Letter To Investors

Dear Investor,

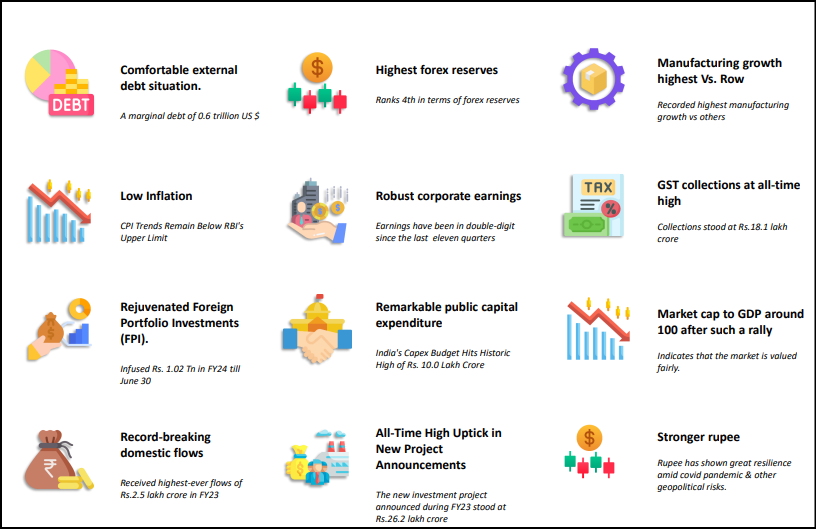

June 2023 witnessed a continuation of the bullish trend in the Indian stock market, with the market achieving new life highs after seven months. This remarkable achievement is a testament to the resilience and strength of the market, demonstrating the confidence and optimism of investors. Several factors contributed to this positive momentum, including robust GDP growth, strong corporate earnings, correction in commodity prices, and improved monsoon conditions. Additionally, foreign investors have displayed unwavering confidence in the Indian market, as evidenced by significant net foreign portfolio investment (FPI) inflows amounting to Rs. 47,148 crore in June 2023. This represents the highest inflows since August 2022, further highlighting the attractiveness and growth potential of the Indian market.

Monsoons continue to play a pivotal role in projecting inflation in India. We are pleased to inform you that the threat of El Nino, which posed a near term risk, has diminished due to heavy rainfall in various parts of the country over the past few days.

Furthermore, the Indian rupee has exhibited strength against major currencies, benefiting from foreign portfolio investment inflows and robust foreign exchange reserves.

Moreover, GST collections have consistently surpassed expectations, reflecting increased economic activity and improved compliance.

We have also observed a shift in investor preferences within the equity space for the third consecutive month, with smallcap and midcap categories outperforming largecap stocks. Additionally, almost all sectors ended the month positively, with the industrial and capital goods sector leading the rally.

On the debt side, yields on government securities (g-secs) followed the desired path in June, with higher residual maturity g-secs yielding higher returns. Yields on corporate bonds displayed mixed trends. Inflation for June 2023 reached 4.6%, primarily driven by price surges in the food and miscellaneous groups.

There is so much that has happened and much more than we anticipate. This is effectively captured in Fisdom Research’s latest edition of its monthly outlook on the Indian economy and capital markets – CapView. This month, the report is titled – “Charging Ahead”. You may have already caught onto the reason, but there is much more.

Tailwinds

Headwinds

1. El Nino resulting in poor rainfall

El Niño can result in poor rainfall, impacting regions with droughts, crop failures, and water shortages.

2. Elections and Government Stability in 2024

Multiple state and general elections in 2024 may bring political shifts and instability.

3. Geopolitical uncertainties and sluggish growth in Europe and USA

Europe and the USA are experiencing slow growth due to geopolitical uncertainties.

4. Increasing global interest rates

Global interest rates are rising, affecting borrowing costs and economic activities

