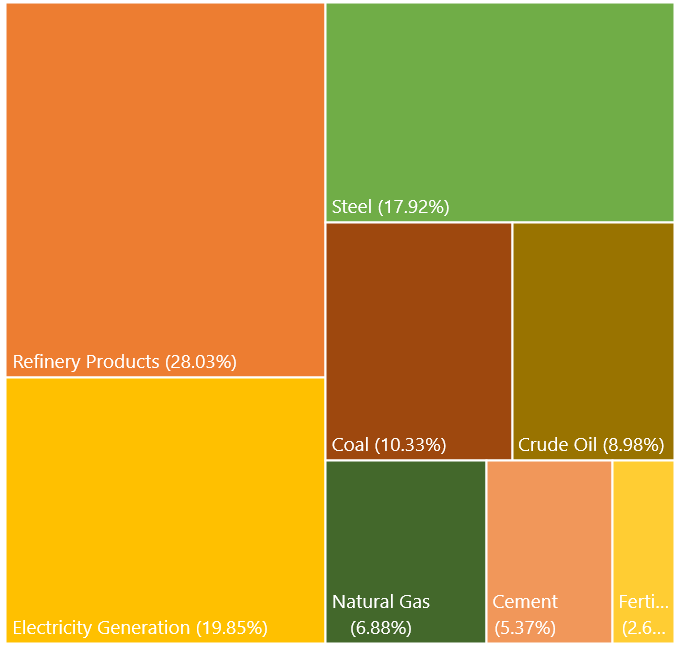

Composition: Eight Core Industries

40.27%

Contribution to Index of Industrial Production

The eight core industries, a significant subset of the aggregate IIP, represent and reflect the direction of production-related economic activities.

It is an important lead indicator for overall industrial performance and general economic activities in the economy.

Eight-Core

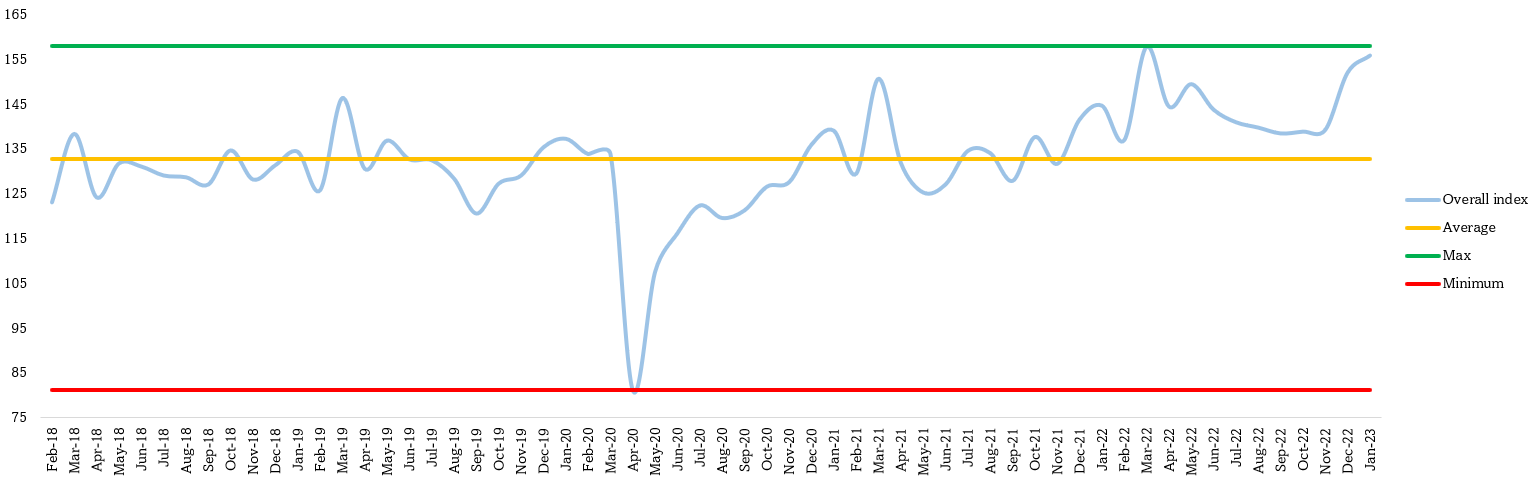

Performance: Eight Core Industries Overall Index

Data Source: CMIE

156.0 ( YoY : 7.7% | MoM: 2.5% )

- Performance of core eight industries enhanced and was very close to its peak in Jan’23. The overall index exceeded their respective levels achieved over the corresponding period of COVID affected last two years and pre-COVID years.

- Except for crude oil industries, all seven other industries grew over the corresponding month of the last year. The coal industry, Fertilizer industry & electricity industry contributed more to the overall growth. These three sectors have grown by 13%, 17% & 12%, respectively, on a YoY basis.

