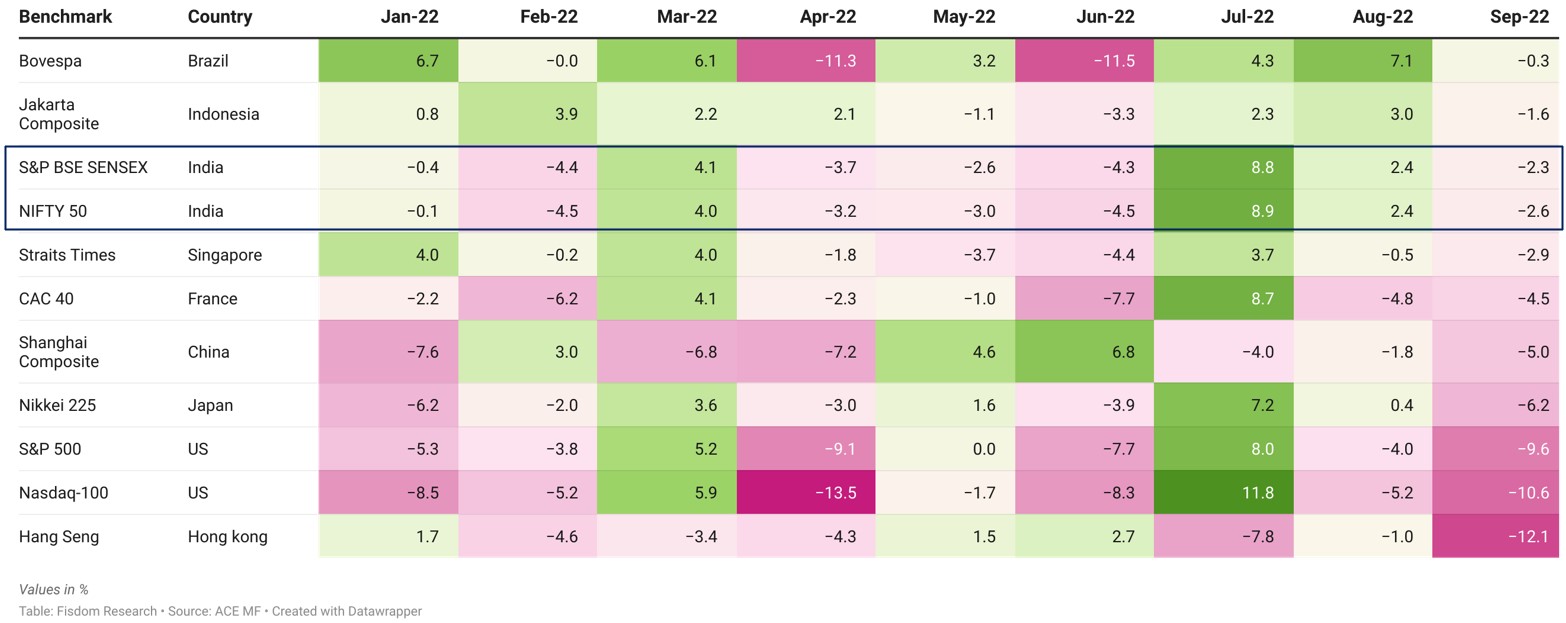

Indian equities stand tall and strong

Indian markets have exhibited remarkable resilience & outperformed most of the AE pack in year 2022

Strong macro fundamentals, proactive monetary & fiscal support and strong corporate balance sheets were a few key reasons behind the resilience of the Indian benchmark indices. We saw the same thing happening in Sept’22.

