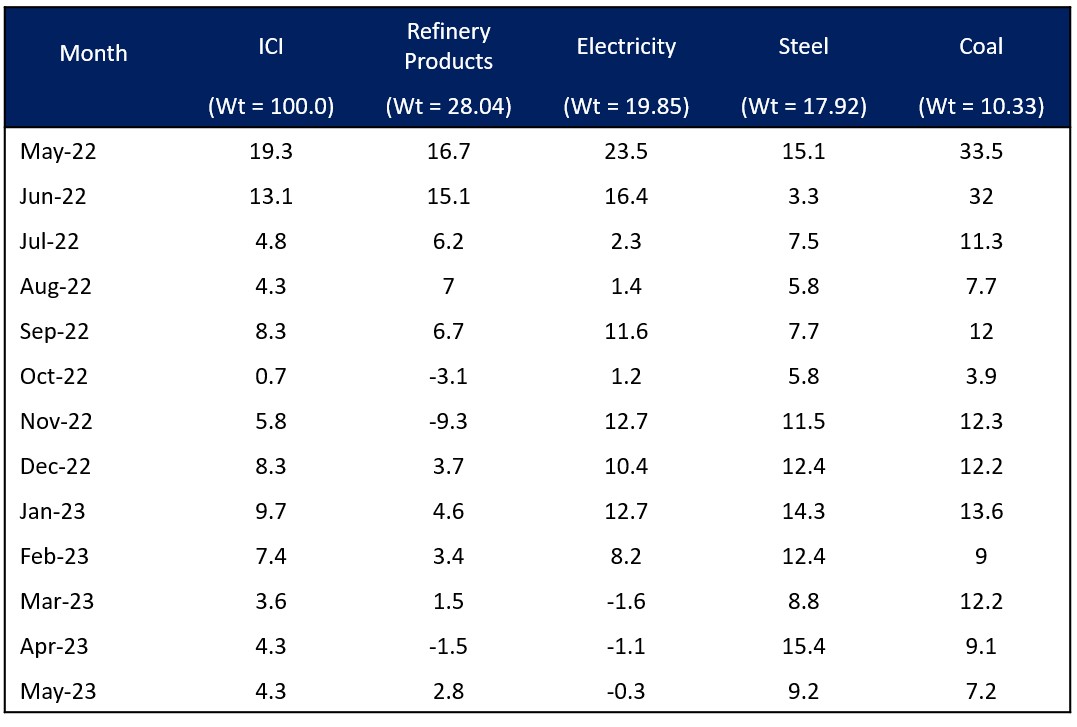

Index of eight core industries (Y-o-Y % change)

- The index of eight core industries (ICI) showed a growth of 4.3% in May 2023 compared to the previous year, primarily driven by the manufacturing segment, including refinery products, fertilisers, steel, and cement

- The four manufacturing industries within the eight core industries recorded a significant growth of 6.9% year-on-year.

- The strong performance of core manufacturing industries is expected to boost the index of industrial production (IIP) in May 2023, with an anticipated 5% increase compared to the previous year.

- Steel production played a significant role in the growth of the ICI, with a 9.2% increase in output compared to last year. Finished steel production consistently exceeded ten million tonnes for the sixth consecutive month.

- Cement production witnessed a remarkable growth of 15.5% in May 2023, but growth is expected to slow down to single digits in June

- Fertilizer production continued to exhibit strong year-on-year growth, with a 9.7% increase, supported by increased production capacity.

- Refinery products showed a modest increase of 2.8% in output, with notable growth in high-speed diesel, motor spirit, and naphtha production.

- Coal production increased by 7.2%, driven by the anticipation of higher demand from the power sector, although the surge did not materialise.

- Electricity generation experienced a marginal decline of 0.3% in May due to subdued summer temperatures and unseasonal rains. However, decent growth in generation is expected in June.

- Crude oil output decreased by 1.9%, while natural gas output witnessed a marginal decline of 0.3% in May.

- Despite the challenges faced by the energy sector, the impressive performance of core manufacturing industries, along with growth in the automobile sector, raises optimism for the overall growth of the index of industrial production (IIP) in May, projected to be around 5% year-on-year.

Bottomline:

- The performance of the eight core industries in May 2023 exhibited positive growth, mainly driven by the manufacturing segment. The manufacturing industries, including refinery products, fertilisers, steel, and cement, showcased impressive year-on-year growth rates. While some sectors, such as coal and electricity generation, faced challenges, the overall outlook remains optimistic.

- The strong performance of core manufacturing industries, coupled with growth in the automobile sector, raises expectations for a decent growth rate in the index of industrial production (IIP) for May. This suggests positive momentum in key sectors of the economy, indicating potential opportunities for sustained growth in the coming months.