Introducing Inflation

Inflation simply refers to the rate of increase in prices of goods and services over a period. Inflation can be expressed at a unit of goods level as well as at an aggregate level considering a proportioned basket of goods and services. The rate of increase in prices could be recorded at a weekly, monthly, annual or any other frequency. Inflation is typically measured at an aggregate level and recorded on an annual basis. Such a basket comprises most commonly consumed goods and services in proportion of its consumption. Constituents of this basket is often held constant for long periods of time for standardised comparability and changed only when there is a significant change in the aggregate consumption pattern. The price of such a basket is expressed relative to the price during a determined base year. The price of this basket is marked and adjusted for prevailing prices on a price gauge known as the Consumer Price Index (CPI).

Inflation is a critical factor to determine the purchasing power of money, which is also the ultimate utility of money. For instance, if the price of a product increases by 50% from INR 100 to INR 150 in a year, the same INR 100 can buy only two-thirds of a unit of the same product in the next year. Inflation erodes the value of money, what matters is by how much?

However, inflation is not all evil. A healthy, consistent and fairly predictable amount of inflation can gradually steer an economy into further prosperity. The predictability factor allows for an economy and its participants to adjust income and expenses in alignment with expected prices and support healthy consumerism and robust trade.

Just like with most aggregates and estimates, these headline numbers serve as a strong indicator of how is the cost of living moving in an economy, but may not necessarily reflect exactly on a per-capita scale.

