Investors in the Indian equities market have been facing a tough time as the market experiences the third consecutive month of negative returns. Unfortunately, March has been no different, with the Nifty ending two out of three weeks in the red.

Nifty 50: Weekly performance

| Period | Nifty Returns |

| 24th Feb 2003 – 03rd Mar 2003 | 0.7% |

| 03rd Mar 2003 – 10th Mar 2003 | -1.0% |

| 10th Mar 2003 – 17th Mar 2003 | -1.7% |

Source: ACE MF

As an investor, it’s natural to feel worried about your portfolio in times of market turbulence. However, it’s important to take a step back and look at the bigger picture.

Even, we have received numerous emails from worried investors expressing similar concerns, prompting us to address these largely exaggerated fears.

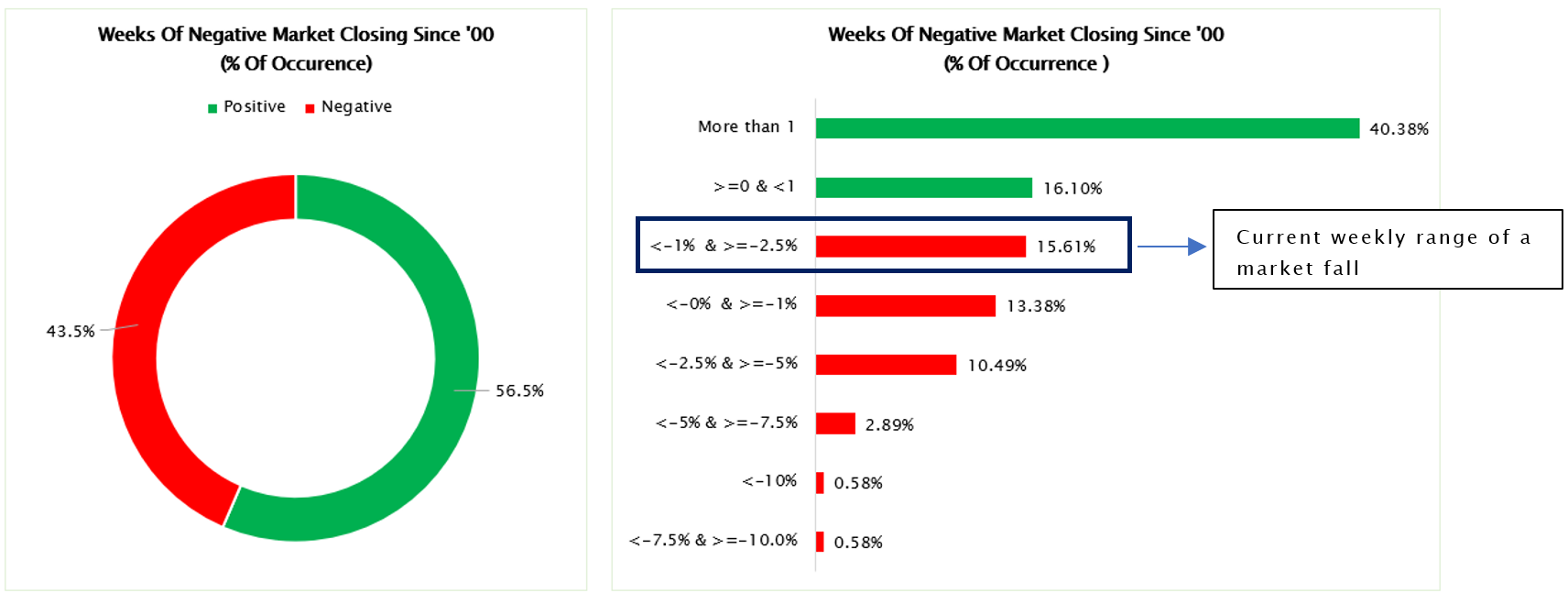

We have delved deep into reassuring investors not to worry about market downturns (and upswings, for that matter) by analyzing market data over the past two decades. Through our research, we aimed to understand the frequency of such market fluctuations. Our findings are presented in the chart below, providing valuable insights into the trends and cycles of the Indian equities market.

Source: ACE MF, Fisdom Research

Over the previous ~1,211 weeks, the Indian markets have experienced several crises and disruptions – both global and domestic – such as the Dot-com bubble, SARS, the Global financial crash, Demonetization, GST, Covid-19, and the Russia-Ukraine crisis, to name a few. Despite these challenges, the markets have seen many more positive weeks than negative.

