Technical Overview – Nifty 50

The benchmark index NIFTY closed down just by -0.05%, or 11 points, to 22,957. The benchmark index reached the 23,000 milestone during today’s session. Because there was no obvious momentum on either side, the benchmark index finished flat, making the session uninteresting for option purchasers. Despite a slow day, the index managed to close higher than it did yesterday.

On-balance volume indication Additionally, volume has surpassed earlier volume thresholds, confirming a breakout. The 14-period RSI momentum indicator is very close to the over-bought zone 70. The trend of follow-up purchases appears to be lagging.

The benchmark index’s 22,850 and 22,750 zones serve as support levels. The levels 23,150 and 23,250 might be used as resistance levels in subsequent sessions.

Technical Overview – Bank Nifty

The day finished with a gain of 0.42%, or 203 points, for the BANK NIFTY index, which closed at 48,972. The Banking Index outperformed the benchmark index during the day, rising to the 49,050 level.

The banking index increased by 300 points, indicating follow-up buying. Even with 200-point volatility in the last 30 minutes of the session, the market managed to settle close to the day’s high. Positive momentum seems to be sustaining itself every day. Right now, the RSI momentum indicator is moving in the direction of the overbought region.

Future session resistance levels are shown at 49,250, and 49,600, while future session support levels are shown at 48,600, and 48,250.

Indian markets:

- Indian stock market benchmarks, the Sensex and the Nifty 50, ended flat with a negative bias on Friday, May 24, due to profit booking at record-high levels amid weak global cues.

- The Sensex reached a new all-time high of 75,636.50 during the session but failed to hold its gains, closing 8 points lower at 75,410.39.

