Asset allocation compass | FY26 Kickoff

| Asset Class | Our View | Commentary |

| Equity | Neutral – Bias Positive | Bottom-up opportunities still exist. Follow 60:20:20 when it comes to large, mid and smallcap allocation. It’s a buy-on-dip market. |

| Debt | Overweight | Follow Barbell Strategy. Overweight on duration play. Reduced fiscal deficit projections, coupled with global bond inclusion and decreased gross borrowing, will likely have a positive impact on the bond market. |

| Gold & Silver | Neutral: Bias Positive | Suggested to buy on the dip. Maintain it as a strategic allocation. |

| Real Estate | Negative | Opting for investments through REITs and realty stocks might be the favorable choice. |

| International Equities | Netural | Maintain it as a strategic allocation; avoid going overweight. Tactically positive on China. |

| Investment Ideas For FY26 | 1.Defence

2.China |

Suggested to be part of satellite portfolio. Allocation: 5-10%, Staggered deployment recommended. |

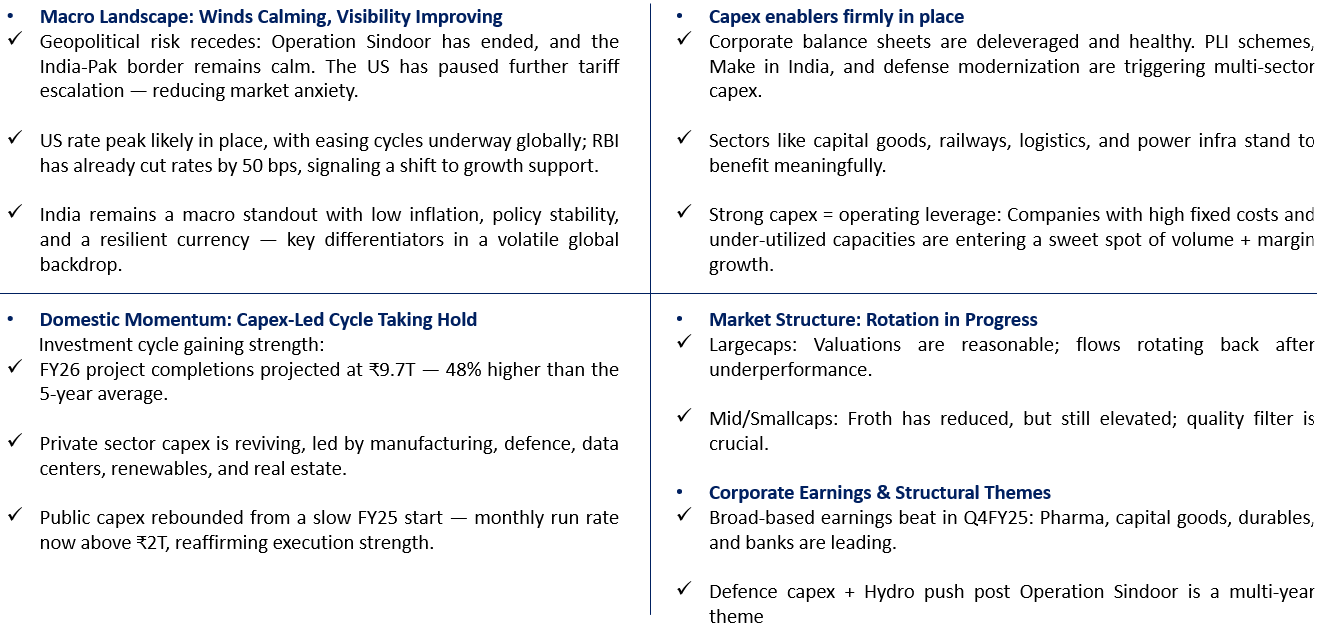

Equity market outlook: Reclaiming stability, refocusing on growth

Sector outlook: Favoring domestic plays amid global uncertainty

| Sector | Outlook | Rationale | Preferred Positioning |

| Financials | Positive | Credit growth strong, asset quality stable, margin tailwinds from lower rates. | Overweight large private banks and diversified NBFCs. |

