Why Talk About “China” Now?

A rare convergence of value, recovery, and global re-engagement makes China one of the most asymmetric opportunities in global investing today

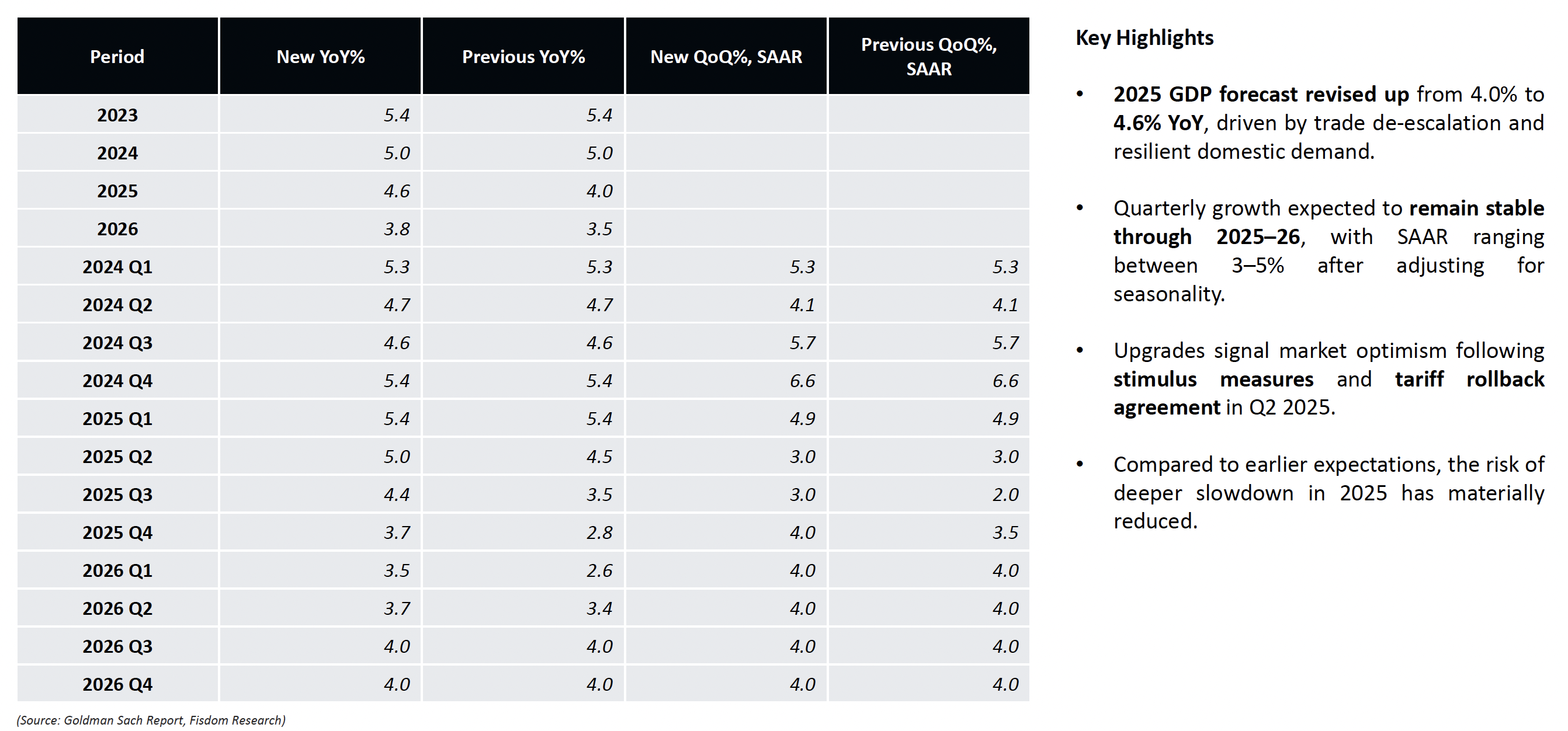

China’s growth remains intact, setting a base for long-term investment conviction