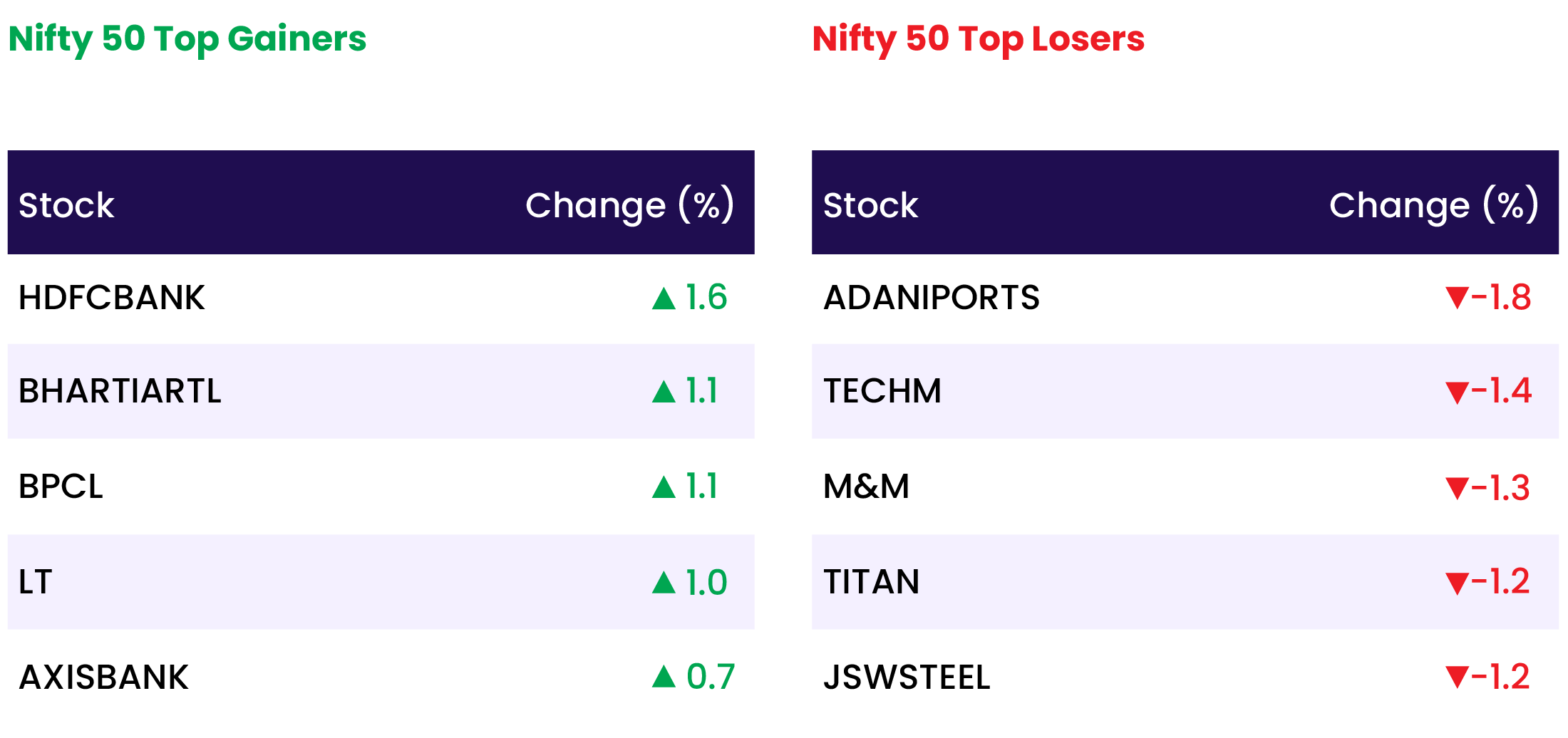

- Sector-wise, oil & gas, capital goods, telecom, and media rose by 0.5-2 percent, while FMCG, healthcare, IT, metal, and realty each declined by 0.5 percent.

- The BSE Midcap index increased by 0.2 percent, whereas the Smallcap index decreased by 0.2 percent.

Global Markets:

- Hong Kong stocks led losses in the Asia Pacific on Friday after Wall Street tumbled overnight on rate concerns, while investors digested inflation data from Japan.

- Hong Kong’s Hang Seng index fell 1.71%, and mainland China’s CSI 300 dropped 1.11%.

- In South Korea, the Kospi ended 1.26% lower, dragged down by heavyweight Samsung Electronics, while the small-cap Kosdaq lost 0.85%.

- The Nikkei 225 slid 1.17%, and the broad-based Topix fell 0.44% as investors assessed April inflation data from Japan for clues on the Bank of Japan’s monetary policy moves.

- Japan’s core inflation, which excludes fresh food and energy, eased to 2.2% from 2.6% in March, matching expectations. Headline inflation slowed to 2.5%, down from 2.7% in March.

- The Australian S&P/ASX 200 also ended 1.08% lower.

Stocks in Spotlight

- Shares of Bharat Dynamics, a Miniratna defense PSU, surged by 10.44 percent to reach a new adjusted 52-week high of Rs 1,658.95, continuing a nine-day rally that resulted in a massive 70 percent gain. The company traded ex-split on May 24, following its recent announcement to split one equity share with a face value of Rs 10 into two shares with a face value of Rs 5 each.

- Vodafone Idea (Vi) shares surged 7.5 percent after UBS upgraded the stock from ‘Neutral’ to ‘Buy,’ raising the target price from Rs 13.10 to Rs 18. The international brokerage anticipates a potential 70-80 percent rally in the stock ahead.

- Finolex Cables’ stock skyrocketed by 12%, propelled by a robust performance in the January-March quarter (Q4FY24), surpassing market predictions. The company’s consolidated net profit saw a notable 6.3% year-on-year (YoY) surge, reaching Rs 186 crore in Q4FY24. Moreover, revenue from operations experienced a substantial YoY growth of 18.3%, amounting to Rs 1,450 crore in Q4FY24.

News from the IPO world🌐

- Beacon Trusteeship IPO to open on May 28

- Go Digit Insurance lists at 5.15% premium over issue price

- OYO withdraws DRHP, to refile IPO post refinancing

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 1.0 |

| NIFTY FINANCIAL SERVICES | 0.6 |

| NIFTY OIL & GAS | 0.5 |

| NIFTY BANK | 0.4 |

| NIFTY PRIVATE BANK | 0.4 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1598 |

| Decline | 2254 |

| Unchanged | 93 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,671 | (0.5) % | 5.2 % |

| 10 Year Gsec India | 7.0 | 0.0 % | (1.5) % |

| WTI Crude (USD/bbl) | 78 | 0.7 % | 12.5 % |

| Gold (INR/10g) | 72,425 | (0.8) % | 6.4 % |

| USD/INR | 83.31 | 0.0 % | 0.3 % |