Straddle is a strategy used in options trading where a trader buys a put and a call option at the same time, for the same expiry date, on the same underlying security, and with the same strike price. This strategy is mainly used by investors when significant market moves are expected, but the direction of share prices may not be clear.

Here, we will discuss the two main straddle strategies, long straddle and short straddle. First, let’s have a look at a simple example to understand the concept of straddle.

Understanding straddle with an example

Suppose a trader expects a company’s stock to have significant price fluctuations because of a recent announcement on November 15. At present, the stock’s price is Rs. 100. The trader sets up a straddle by buying both a Rs. 5 put option and a Rs. 5 call option. The strike price is Rs. 100 with an expiry on November 30. The total option premium for this straddle will be Rs. 10. The trader will fetch a profit in case the price of the underlying stock goes above Rs. 110 (the net of strike price and total option premium) or below Rs. 90 (strike price less the net option premium) at expiration.

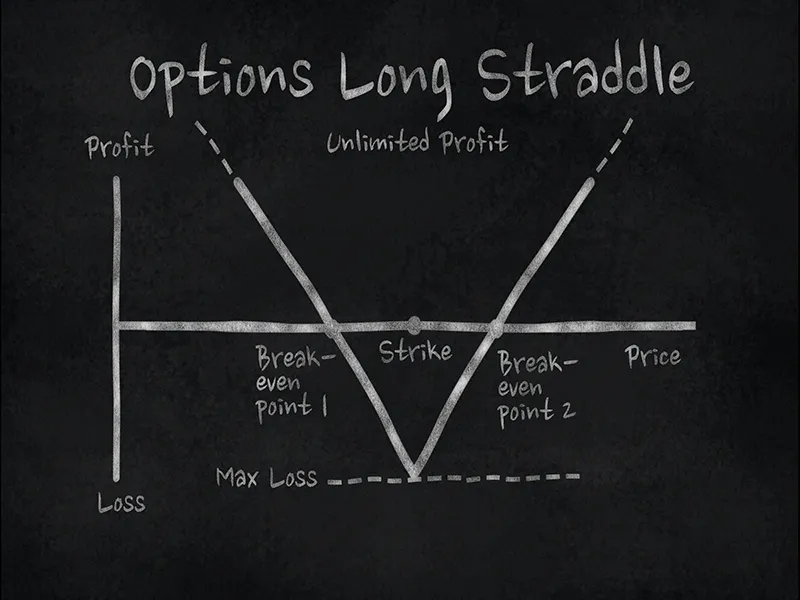

Long straddle options strategy

This strategy is used when a trader expects the market to rise or fall sharply. However, they may not know the direction of movement. This strategy helps traders trade safely during volatile market conditions.

Long straddle strategy:

- Helps traders avoid trading mistakes

- Helps to solve the dilemma of direction.

Whenever some big news releases or major event occurs, the market tends to react to it drastically. This results in the share prices going either up or down. However, since the trader cannot predict the direction of the price, he/she has to rely on the long straddle strategy.

When is long straddle used?

Understanding the timing of using a long straddle is very important. Whenever a trader foresees significant market movement, resulting in share price changes, he can make use of the long straddle trading strategy no matter the price direction. With this, a trader can earn profits irrespective of the direction of price movements.

This strategy involves buying both call and put options at-the-money, which means the prices will be somewhere near the current strike prices. Since the price of the call and put option are the same, the trader can still make gains due to price movement irrespective of the direction. Thus, if the prices move up, a trader uses the call option and expires the put option. If the prices come down, the put option is used and the call option is expired.

In this strategy, a trader incurs loss only if there is no market movement. Even if there is a loss, it is limited to the premium that the trader has paid. On the other hand, the trader can gain unlimited profit using this strategy, if the market is volatile.

Benefits of a long straddle strategy

Some of the positive aspects of using a long straddle strategy are:

- It helps in limiting the risks and can fetch unlimited profits

- If an investor can predict the market volatility correctly, the price movement direction does not matter and he/she can still make profits

Drawbacks of a long straddle strategy

Some of the limitations of this strategy are:

- Traders may have to pay high premiums while trading through this strategy

- To maximise profits, the price movements have to be substantial after considering premium payment

What is the Short Straddle Options strategy?

Also known as sell straddle, this strategy involves a short call and a short put bought with the same underlying asset, strike price and expiration date. This strategy is the opposite of a long straddle strategy since it is used when the market is least volatile.

In the short straddle strategy:

- A trader can expect profits by writing call and put options after paying a premium.

- The trader does not anticipate any market movement

- Trader expects to earn profits without any price movement

It is important to note that there can be larger risks here if the market moves differently than a trader’s prediction. At times, the premium paid may not be enough to compensate against the loss incurred. Therefore, to avoid large-scale losses, a trader must ensure to have accurate market information about no price movements expected in the future.

When is short straddle used?

As we know, this strategy is most suitable when the trader is able to predict no or minimal movement in the security prices. This strategy can fetch maximum benefits only if the trader can rightly predict least volatility. When the market is least volatile, the trader can make a profit as against a bearish or bullish market condition.

If a trader can predict such a market scenario, he/she can use this strategy to invest by writing an at-the-money call option and a similar put option. The condition is that both should be for the same underlying asset, strike price and expiration date.

If the market does not move much as predicted, the call and put options will expire and the trader makes profits through the premiums received. If, however, the market moves up, the trader could incur huge losses.

In high market volatilities, the call and put options turn highly overvalued and may begin moving downward. By using a short straddle strategy when volatility is expected to come down, a trader can make profits by closing the position before expiry.

Benefits of short straddle strategy

Here are the key benefits of short straddle strategy:

- Profits can be obtained even during non-volatile markets

- This strategy suits most the risk-prone traders

Drawbacks of short straddle strategy

Some of the drawbacks of short straddle strategy are:

- The scope of risk and losses is infinite

- Maximum possible profit is same as the premiums received

- Traders may incur huge losses in case the prices move opposite to what was anticipated

Conclusion

In comparison to the long straddle, the short straddle option strategy is far more complex and is best suited for seasoned traders. The long straddle strategy can be used by all traders since it is simple to understand and implement. It is best for investors and traders to identify their personal expertise when it comes to trading with specific straddle strategies.

FAQs

Strike price is the price at which an option buyer and an option seller agree to enter an options contract.

Every options contract comes with an expiration day or date. The option owner can exercise the option till the expiration date. The expiration date is set for the last Thursday of a month. In case the Thursday is a holiday, the contract’s expiry will be the previous trading day.

If the current option price is the same as the strike price, then the option is termed at-the-money.

You can trade only on options of select companies and indexes as designated by stock exchanges. Options of newer companies or indexes may be allowed to trade from time to time.

In India, NSE & BSE allow options trading. These exchanges are regulated by SEBI. Apart from these, options can also be traded through OTC markets, which offer non-standardized deals with no guarantor.