At the very outset, wish you a very prosperous 2019.

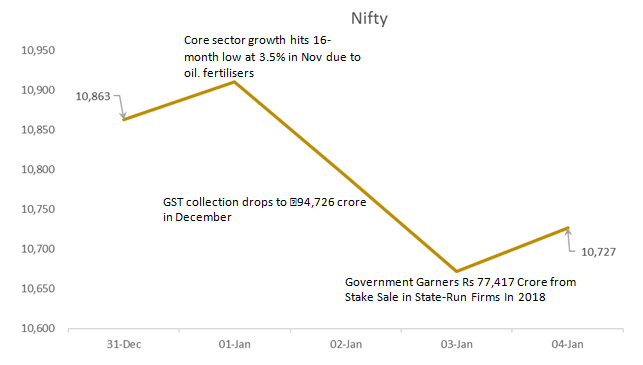

Last year has been quite eventful with many not-so-pretty events unfurling. However, the good news is that Indian equities continued to remain wealth creators. While 2017 was extraordinary and 2018 delivered relatively low, Nifty still managed to deliver an annualised 15.4% in the past two years.

For those of you bored of the routine, here’s a short video that sums up 2018 and our hopes for 2019 in a manner much more fun than you would have ever seen – Click Here.

As a fresh start to a brand-new year, here are three thoughts that may just change the way you look at certain aspects of your personal finance.

- Credit cards are NOT financially unhealthy

The most popular misconception is that credit cards are instruments meant to destroy your financial stability. However, this could not be farther from the truth. Credit cards, if used wisely & consciously can save you a lot in of rebates, discounts, reward points and liquidity!

The only thing that makes using credit cards unhealthy, is your lack of self-discipline.

Did You Know?

Warren Buffett once bought Bill Gates lunch at McDonald’s using a coupon.

If Warren Buffett values a good deal, you shouldn’t shy away from the ones a credit card offers you. However, proceed with self-discipline.

- You WILL retire & no, things won’t just fall into place

Nobody likes the thought of growing old. But, the truth is, all of us are growing older with every passing moment and are getting closer to the point where we no longer can work as much as we can now. There will come a point where we may have to live off our nest egg.

People around you may say that it will all fall place, but trust me, it won’t till you prepare for it.

Don’t take my word for it – try talking to the older folks around you and the importance of retirement planning.

Food for thought: Living longer is an actual risk!

- Your car is NOT an asset

Seriously, if you still view your car as an asset, you need to rethink. A car is subject to wear & tear, consistent usage, rapid depreciation and keeps sucking in more money for upkeep, maintenance & insurance.

And, in my personal opinion, none of this strike as a feature of an asset. Unless you are a celebrity (whose stuff get sold at auctions), own a vintage or you happen to meet an irrationally desperate buyer, the chances that you can sell your car at a profit is pretty slim.

Did You Know?

There’s some news around the event that Britney Spears’ chewing gum was auctioned off and sold on e-Bay for $14,000.

Unless you’re feeling like Britney Spears, don’t expect your car to be auctioned off at an exorbitant price

Though unconnected to the previous section, in of those readers following our for the “What Moved My Market” feature, here’s what moved our market in the past week.

Fund News:

- Fund manager change in Franklin Templeton schemes:

| Scheme Name | Change in Fund Managers |

| Franklin India Equity Hybrid Fund | Krishna Prasad Natarajan (Added) |

| Franklin India Debt Hybrid Fund | Krishna Prasad Natarajan (Added) |

| Franklin India Pension Plan | Krishna Prasad Natarajan (Added) |

| Templeton India Equity Income Fund | Lakshmikant Reddy & Anand Radhakrishnan (Replaces Vikas Chiranewal) |

| Templeton India Value Fund | Lakshmikant Reddy & Anand Radhakrishnan (Replaces Vikas Chiranewal) |

If you have any concern, please write to us at ask@fisdom.com or call at +080 48039999, we would be happy to answer your query.