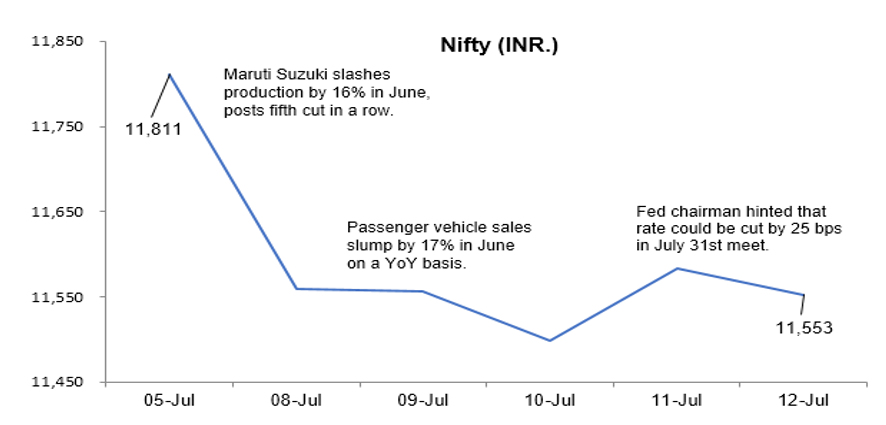

While most indicators were well in order, bellwether Indian indices slumped through the week. The only plausible explanation is that hot foreign money was pulled out as an aftermath of the proposed tax surcharges reflecting concerns around appreciation potential on a post-tax basis. In our opinion, this is atypical of a knee-jerk reaction and is expected to be short-lived as the markets adjust and price-in the proposed tax amendments.

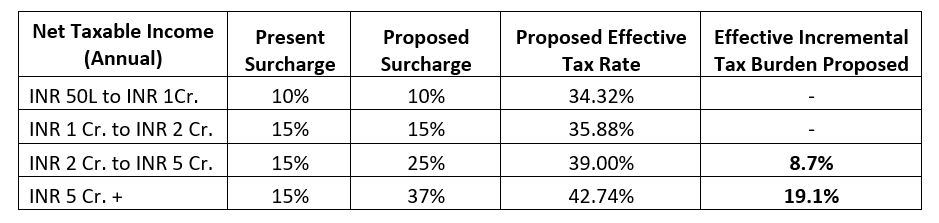

To offer context, the Union Budget for 2019-20 proposed a hike in the surcharge applicable on the income of HNI/UHNIs. Below is a snapshot of the steep hike in surcharge proposed.

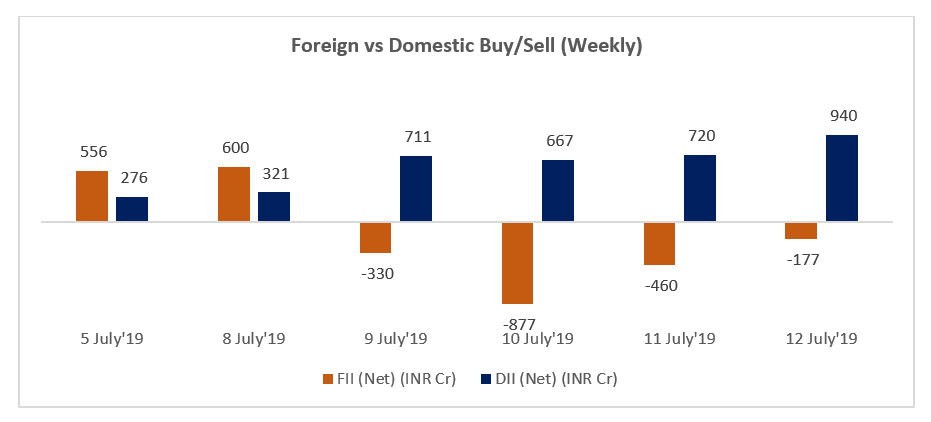

However, seems like the Indians have realized the long-term benefits of the fiscally prudent budget and continue to play the India growth story with renewed enthusiasm while ignoring the foreign portfolio investors. The resilience and belief displayed by domestic investors reflect the growth potential of Indian equities in a rather strong fashion. We expect foreign portfolio investors to follow suit soon – perhaps as early as next week.

Here’s a snapshot of how the foreign and domestic investors played during the week.

Apart from the demand/supply play, here’s how the markets looked like during key events during the week.

Key Takeaways

The Union Budget was in a way fiscally prudent and in conjunction with effective implementation of other proposed action plans, it is expected to bolster India’s economic growth and progress significantly over a period. Retail investors can take cues from the resilience and faith established by domestic investors as an aggregate and continue investing in perhaps the steepest growth curve among global economies in the years to come. Though, as a word of caution, investors are advised to avoid investing with extreme perspectives and are advised to stick to their investment plan and asset allocation prescribed.