Upgraded real GDP projections reflect policy support and trade thaw

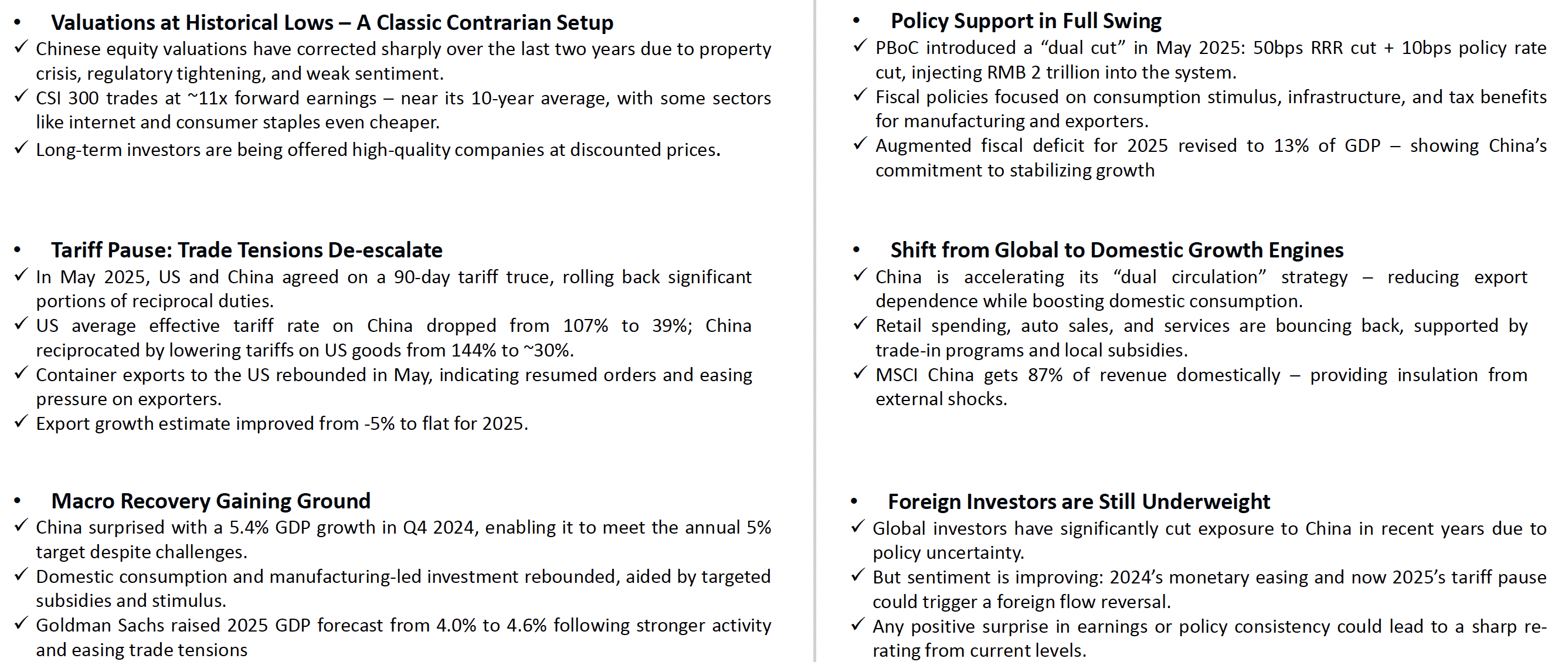

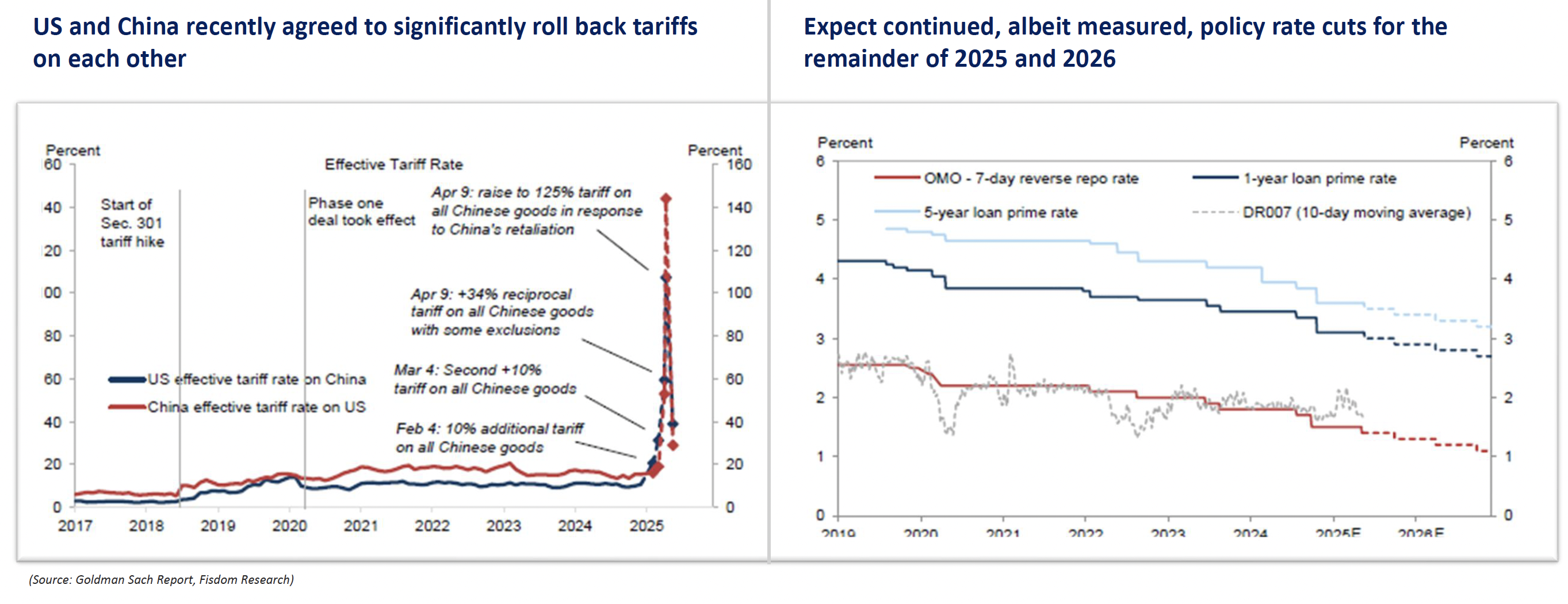

Policy & Trade Pivot: A Twin-Engine Supporting China’s Rebound

The twin tailwinds of tariff relief and rate cuts are boosting China’s