| Capital Goods & Industrials | Positive | Beneficiaries of rising public & private capex; defence orders gaining traction. | Overweight PSUs like HAL, BEL, and execution-focused EPCs. |

| Healthcare | Positive | Hospital occupancy rising, pharma growth visible in both US specialty and domestic. | Overweight hospitals specialty pharma. |

| Telecom | Positive | Tariff hikes likely post-elections, ARPU improving, sector moving toward profitability. | Prefer leaders; integrated telcos with 5G monetization. |

| Consumer Discretionary | Selective | Urban premium demand robust, supportive macros (tax cuts + low inflation). | Focus on autos, QSRs, durables with brand and pricing strength. |

| Consumer Staples | Neutral | Margins improving with raw material relief; rural volume recovery still weak. | Hold core names with pricing power and rural exposure. |

| IT Services | Cautious | Deal wins muted, margin pressure visible; client spending under scrutiny. | Stay underweight; monitor H2 outlook for potential re-entry. |

| Metals & Commodities | Tactical | Global pricing soft, China slowdown impact visible; pick only balance sheet-strong names. | Tactical exposure to low-cost producers with deleveraged balance sheets. |

| Auto & Ancillaries | Tactical | Tractor and 2W demand to benefit from rural rebound; EV pipeline builds long-term case. | Prefer OEMs with EV focus and rural demand recovery levers. |

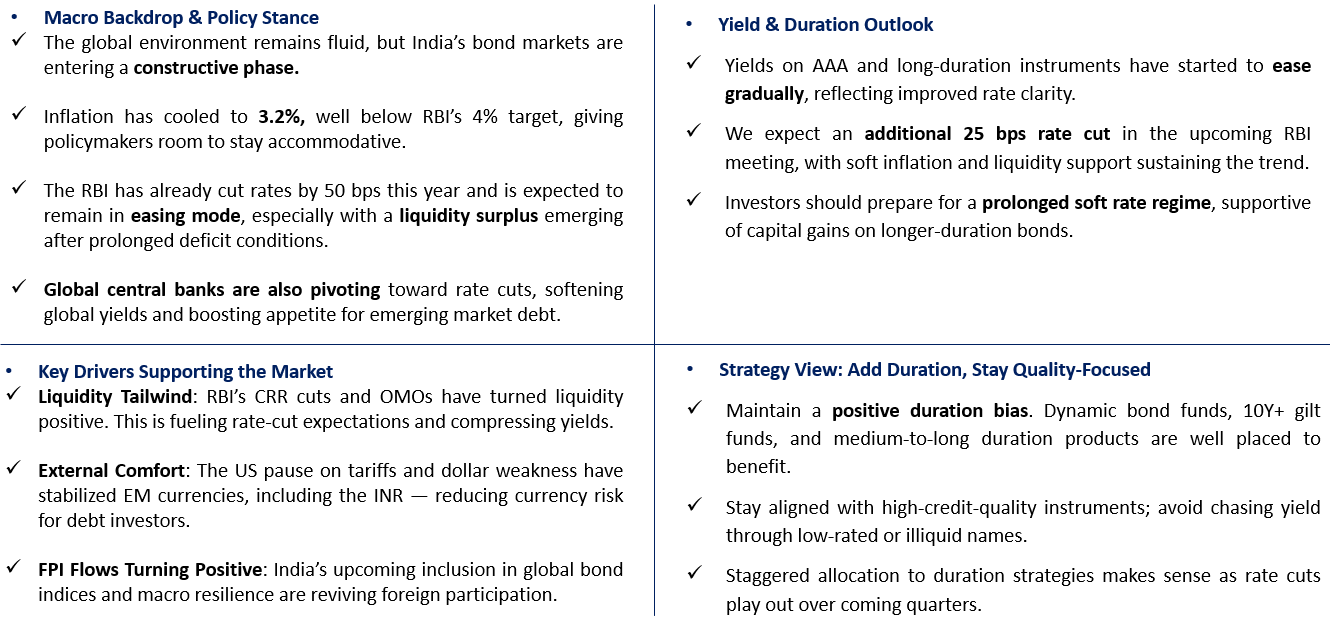

Debt market outlook: Anchored by stability, poised for duration gains