Stock trading is a very integral part of stock markets. In the past year itself, there has been a tremendous increase in the number of traders that have taken up stock trading as either their primary or secondary source of income. Stock trading involves a lot of research and understanding of the stock markets. Apart from that traders use various tools and techniques to analyze the price trends and movements. One such technical analysis tool is a morning star pattern.

Given below is the meaning of the morning star pattern and related details of the same.

What is morning star pattern?

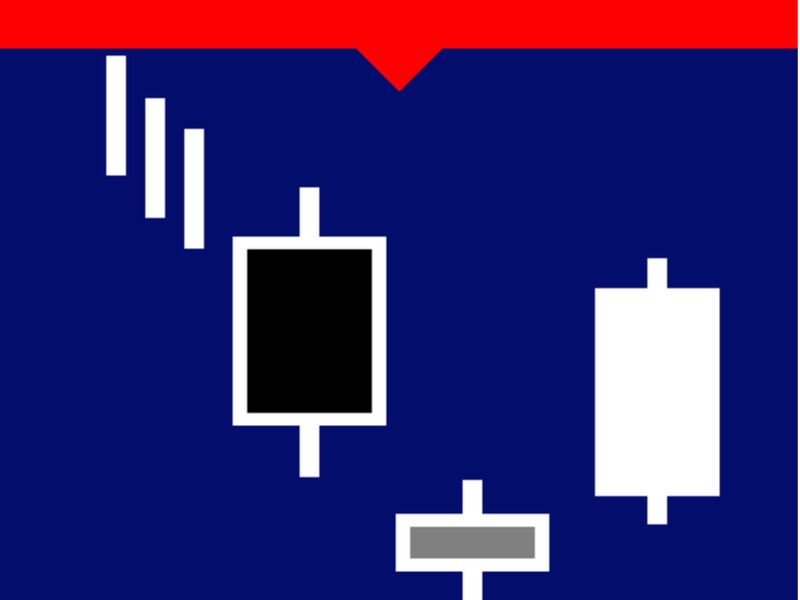

The morning star pattern is a technical analysis tool that bases the analysis of the stock charts on candlestick patterns. This pattern is a bullish reversal trend where the downward or the bearish trend is viewed to be reversed. This pattern is also known as the Three Inside Down Pattern where the bulls are seen to be taking control from a bearish trend. This creates a buying pressure on the stock and the prices are seen on the upward side. This pattern is named after the star on the candlestick that appears when the stock prices close above the opening price in an upward trend.

How to identify the morning star pattern?

There are many interpretations of the candlesticks and it sometimes becomes difficult for the traders to identify their target pattern amid the chaos of the markets. Therefore, to identify the morning star pattern, traders can watch out for the following events.

- The first step is to observe the market to establish a trend.

- The target stock has to be primarily on a downward trend and the first candle has to be red indicating a bearish mood.

- The second candle has to be a smaller body with a long wick on both ends. The colour of the candle is immaterial at this point.

- The third candle should be green and has to be backed by larger volumes. It should be of the same size as the first candle if not larger. When the third candle is backed by larger volumes indicating a bullish mood, a successful morning star pattern is said to have formed.

When the stock is on a downward trend, the prices of the stock keep going down. The buyer or the bulls enter the market when the stock prices are sufficiently low. This begins the buying trend and the sellers also start covering their short positions. This further intensifies the upward trend as the prices of the stock keep increasing finally creating a bullish market.

What is the significance of the morning star pattern?

The morning star pattern is a visual pattern that needs no complex calculation to execute successfully. It is a trend reversal pattern that indicates when an upward trend is formed. This pattern is formed in three trading sessions or is not formed at all. Volume is a major indicator of the morning star pattern. The increasing trend is to be backed by the high volumes and the traders can see a definitive pattern form over three days. Risk-averse traders may further wait to observe the price action however, the ideal entry point for the traders when the morning star pattern is formed is at the opening of the immediate next candle once the pattern is complete.

What are the pros and cons of the morning star pattern?

Like any technical analysis tool, the market star pattern also comes with its own set of pros and cons. Therefore it is important for the traders to understand this pattern completely before applying it and taking their trading positions. Some of the key pros and cons of this pattern are mentioned below.

- Pros

Few of the key benefits or pros of the morning star pattern are mentioned hereunder.

- This is a relatively easier technical analysis tool as there are no complex formulas needed to compute the outcome. At the same time, being a visual pattern, it is easier to identify and understand.

- This pattern can be considered to be more or less 100% accurate in comparison to other technical analysis tools which may not give the most accurate results or the results are open to interpretation.

- Another important feature or benefit of this tool or pattern is that it can be used across all kinds of assets whether they are stocks, indices, or currencies. This makes it multidimensional and easy to apply.

- Cons

Some of the common shortcomings or cons of this pattern are,

- This pattern can be easily mistaken for a Doji pattern which may result in misinterpretation of the market trends enabling the traders to take an incorrect profitable position.

- Another major disadvantage of this pattern is that it is quite rare in the bullish run. Especially in daily or weekly charts.

- Also, traders can mistake any small candle showing a downtrend to be a morning star which can lead to the further wrong analysis of the trends.

Conclusion

The morning star pattern is one of the easiest patterns to understand and implement. It indicates clear entry points so it can be easily used by new and seasoned traders. Apart from technical analysis, traders should not forget to undertake a thorough fundamental analysis to select the target stocks or sectors. This will also help the traders to stay safe from the failed reversal trends and assert the analysis.

FAQs

The three key factors needed for the morning star pattern are the three candle stocks establishing the movement from a downward trend to an upward trend.

For establishing the morning star pattern, the markets need to be primarily in the downtrend or the bearish trend.

When the volumes of the security are higher in the third candle as compared to the first candle, the pattern is said to be established and supported by the said volumes.

The ideal entry point for traders in the morning star pattern is when the morning star pattern is formed is at the opening of the immediate next candle once the pattern is complete.