near-term resilience and long-term re-rating potential.

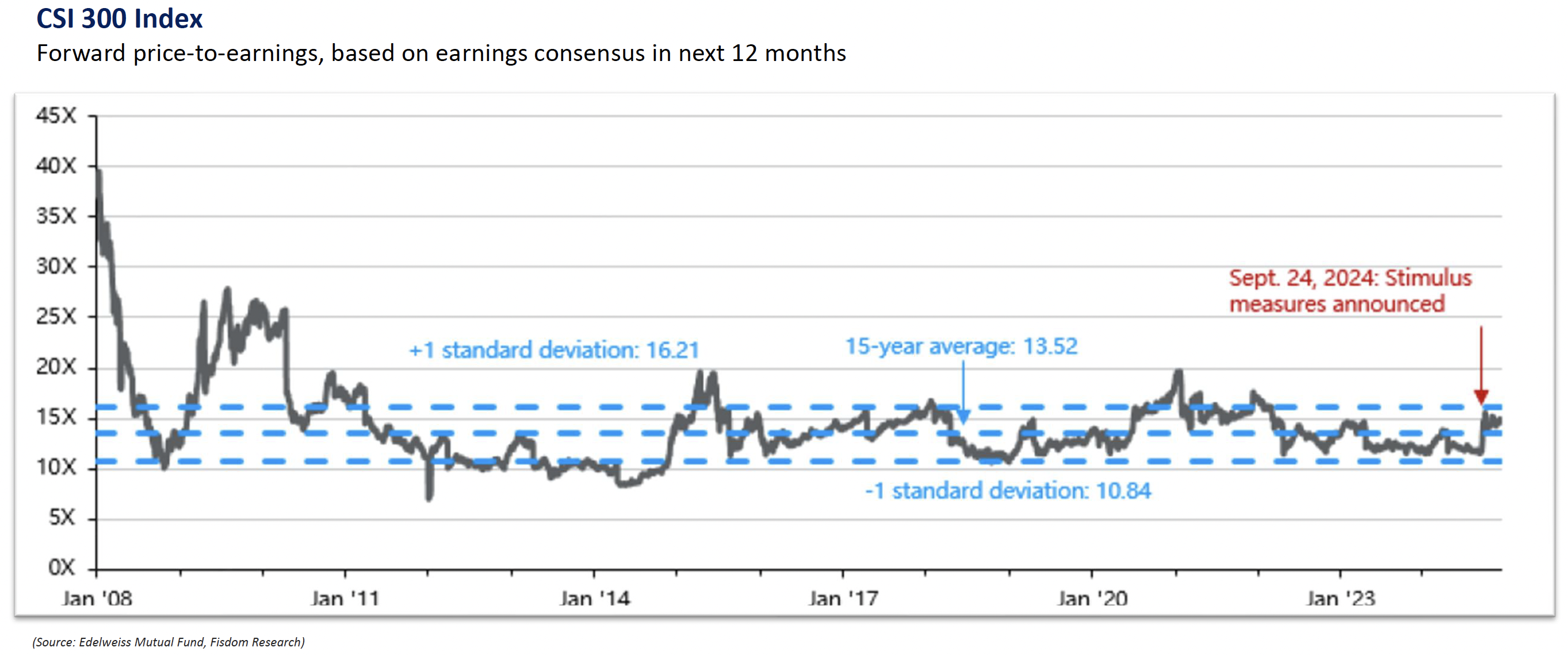

Valuations near its 10Y average – A Classic Contrarian Setup

CSI 300 trades at ~11x forward earnings – near its 10-year average, with some sectors like internet and consumer staples even cheaper.