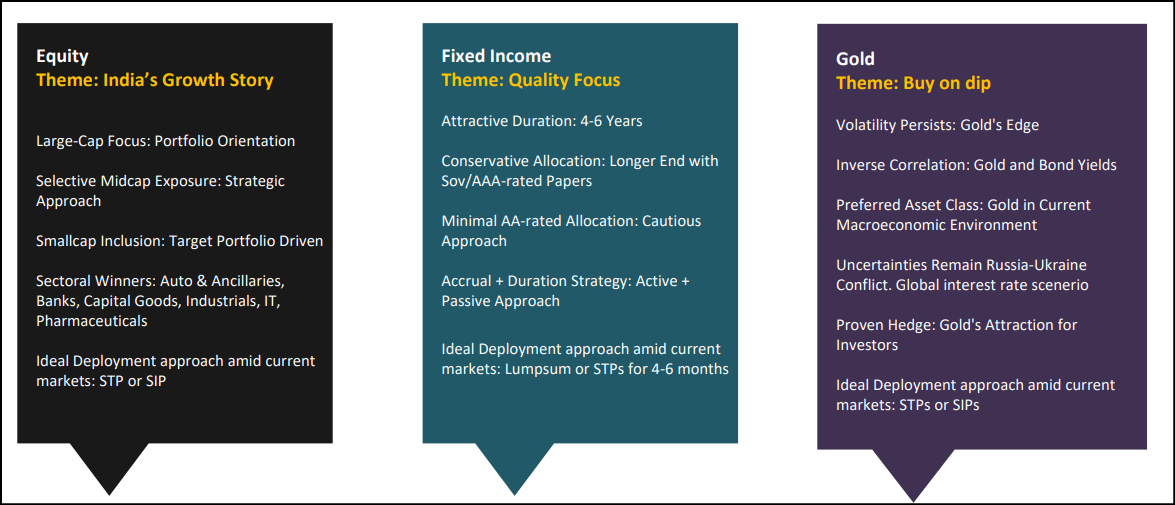

Asset Class Views

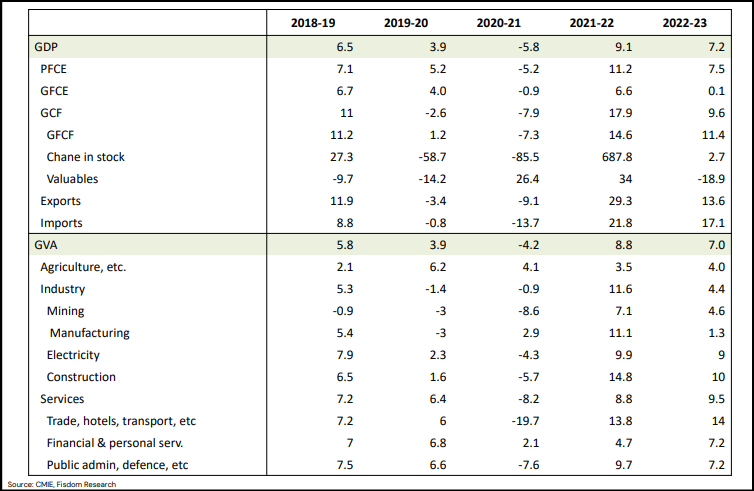

GDP Growth

Highlights: We are expecting another quarter of robust GDP growth in Q1FY24

- India’s real GDP grew by 6.1% in the last quarter of FY23, surpassing expectations. The growth improved from the previous quarter, primarily driven by external transactions, while domestic demand remained steady.

- Forecasters anticipate further strengthening of economic growth in the first quarter of 2023-24. The median growth projection from a survey of 39 professional forecasters conducted by the RBI is 6.9%, with CMIE projecting it at 6.8%. The RBI is optimistic, expecting real GDP to grow as high as 8% in the June 2023 quarter.

- The first quarter is expected to benefit from the low base effect caused by the COVID-19 pandemic, leading to robust growth.

- Though traded deficit is expected to rise, the growth in real exports is anticipated to be higher than that of imports.

- Overall, consumption, investments, and trade are expected to contribute to accelerating real GDP growth in the June 2023 quarter.

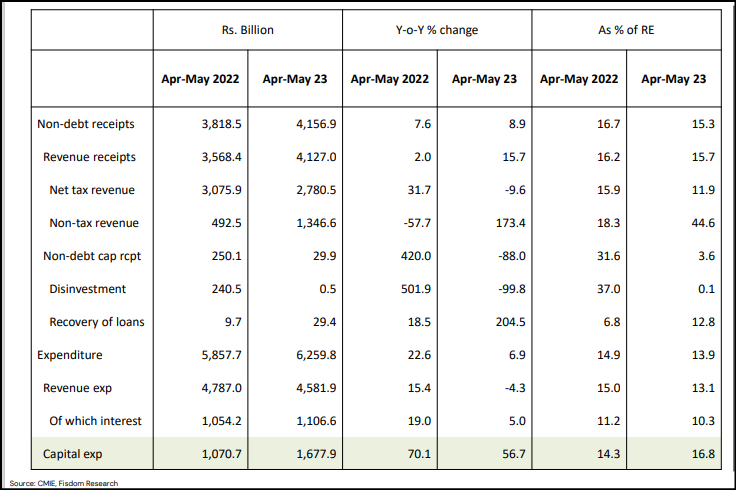

Government Finances

Highlights: Capex to keep the pace in FY24 as well.

- The Central Government embarked on a remarkable growth trajectory by recording a robust 56.7% increase in capital expenditure during the initial two months of the fiscal year 2023-24, surpassing expectations. The total expenditure reached an impressive Rs.1.7 trillion, demonstrating the government’s commitment to infrastructure development.

- A historic milestone was achieved as the government allocated a

record-high budget of Rs.10 trillion for capital expenditure in 2023-24. - By effectively utilising 16.8% of the allocated funds by May, the government showcased its dedication towards propelling economic growth through strategic investments.

- In a bid to bolster economic growth at the state level, the Central Government committed to providing interest-free long-term capex loans amounting to Rs.1.3 trillion.

- The Reserve Bank of India (RBI) played a pivotal role by transferring a substantial surplus of Rs.874.2 billion in May 2023. This more-than-doubled surplus compared to the previous year invigorated the government’s non-debt receipts, further strengthening its financial position.

- This shows the government’s resolute focus on capital expenditure, revenue allocation, tax collections, disinvestment strategies, and fiscal prudence during the initial months of the fiscal year 2023-24.