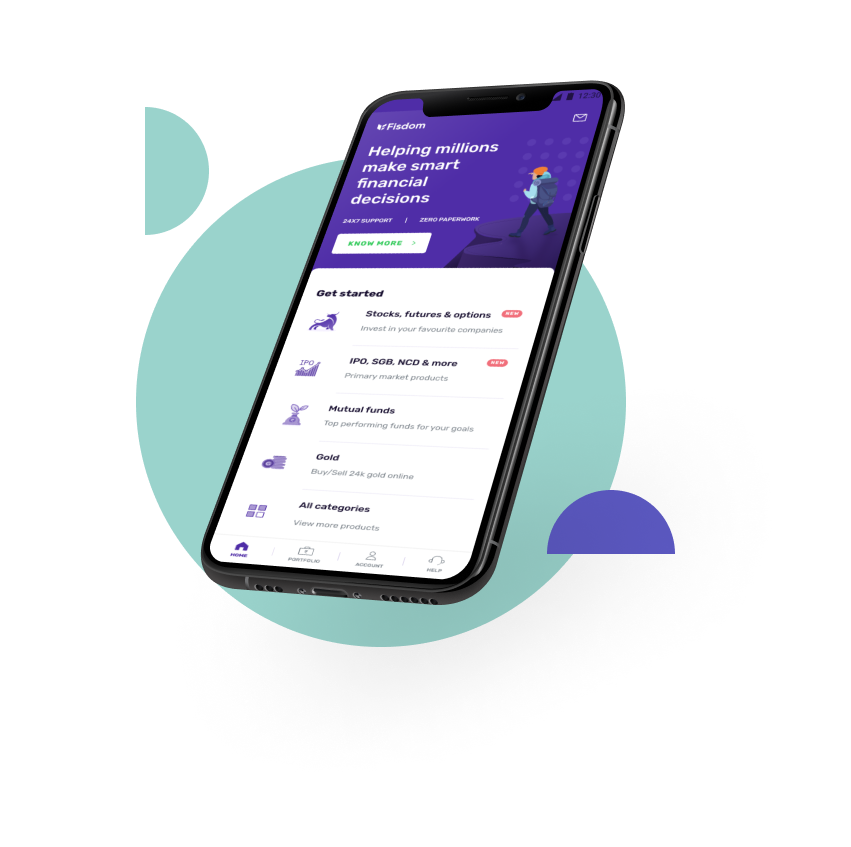

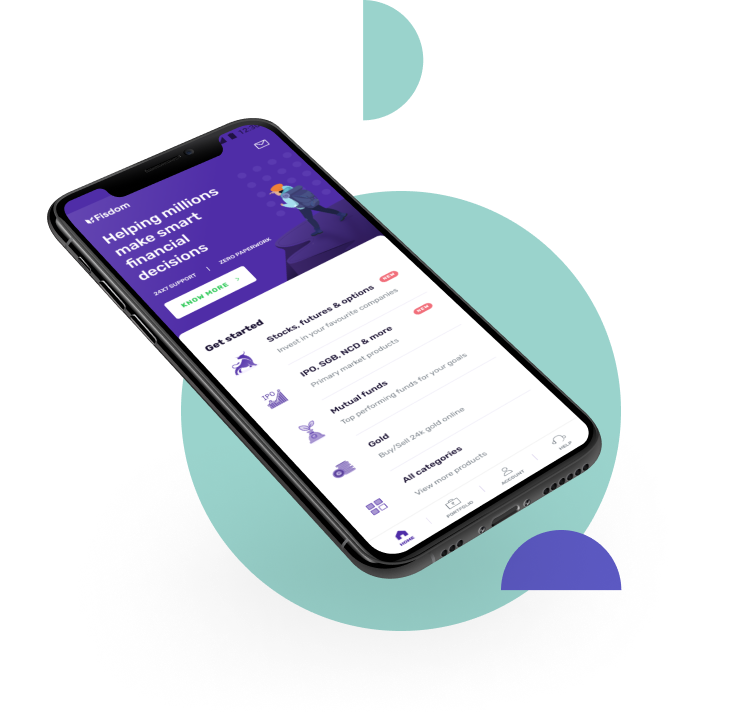

Get going digitally on our app with our paperless KYC, mandates and start investing online just in 5 minutes.

We evaluate and change your investments regularly in the right mix of mutual funds, to keep you on track.

Our research team works in your best interest to give you unbiased, studied and transparent advice.

Start with as low as INR 500/month

Why keep your savings idle? Invest in short term debt funds

Higher return & tax benefits with lowest lock in

Trusted by banks and digital partners to deliver greater financial growth to their customers

Join our family of 20 cr Indians who manage their finances better through our trusted partnerships and network.