Relevance

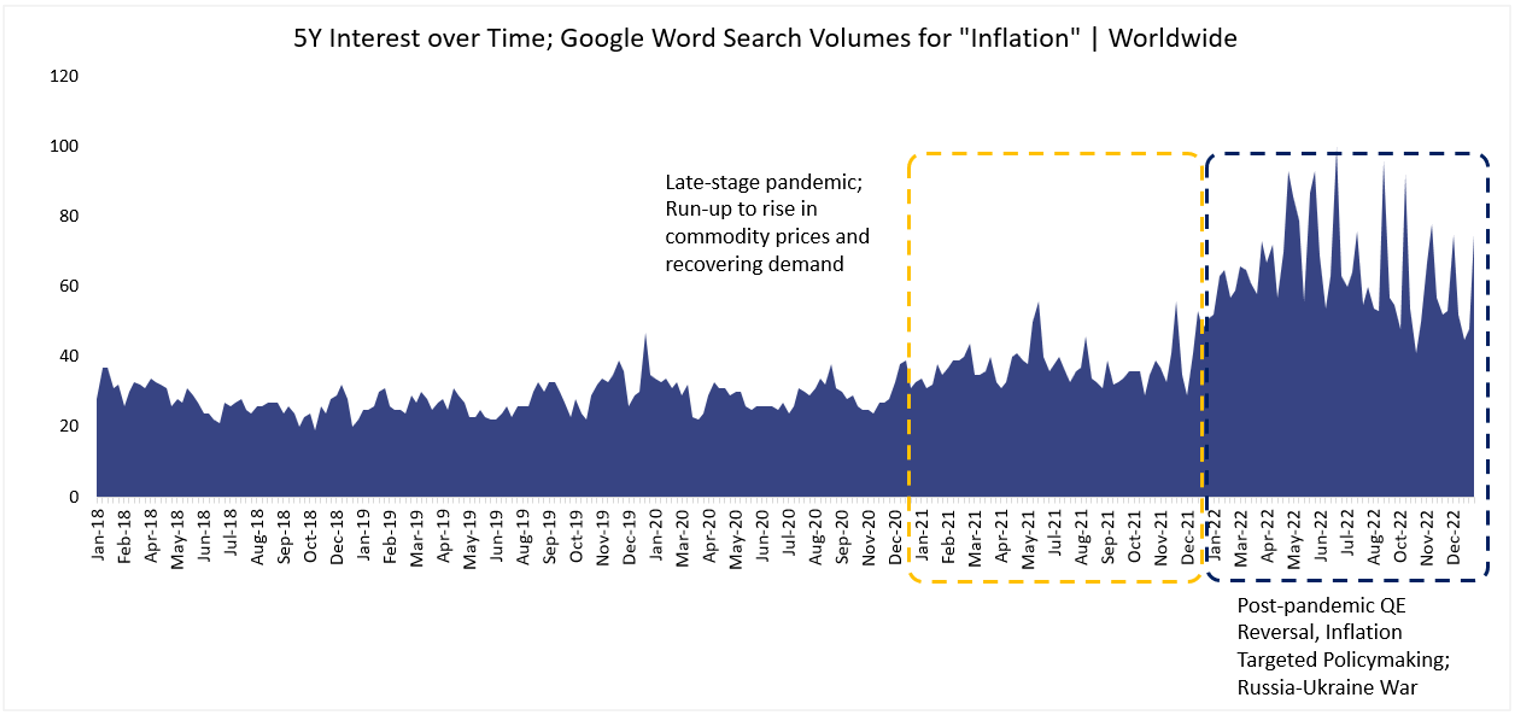

In recent times, the subject of inflation has been grabbing headlines for all the wrong reasons. Since the late-pandemic era, roughly pegged at the beginning of CY21, inflation started garnering interest as a subject of concern as aggregate demand recovered. Moving ahead, CY22 greeted the world with a multitude of inflation-inducing challenges including, but not limited to, recovering demand, reversal of easy monetary policies, withdrawal of systemic liquidity, Russia-Ukraine geopolitical crisis and associated consequences.

An insight into interest in the subject of “inflation” through global online searches for the term is probably indicative of increasing intensity of the inflationary heat hitting home.

(Source: Google Trends, Fisdom Research)

At the heart of it, prices are finally a function of demand and supply with inflation being merely a diagnosis warranting an investigation into the causes of the symptoms, i.e., shift in demand-supply dynamics. In a free-trade environment, price of goods and services is the level at which aggregate demand intercepts aggregate supply. Economies typically witness bouts of demand-pull or cost-push inflation and, in rare occurrences, a combination of both.

Back to basics

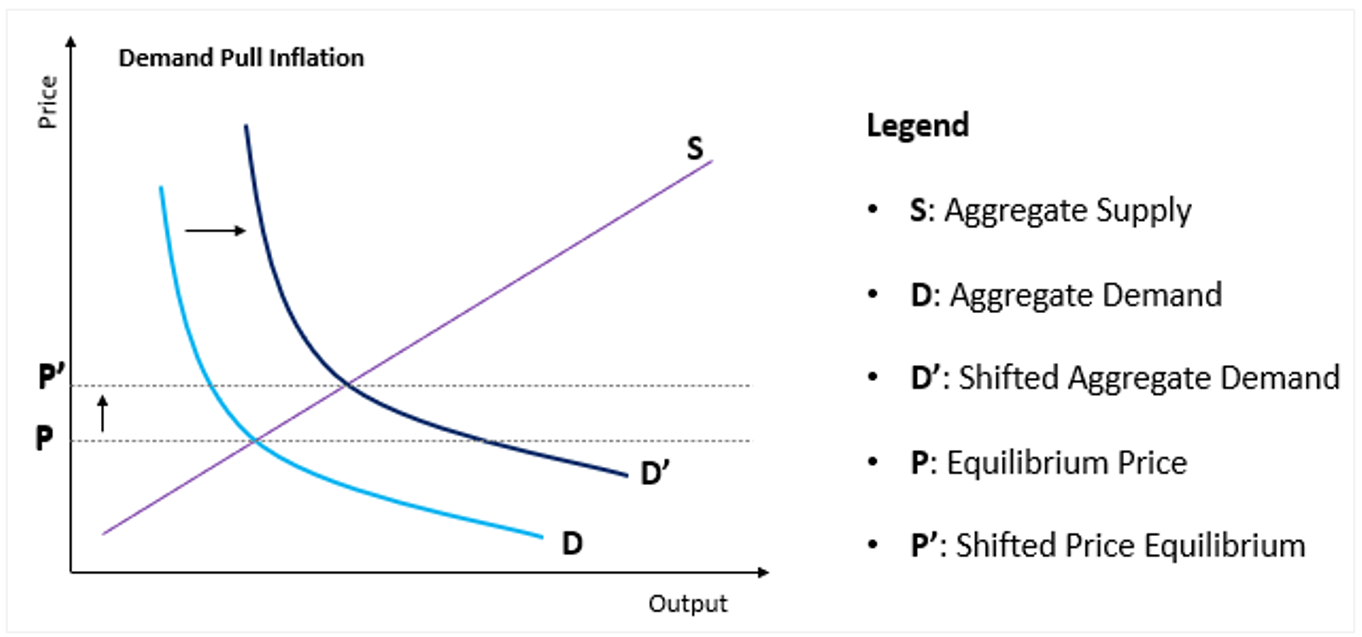

A typical, often desirable in moderation, type of inflation is the one characterised by demand pull. Demand-pull inflation is characterised by the straightforward pricing theory that suggests that any incremental demand for goods/services available in limited quantity will translate to higher prices.

