Letter To Investors

The market bounced back to positive territory in September 2023 after crossing the historic levels of 20,000 of the Nifty 50 indices, This was after a dip witnessed in benchmark indices in August 2023. The midcap and small-cap indices continued their positive trajectory for the sixth consecutive month. This impressive rally can be attributed to multiple factors: robust domestic flows, superior macroeconomic fundamentals relative to emerging and developed markets, a promising earnings outlook, increased stability in the banking sector, and positive signs regarding private capital expenditure.

In terms of sector performance, all sectors ended positively, wherein Utilities, Telecom, Power, and Metal indices outperformed. As opposed to this, the Consumer Discretionary, FMCG and Basic Materials sectors lagged. In the fixed-income market, 10-year G-sec yields aligned with the previous month’s close, settling at 7.18%. Indian bond yields have remained stable because investors do not expect the Reserve Bank of India (RBI) to raise rates further.

Additionally, India’s inclusion in JPMorgan’s emerging market debt index has softened the impact on yields. Turning to the broader economic landscape, manufacturing firms saw substantial increases in both demand and output thanks to favourable market dynamics, effective advertising, and positive demand trends. While there has been an improvement in the monsoon and crop sowing, challenges and disparities in crop performance persist across different regions and crop types. India’s trade deficit reached a 10-month high amid a rise in crude oil prices in September 2023. The gap between Indian and US government bonds has dropped to its lowest in 14 years, now below 300 basis points; this has triggered FIIs to hit the sell button from emerging markets, including India, in September 2023.

Overall, the current market conditions are marked by both challenges and opportunities. We remain committed to navigating these dynamic waters diligently and adjusting our investment strategies as needed to maximize returns while managing risks.

Please do not hesitate to reach out if you have any questions or require further information. Thank you for your continued support

Asset Class Views

| Equity Theme: India’s Growth Story

|

| Fixed Income Theme: Quality Focus

|

| Gold Theme: Buy on dip

|

Why Cautious?

- El Nino resulting in poor rainfall

- Election led to uncertainty in 2024

- Geopolitical uncertainties & and sluggish growth in Europe & and the USA

- Inflation resurgence amid Israel-Hamas conflict

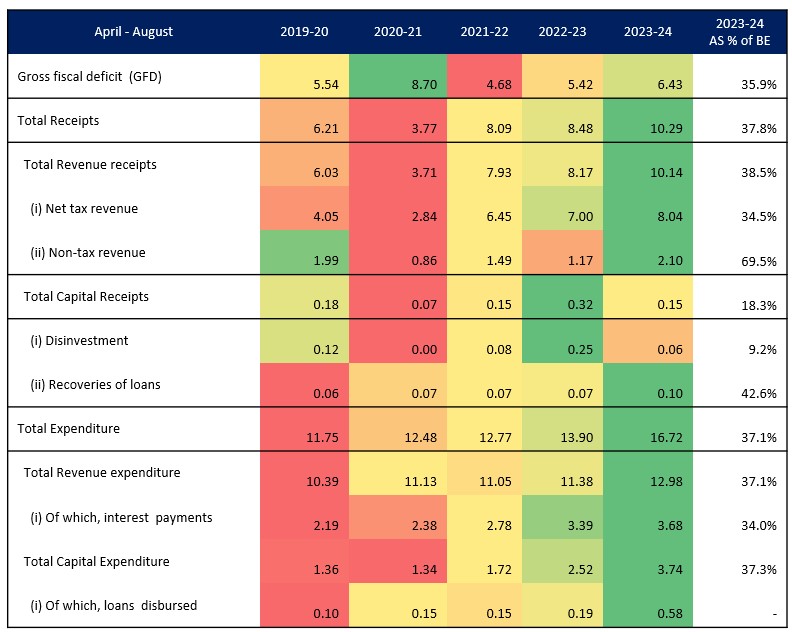

Accounts: Centre Government Finances

Remarkable tax collection surge in august 2023 eases fiscal concerns

Source: CMIE, Fisdom Research

Government’s Remarkable Tax Collection Reversal

- Central Government tax collections in August 2023 surged, mitigating fiscal concerns.

- In August 2023, tax collections witnessed an extraordinary growth of 553.3%. As a % of BE, it is the highest ever seen in at least two decades.

- This impressive performance resulted in a cumulative tax revenue growth of 14.8% during the first five months of the fiscal year compared to the previous year.

Government’s Capex Growth

During the initial five months of the ongoing fiscal year, the Central Government experienced a notable upswing of 14% in its revenue expenditure, reaching a total of Rs. 12.9 trillion. Most of these expenditures were channelled into subsidies, agriculture, and pension disbursements.

Simultaneously, there was a remarkable 48% surge in capital expenditure. This substantial increase was predominantly directed towards bolstering infrastructure development, focusing on the railway and road sectors.