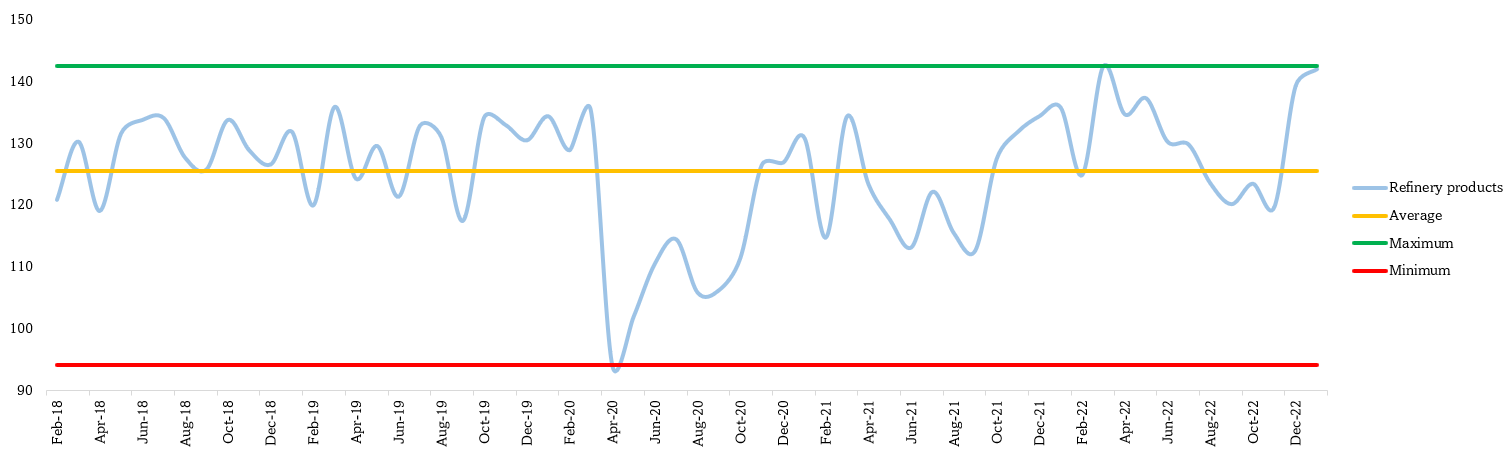

Refinery Products

Production: Refinery Products

Data Source: CMIE

142.0 (YoY : 4.4% | MoM: 1.9%)

- Performance of refinery products industries was very close to its peak touched in Mar’22. Crude Oil Processed during January 2023 was 22809.58 TMT, which is 4.61% higher than the target for the month and 5.07% higher than January 2022.

- Both CPSE refineries & private JVs had processed 5.5% & 3.08% higher than their target for January 2023. Cumulative throughput during April – January 2023 from CPSE refineries was 1.6% higher than the target for the period, but it was 1.8% lower than the target.

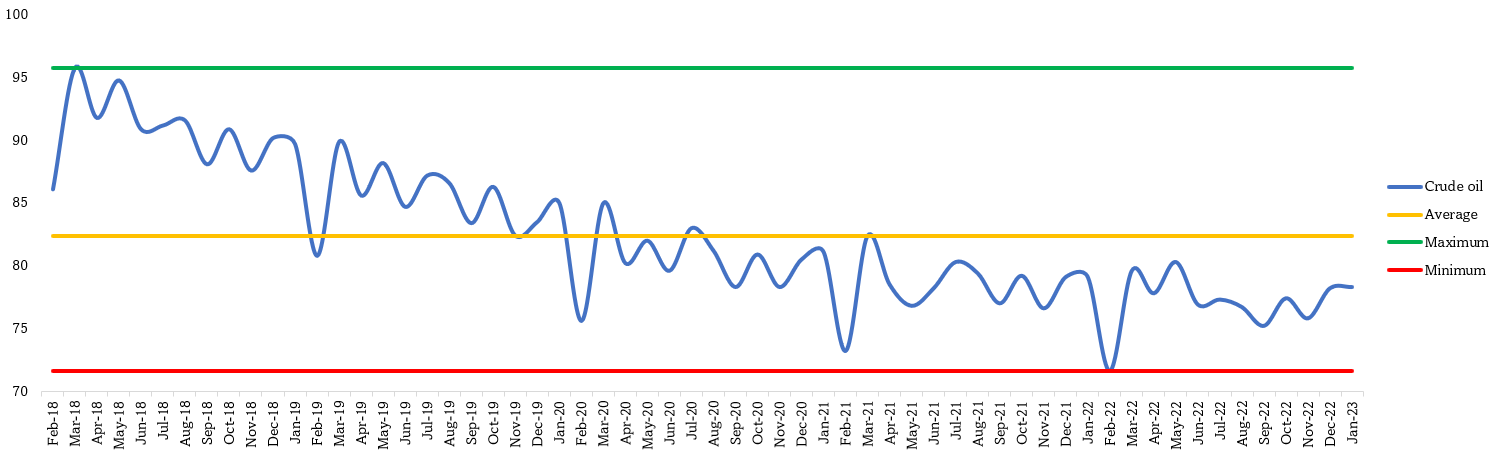

Crude Oil

Production: Crude Oil

Data Source: CMIE

78.3 ( YoY : -1.0% | MoM: 0.1%)

- Performance of refinery products industries was not that great and is still far away from its pre-pandemic levels. Crude oil production during January 2023 was 8.33% lower than the target for the month and 1.06% lower than the production of January 2022. Cumulative production during April-January, 2022-23 was 7.17% lower than the target for the period.

- Crude oil production by ONGC was up by 5.4%, and production by OIL & Pvt/JVs was down by 10.1% & 15.4%, respectively. Detailed reasons behind the shortfall are highlighted in the next slide.