Illustration: Demand-pull Inflation

Source: Fisdom Research

Demand pull inflation in an economy is typically attributable to an increase in retail consumption, government spending or even monetary and fiscal expansion, i.e., incremental supply of disposable money in the hands of general public and corporations.

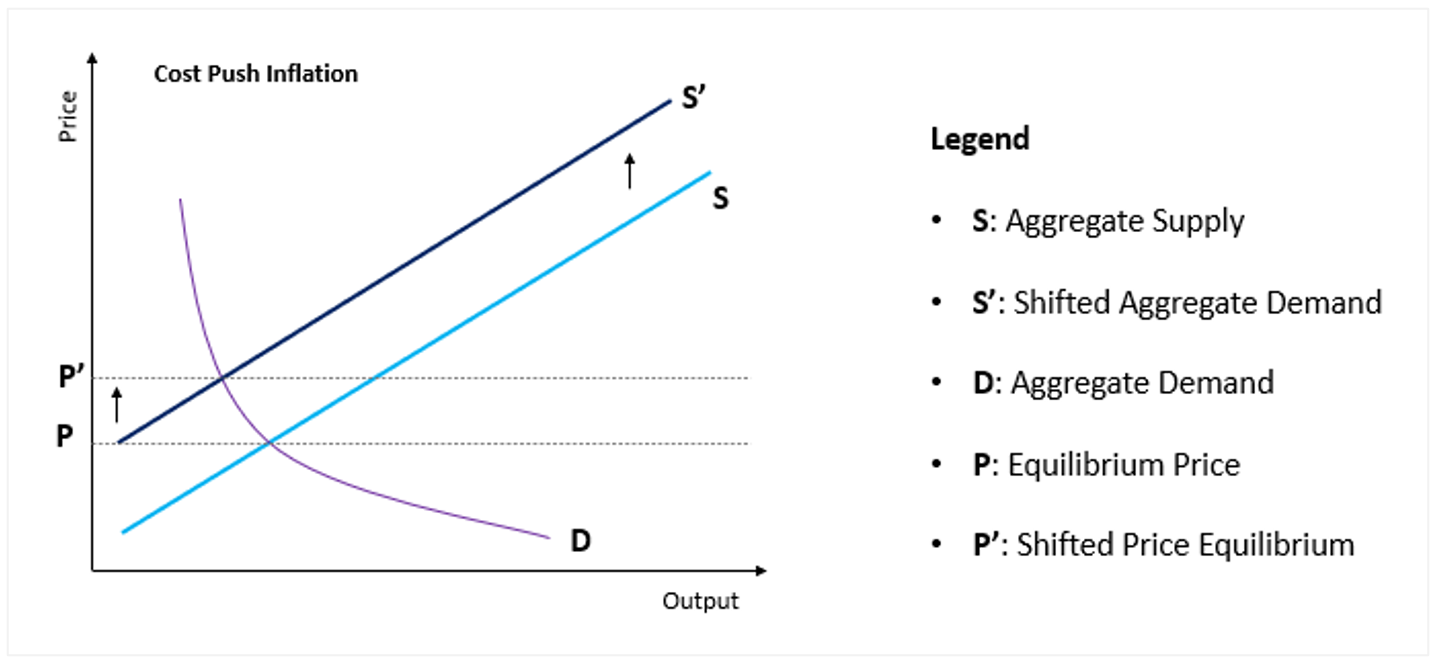

In response to incremental demand, companies often seek to ramp up aggregate supply proportionately. But supply expansion is subject to a longer gestation and more variables versus relatively simpler demand uptick. Cost increment on account of higher production capacity, incremental demand for raw materials and overall higher cost of all factors requisite for production makes additional production a costlier affair for producers. Such incremental cost per unit translated to a lower output at previous price equilibrium.

Illustration: Cost-push Inflation

Source: Fisdom Research

For producers operating with pricing power, a transmission of such incremental costs to the consumers in a gambit to protect margins feeds right into the demand-pull inflation directly through higher prices.

Cut to today – Global

The state of global inflation today is an outcome of supply-related challenges and voracious consumerism. The world is currently experiencing the repercussions of what was referred to a rare occurrence earlier – a hybrid inflation. Hybrid inflation is far more difficult to contain as its ripples reach the farthest corners of the economy.

The post-pandemic state of affairs warrants an investigation into inflation for goods, distinct from inflation in services.