By broadening the scope of our study, we have found that some of the most intense negative weeks in the market have provided a great opportunity for investors who are willing to take a chance. This is because, during times of fear and uncertainty, the market often becomes oversold and undervalued, creating a ripe opportunity for savvy investors.

As investors, we have all experienced the ups and downs of the market. It’s easy to get caught up in the panic and uncertainty that comes with negative weeks, but what if we told you that these tumultuous times could be a blessing in disguise?

To illustrate this point, we have compiled a table below that highlights the returns realized by market participants who capitalized on the breaking of markets by investing fresh monies on said days. As you can see, these investors were able to take advantage of the market’s oversold conditions and were rewarded with significant returns over various tenures.

List is huge & hence we are listing largest steeply week for your reference:

| Date | Weekly Fall | 1 Year | 3 Year | 5 Year | Wealth Growth in 5 years |

| 24-Oct-08 | -15.9% | 93.4% | 25.4% | 19.0% | 2.4x |

| 10-Oct-08 | -14.1% | 50.8% | 14.9% | 12.9% | 1.8x |

| 14-May-04 | -12.3% | 25.7% | 37.7% | 17.8% | 2.3x |

| 20-Mar-20 | -12.2% | 68.6% | 25.0% | – | – |

| 14-Sep-01 | -11.2% | 7.9% | 22.4% | 30.4% | 3.8x |

| 19-May-06 | -11.0% | 29.8% | 10.0% | 10.8% | 1.7x |

| 22-Sep-00 | -10.6% | -32.6% | 1.0% | 14.4% | 2.0x |

| 12-Apr-01 | -9.8% | 11.9% | 21.5% | 27.0% | 3.3x |

| 12-May-00 | -9.8% | -11.1% | -10.0% | 9.2% | 1.5x |

| 10-Jul-09 | -9.5% | 33.7% | 10.1% | 13.6% | 1.9x |

| 13-Mar-20 | -9.4% | 51.0% | 19.9% | – | – |

| 7-Mar-08 | -8.7% | -45.1% | 4.6% | 4.2% | 1.2x |

| 13-Oct-00 | -8.4% | -18.4% | 9.5% | 16.6% | 2.2x |

| 18-Jan-08 | -8.0% | -50.4% | 0.1% | 1.2% | 1.1x |

Source: ACE MF, Fisdom Research. Returns less than one year are absolute are more than one year are CAGR.

The table above brings forth two key observations:

- The table below clearly shows that wealth creation is possible in the long run, irrespective of the quantum of market fall. Even when the market experiences a significant decline of 8% or more on a weekly basis, investors who stay the course have multiple opportunities to create wealth. The only people who lose out are those who give in to participative fears and sell off their investments prematurely.

Don’t Forget….

Investing is a timeless activity that offers investors pockets of return amplifiers, which are often disguised as market falls. As Mr. Charlie Munger has said, success in investing comes to those who are very patient most of the time, and aggressive when the right opportunities arise. By staying invested and patient during market downturns, investors can position themselves to take advantage of the eventual recovery and create wealth in the long run.

It is important to remember that investing is a long-term game, and short-term market fluctuations should not be the sole determinant of investment decisions. By focusing on a well-diversified portfolio, with a long-term investment horizon, investors can weather the ups and downs of the market and potentially achieve their financial goals.

How can you mitigate volatility?

