It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

-Henry Ford

Big News:

The monetary policy committee cut repo rates by 25 basis points (0.25%) to 6.25% in its sixth bi-monthly monetary policy. Consequently, the reverse repo has come down to 6 percent.

Implications in brief:

- Cheaper loans, increased consumption.

- Low-interest cost, revival of corporate profitability.

- Need to watch out for increase in inflation due to increase in demand

Now, let’s elaborate the impact on your personal finance-

1. Housing & Consumer loan may get cheap

As RBI has reduced the key policy rates, the presumption is that banks will pass on the same benefit in the same to the end consumer.

For new borrowers: They can expect loans at lower interest rates

For existing borrower: Those who has existing home loan & car loan on floating rate can expect lower interest rates.

Borrowers having a loan at fixed rate can negotiate with the existing borrower or can switch to new banks offering a flexible rate at lower rates.

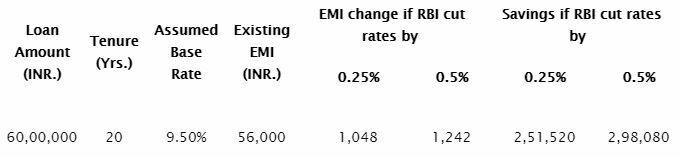

Below example will help you understanding the real impact:

2. Impact on fixed deposits

The repo rate can push banks to reduce their fixed deposit as main objective of cutting repo is to allow more money to flow in the hands of end consumers.

Please note that existing FDs will not get impacted by the cut. But yes, if you are planning to start with any new FDs, start it before new rates come into effect.

3. Impact on debt mutual fund

Lower rates are always good news for a bond market, which are very sensitive to interest rate changes. When interest rates fall, prices of bonds go up.

4. Impact on equity mutual fund

When RBI cuts interest rates, it allows banks to reduce their lending rates and hence, reduces the borrowing cost of the company. It contributes to an increase in profitability and indirectly revenues by way of higher private capital expenditure.

We expect the rates to go up in the second half of the fiscal year; however, there is enough scope for another cut intermittently.

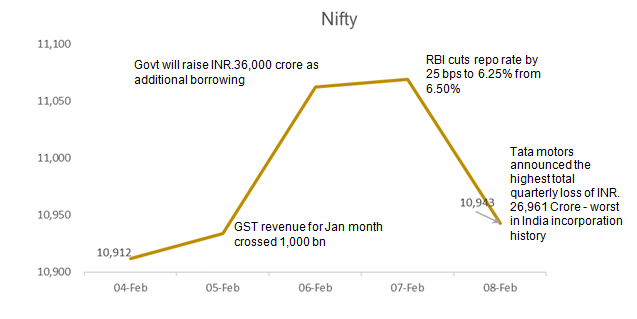

Here’s how the Indian equities reacted to the anticipatory MPC meeting and how did it finally end once the committee declared what it had to.

If you have any concern, please write to us at ask@fisdom.com or call at +918048039999, we would be happy to answer your query.