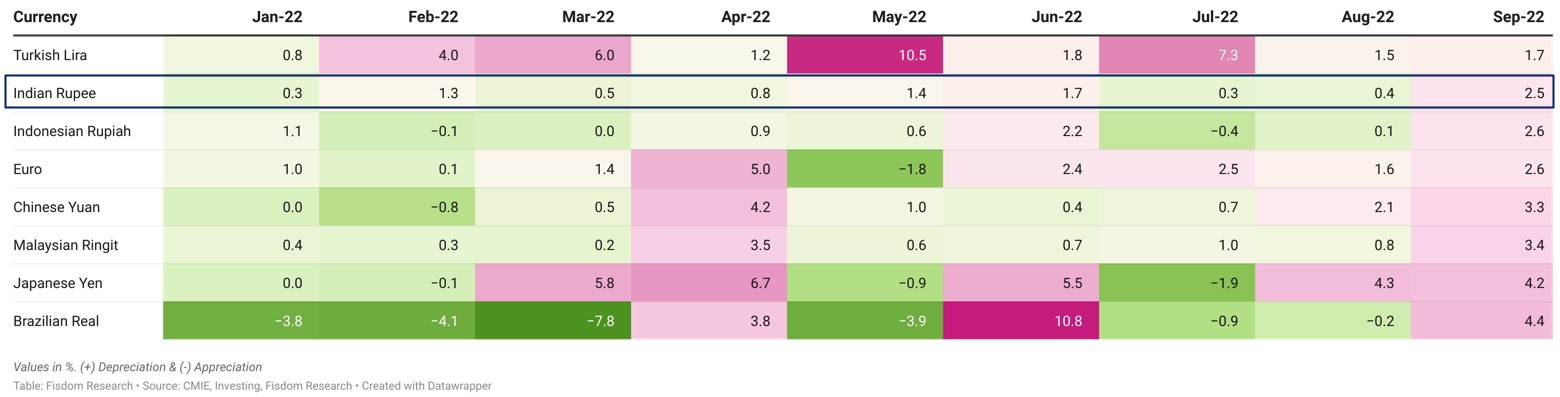

Bruised yet valiant INR

INR among strongest in the EM pack

- The Dollar index strengthened to a two-decade high on the back of expectations of a prolonged and rather aggressive rate hike cycle in the U.S. Most other currencies plummeted steeply with a few even slumping to GFC-era levels.

- The EM pack, in general, has been resilient versus AE counterparts. Even among EMs, Indian currency has been able to uphold value through great resilience. Most of the INR’s strength is attributable to prudent central bank policymaking and forex reserve management.

- The INR remains vulnerable to externalities with AE central banks’ policies, RUS-UKR geopolitical crisis ripple effects on trade economics and increasing probability of elevated energy prices featuring as key risks in the near term.

- We expect the USD/INR pair to exhibit heightened volatility in the near term with a deprecative bias. The pace of value erosion along with probability of risks materializing point the trajectory towards INR 82.75 – INR 83.50 range by the end of CY22. While already seemingly at the brink of RBI’s tolerance range, an increased quantum of forex intervention may arrest further slides while stabilizing the currency in the INR 82.50 range.

