|

||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

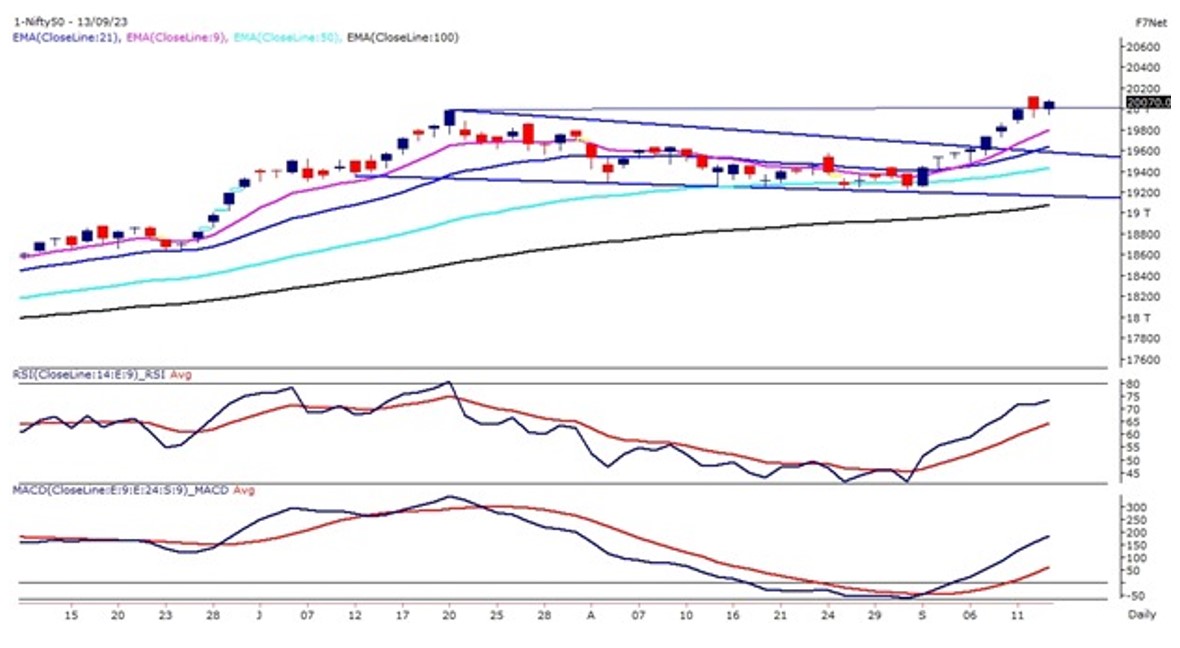

Technical Overview – Nifty 50 | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

NIFTY50 on 13th Sept witnessed a flat opening and registered an intraday low at 19,944.10 levels in the first 15 mins of the trade and post that index found support near 9 EMA and moved higher. The prices on the intraday chart traded with a bullish bias in a higher low formation and neglected its previous day’s bearish sentiments. The Benchmark index on the daily chart is holding above its horizontal trend line which is placed at the 20,000 mark. The index on the weekly chart indicates a strong bullish market as prices have completed their retracement near the trend line support. In the last hour, Short-Unwinding from PUT Writers and Short-Buildup (SB) on the CALL side continues. The momentum oscillator RSI (14) has rebounded sharply from the 40 levels and presently closed above 70 levels with a bullish crossover. The MACD indicator has shifted higher above its line of polarity with a bullish crossover. The technical landscape continues to be positive as long as Nifty trades above the 19,900 mark. Technically speaking, immediate bullish targets or resistance are seen at Nifty’s next psychological 20,200 mark. | ||||||||||||||||||||||||||

Technical Overview – Bank Nifty | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

The Bank Nifty on the weekly expiry day witnessed a flat opening and registered an intraday low at 45,299.40 levels in the first 30 mins of the trade and post that banking index found support near 9 EMA and moved higher. The prices on the intraday chart traded with a bullish bias in a higher low formation and neglected its previous day’s bearish sentiments. The broader trend for the Banking index remains bullish as prices are trading in a higher high higher bottom formation. The momentum oscillator RSI (14) is steady above 60 levels with a bullish crossover. The MACD indicator has shifted higher above its line of polarity with a bullish crossover. The technical landscape continues to be positive as long as Bank Nifty trades above the 45,300 mark. Technically speaking, immediate bullish targets or resistance are seen at Bank Nifty’s next psychological 46,400 mark. | ||||||||||||||||||||||||||

Indian markets:

| ||||||||||||||||||||||||||

Global Markets

| ||||||||||||||||||||||||||

Stocks in Spotlight

| ||||||||||||||||||||||||||

News from the IPO world🌐

| ||||||||||||||||||||||||||

|

Day Leader Board

| ||||||||||||||||||||||||||

Sectoral Performance

| ||||||||||||||||||||||||||

Advance Decline Ratio

| ||||||||||||||||||||||||||

Numbers to track

| ||||||||||||||||||||||||||

|

Please visit www.fisdom.com for a standard disclaimer. |