Outlook |

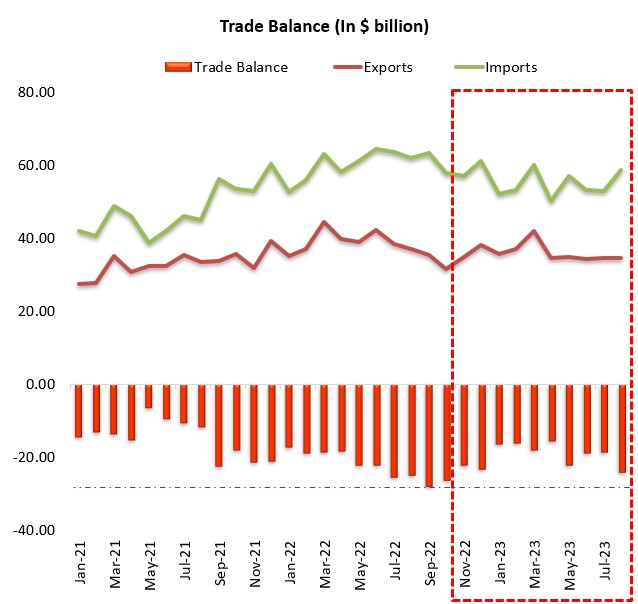

Accounts: Trade Deficit Soars To 10 Month High

Import bill surges while exports stay stagnant.

Source: CMIE, Fisdom Research

I. Import Bill At 5-Month High

Costly imports in August, especially for Oil:

- In August, India spent a lot on oil (POL imports), which increased by 12.2% due to higher oil prices.

- In September, the price of oil continued to rise, reaching USD 95.6 per barrel, driven by factors like Russia’s fuel export ban and Saudi Arabian production cuts.

Rise in Non-POL Imports, especially Gold

- India also bought more other items (non-POL imports) and saw a significant increase in gold imports, likely due to the upcoming festive season.

II. Exports remain stagnant

- Despite increased imports, India’s export earnings remained at USD 34.5 billion.

- While petroleum exports declined, exports of other goods (non-POL exports) increased by 3%, totalling USD 28.6 billion.

Outlook |

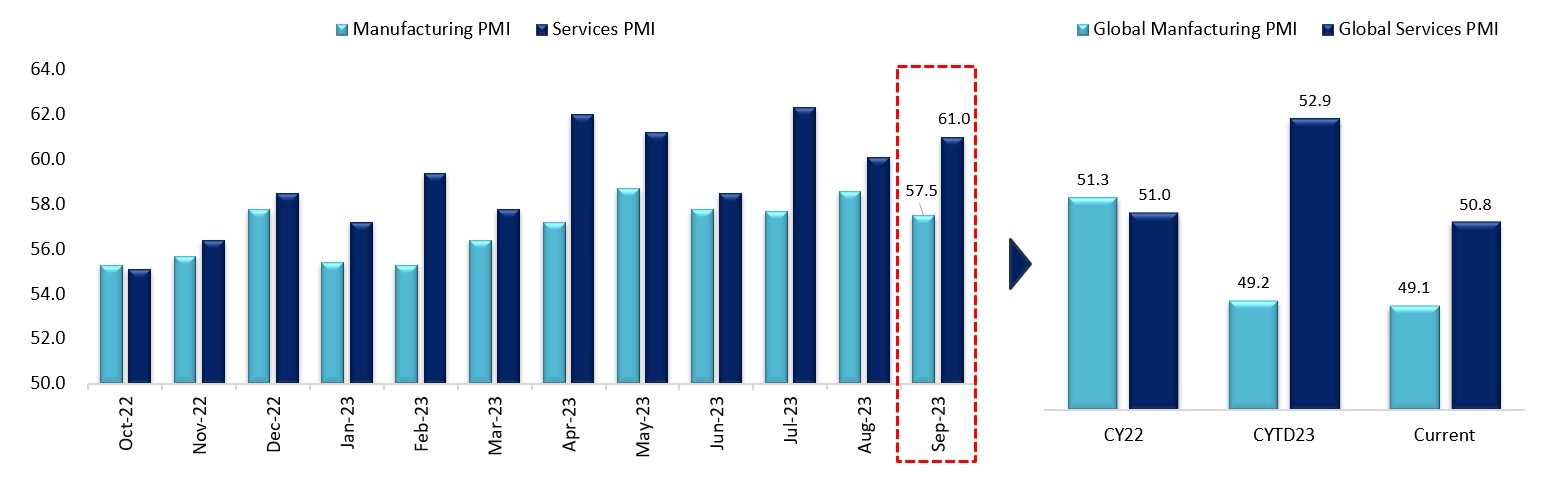

Manufacturing & Services: India’s Unique Position in the Global Context

India bucks the trend as global manufacturing & services PMI contracts

Source: CMIE, Fisdom Research

- India’s manufacturing and services sectors sustained exceptional performance, consistently staying within the growth zone. Notably, this performance outshines that of many other countries worldwide.

- In terms of manufacturing PMI growth, the driving force was the strength of demand. Manufacturing firms saw substantial increases in both demand and output thanks to favourable market dynamics, effective advertising, and positive demand trends. Similarly, the services PMI also pointed to a significant upswing in output, marking one of the most robust growth rates in over 13 years. This growth was fueled by a favorable demand environment, resulting in increased workloads.

Outlook |