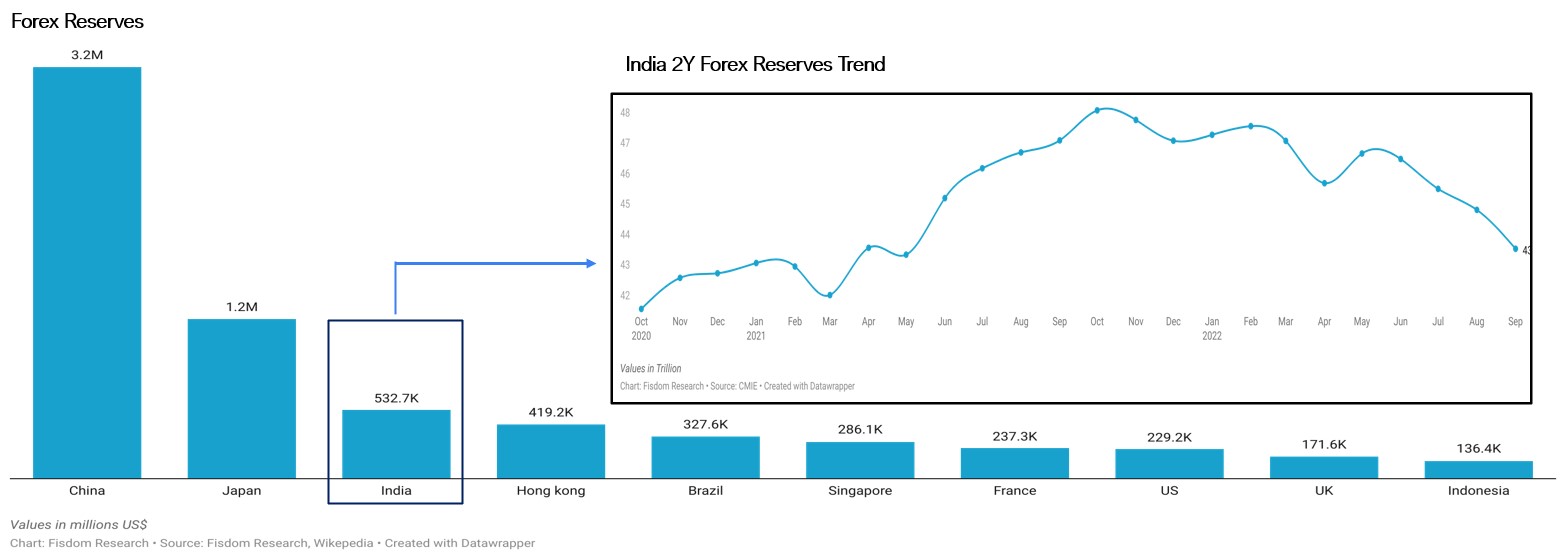

Dwindling but strong forex reserves

India’s forex reserves stand strong vs. broader EM pack

- Unlike 1991, when India pledged its gold reserves to stave off a major financial crisis, the country today can depend on its soaring forex reserves insulates against most economic challenges. Though it is depleting fast, it remains relatively stronger than many EMs and AEs.

- We expect India’s forex reserves’ pace of depletion to flatten going ahead on the back of improving trade economics, strengthening case for attraction of foreign capital, prudent forex intervention policy by the central bank and mark-to-market uptick in prices of gold holdings.

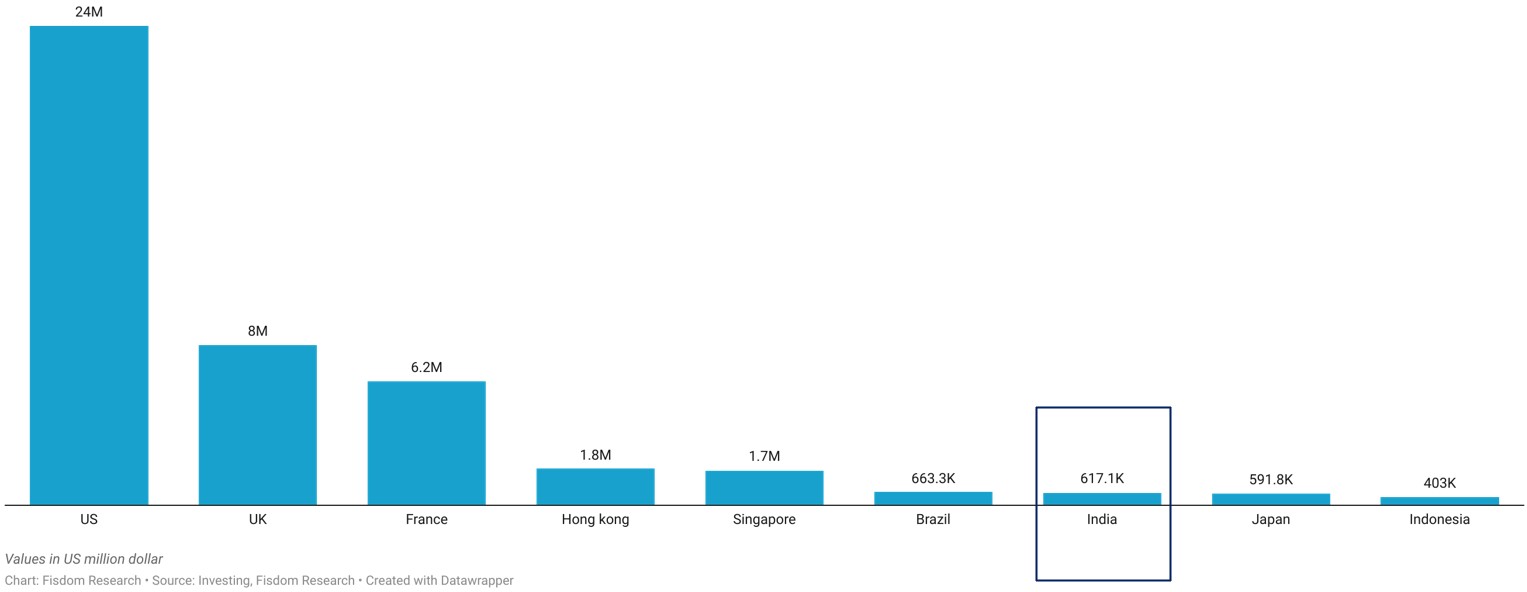

Controlled external debt situation

India placed relatively in much better position compared to other countries

- Drawing upon insights from RBI’s report covering India’s external debt situation, the Indian economy’s sustainability basis debt fared better than the LMIC (Low and Middle Income Countries) group while also outranking most on a variety of vulnerability indicators.

- Basis external debt, India ranks at a modest 23, globally. However, U.S’ state of ballooning external debt in a highly globalized trade economy is a looming risk to the world economy even as it flags the possibility of a dreadful contagion.