Sometimes, it takes years to become an overnight success.

India, like the rest of the world, has been experience a myriad set of challenges. Just when the economy was recuperating from the pandemic ridden turmoil, it had to bear the brunt of the RUS UKR geopolitical crisis. Remnants of the turmoil and crisis continues to linger across the global economy even as many struggle to shake it off and bounce right back. But, here’s where India detaches itself from the global context.

India has been witnessing a strong economic recovery and has been earning the reputation comparable to that of an oasis in the desert. With high frequency and macroeconomic fundamental indicators reflecting confidence, resilience and progress, the Indian economic recovery has just started to take shape. National accounts are getting in shape, the banking system is healthier than ever, consumption is robust, forex reserves are strong, the currency remains economically accretive, the central bank is gaining a handle on inflation, GDP components are strengthening at a fast pace and the list could go on. However, the path ahead is anything but strewn with roses. External risks, domestic challenges and threatening possibilities follow the economy like a shadow.

There is much more to the great Indian economic recovery than meets the eye. The bulls are now awake, but it is yet to charge ahead.

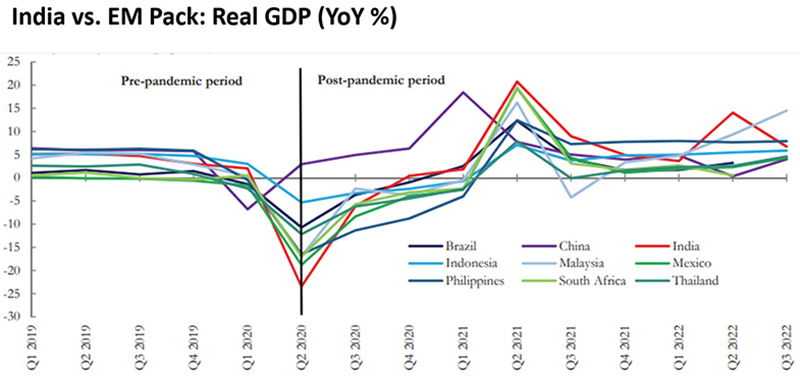

Indian economic recovery outshines remainder EM pack

Consumption and large public capex outlay have been critical factors

(Source: CEIC, World Bank, Fisdom Research | Note: Quarters defined per Calendar Year)

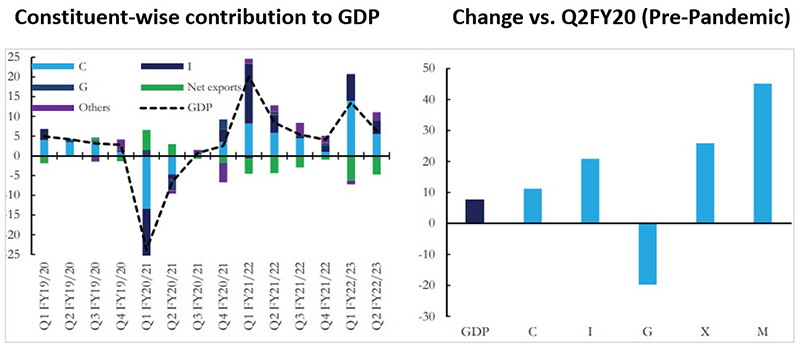

- India recorded a real GDP growth of 63% in Q2FY23 on the back of robust domestic consumption. The same was accentuated further on account of a rebound in public sentiment during the festive season which opened in full swing after relatively dull, restrictive festivities in the past couple of pandemic-ridden years.

- Rollback of pandemic relief stimulus packages by the government arrested an otherwise fuller rebound in real GDP

- A sizeable and committed public capex agenda coupled with expanding private capex continues to bolster investment growth

- The export component remains dented though amid weak external markets while imports run significantly ahead

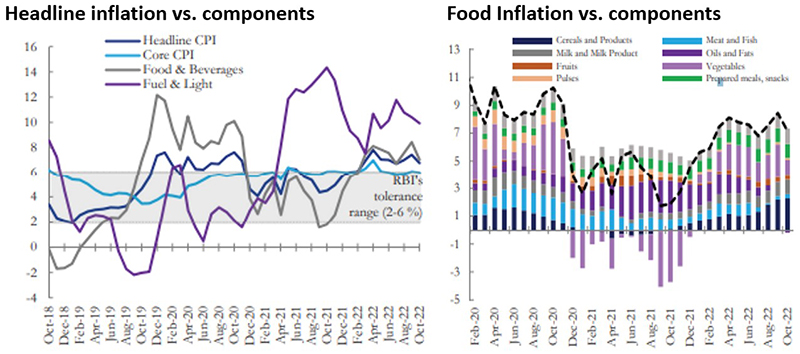

Headline inflation remains elevated; components show signs of easing

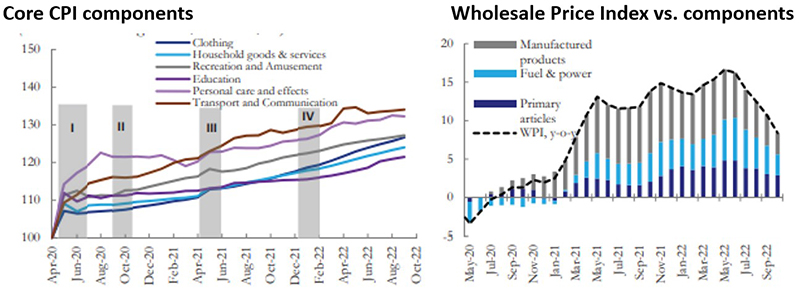

Food, fuel and WPI moderate; trade disruption exerts persistent pressure on key components

(Source: NSO, Ministry of Commerce, CEIC, World Bank, Fisdom Research)

- Inflationary heat intensified especially through the first quarter of CY22 on the back of residual pandemic-related trade disruption and follow on disruption on the back of the RUS UKR geopolitical crisis.

- Though still beyond the central bank’s tolerance threshold, inflation exhibits signs of softening.

- Fuel prices have eased on the back of softening global prices and reduction in government tariffs. Food prices have eased on account of a higher base effect, cheaper transportation, improving supply chains, reduced input prices. Per World Bank observations, Policy support on limiting exports of key grains, easing import tariffs on edible oil and efficient management of fertilizer supply supported easing food prices.

- Moderation in global energy prices reflect in softening WPI numbers.