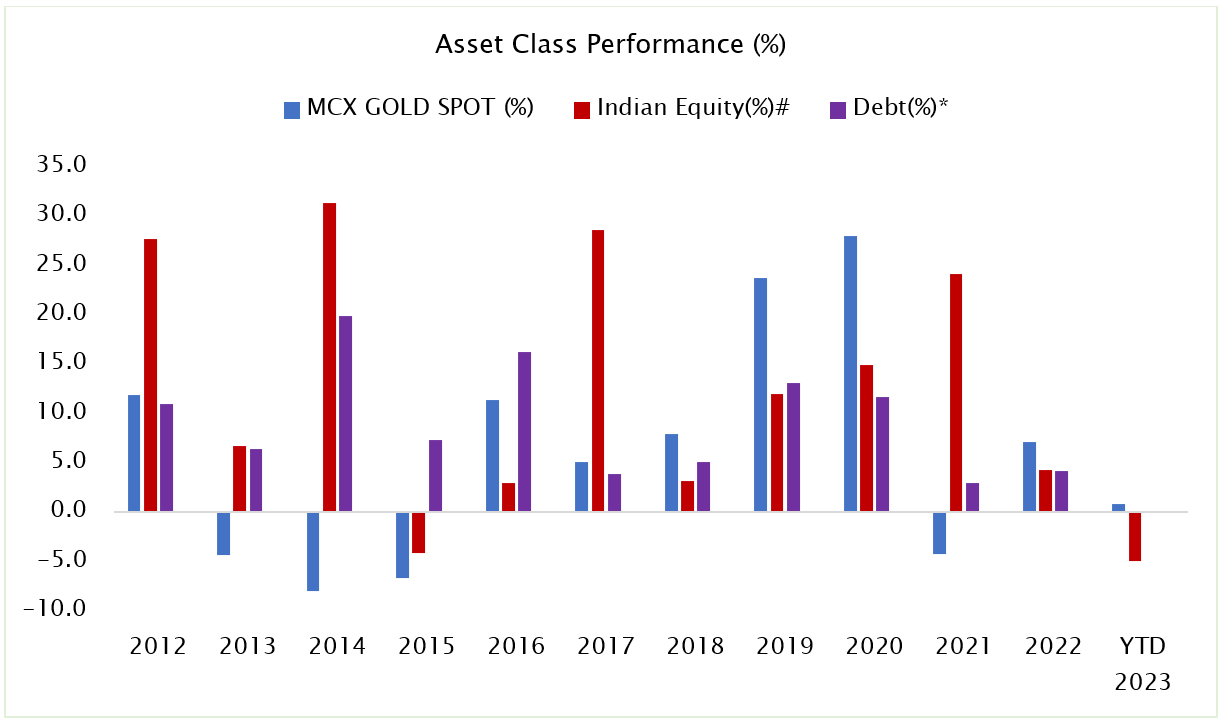

Maximizing Your Investments: The Benefits of Asset Rotation and Diversification

Source: ACE MF, Debt*: NAV of SBI Magnum Gilt Fund has been considered, #Indian Equity: Prices for nifty 50 has been considered.

Asset allocation is a critical component of any successful investment strategy. By diversifying your assets across different classes and proactively taking advantage of market volatility, you can build a balanced portfolio that maximizes returns and minimizes risk. With the right strategies in place, investors can navigate the unpredictable investment landscape of 2023 and beyond.

If you harbor insights you wish to share with us, then do write we away. We excitedly await to hear from you.

Happy Weekend!

Markets this week

| 13th March 2023 (Open) | 17th March 2023 (Close) | %Change | |

| Nifty 50 | 17,966 | 17,100 | -1.8% |

| Sensex | 59,031 | 57,990 | -1.8% |

Source: BSE and NSE

- Markets witnessed volatility and ended on a negative note.

- Global markets witnessed weak cues this week following the crashing of several US banks, resulting in the offloading of equities by foreign institutional investors (FIIs).

- However, there was some recovery in the second part of the week due to the following reasons: Financial aid was provided to support the US banks, softening of crude oil prices and expectations that the US Federal Reserve may not take an aggressive stance in the upcoming policy

- Despite the volatility in the global markets, domestic institutional investors (DIIs) continued to buy equities, showing confidence in the long-term growth prospects of the Indian economy. While FIIs sold equities worth Rs. 7,953.66 crore this week, DIIs purchased equities worth Rs. 9,233.05 crore.

- Overall, in the current month, FIIs and DIIs have bought equities worth Rs. 6,408.19 crore and Rs. 16,162.40 crore, respectively.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| BPCL | ▲ +7.77% | IndusInd Bank | ▼ -10.86% |

| Tech Mahindra | ▲ +6.21% | TCS | ▼ -4.55% |

| TITAN Company | ▲ +3.37% | Eicher Motors | ▼ -4.54% |

| Nestle India | ▲ +2.01% | M&M | ▼ -4.50% |

| L&T | ▲ +1.76% | Reliance Industries | ▼ -4.29% |

Source: BSE

Stocks that made the news this week:

- HDFC has announced that its board will convene on Monday, 27 March 2023, to deliberate on the possibility of raising funds through the issuance of non-convertible debentures in multiple tranches, amounting to a total of Rs 57,000 crore. This potential move is part of HDFC’s ongoing efforts to secure additional capital and expand its financial capabilities.

- Zee Entertainment Enterprises committed to repay its outstanding debts to IndusInd Bank. This move is part of the company’s efforts to address the insolvency proceedings brought against it and move closer to completing its merger with a Sony Group subsidiary, with the aim of establishing a massive $10 billion media conglomerate.

- Voltas, a leading air conditioning and engineering solutions provider, has announced that it will not be reducing its prices this year, despite a dip in raw material costs. Instead, the company’s management has indicated that it is planning to implement price hikes in April. This move has garnered positive attention from industry analysts, with Nomura expressing a bullish outlook on the company’s stock.