“Opportunity and risk come in pairs”

― Bangambiki Habyarimana, The Great Pearl of Wisdom

While last weekend was Republic Day and we would love to share something interesting around the theme, mutual funds have received yet another shock through a credit default – but don’t worry, we’ve got your back!

This mail is to inform you about the default, corrective action taken and finally about how the week was Indian equities.

As an aftermath to the IL&FS downgrade, the credit rating of associated entity Jharkhand Road Projects Implementation Co. Ltd was downgraded to CRISIL D from CRISIL BB (Source: https://www.crisil.com/en/home/our-businesses/ratings/company-factsheet.JHRPIC.html). This downgrade was majorly driven by a default on payment of interest and principal obligations on CRISIL-rated NCDs which was due on 21 January 2019.

This event must be considered as an indicator to possible contagion in other entities associated the form of SPVs.

We have received communication from Aditya Birla Sun life AMC that the holdings are in the form of secured lending against an escrow maintained by JRPICL, which significantly protects it against the downside risk of complete write-off. ABSL AMC is optimistic about recovery of funds. However, we have reason to believe otherwise.

We continue to track portfolios holding associated SPVs and will communicate in case of any findings or information received. Fund names being withheld to avoid unwarranted panic.

Investors holding funds with exposure to JRPICL would have received a notification. All one needs to do is accept the request while we work it out for you.

If you have not received a notification, that may be because your portfolio remains unaffected by this change. However, if you believe there’s reason to worry, feel free to write back.

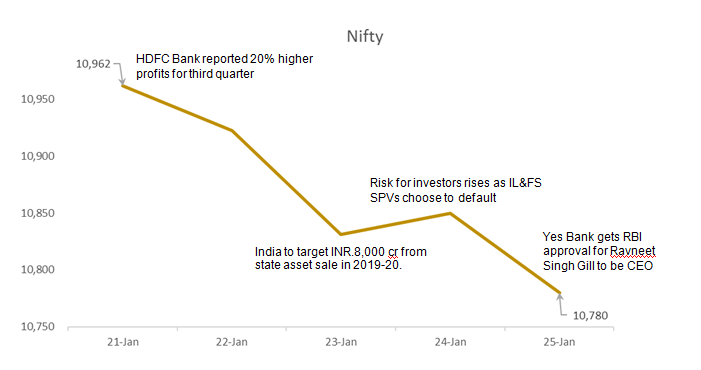

Now, moving on to our weekly Nifty-at-a-glance, here’s about the week that went by:

Fund News:

TATA Mutual Fund has decided to remove exit load from TATA Money Market Fund and TATA Short Term Bond Fund with effect from January 24, 2019.

L&T Mutual Fund has decided to appoint Jalpan Shah as Fund Manager – Debt along with existing Karan Desai, Praveen Ayathan and Venugopal Manghat to manage L&T Arbitrage Opportunities Fund with effect from January 24, 2019.

If you have any concern, please write to us at ask@fisdom.com or call at +918048039999, we would be happy to answer your query.