Letter to investor

Dear Investors,

Greetings! We’re thrilled to bring you another edition of The Capview, brimming with exhilarating insights into the Indian capital market and economy, both of which are surging forward hand-in-hand.

Firstly, our external debt situation remains comfortable, allowing more fiscal room and stability. Inflation has also been kept in check, with Consumer Price Index (CPI) trends consistently remaining below the Reserve Bank of India’s upper limit.

The confidence of foreign investors in India’s growth story is evident in the rejuvenated Foreign Portfolio Investments (FPI) which have infused over Rs. 60,000 crore into our economy in the last three months. This has been paralleled by record-breaking domestic flows, with FY23 seeing the highest-ever inflows of Rs. 2.5 lakh crore.

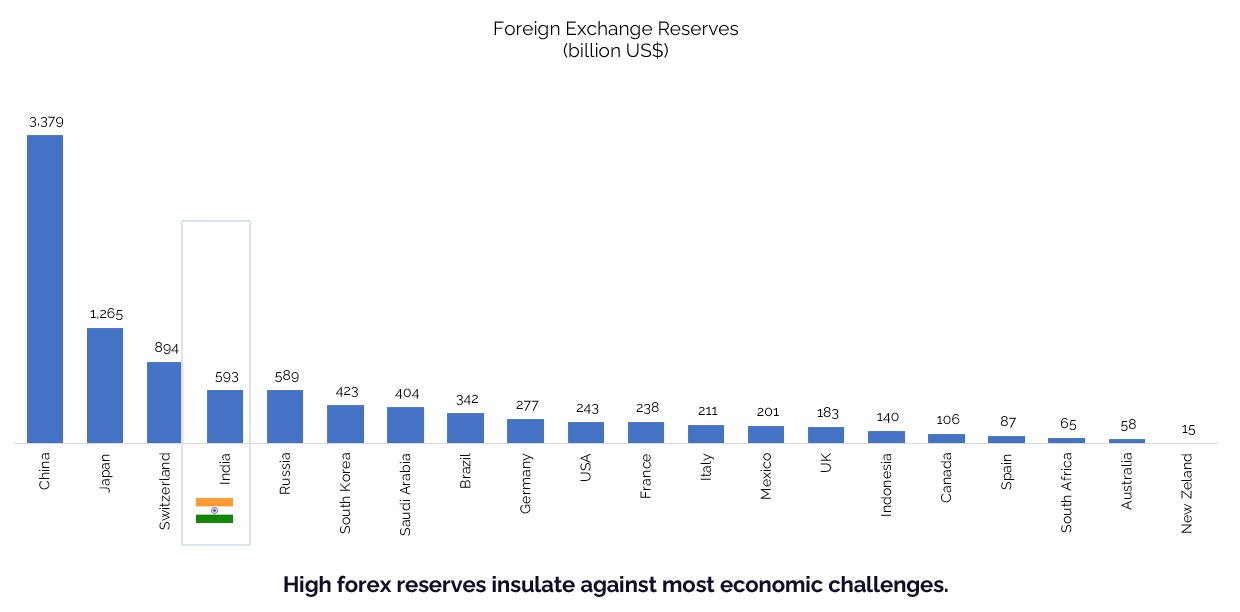

Our position in the global economic landscape is further bolstered by our forex reserves, which currently rank fourth globally. This represents a strong buffer to balance the impact of any external shocks.

India Inc is also witnessing robust corporate earnings growth, consistently posting double-digit growth for the last eleven quarters. This is indicative of a healthy and vibrant corporate sector, boding well for continued capital market strength.

Macro indicators such as the public capital expenditure in India, government’s commitment to infrastructure development and job creation, which will stimulate further economic growth, and new project announcements have seen new highs during FY23 further underlining the positive business sentiment. We have also outperformed other countries in manufacturing growth.

Along with this the GST collections are demonstrating the resilience and recovery of the Indian economy. Additionally, the Market Cap to GDP ratio being below 100 suggests that the market is valued fairly and is not overpriced.

And finally, amid the global uncertainty due to the interest rate hikes and other geopolitical risks, the Indian rupee has shown tremendous resilience, further demonstrating the inherent strengths of the Indian economy.

In conclusion, we believe these factors bode well for a promising outlook for our economy and capital markets.

India’s golden era: unlocking a decade of incredible possibilities

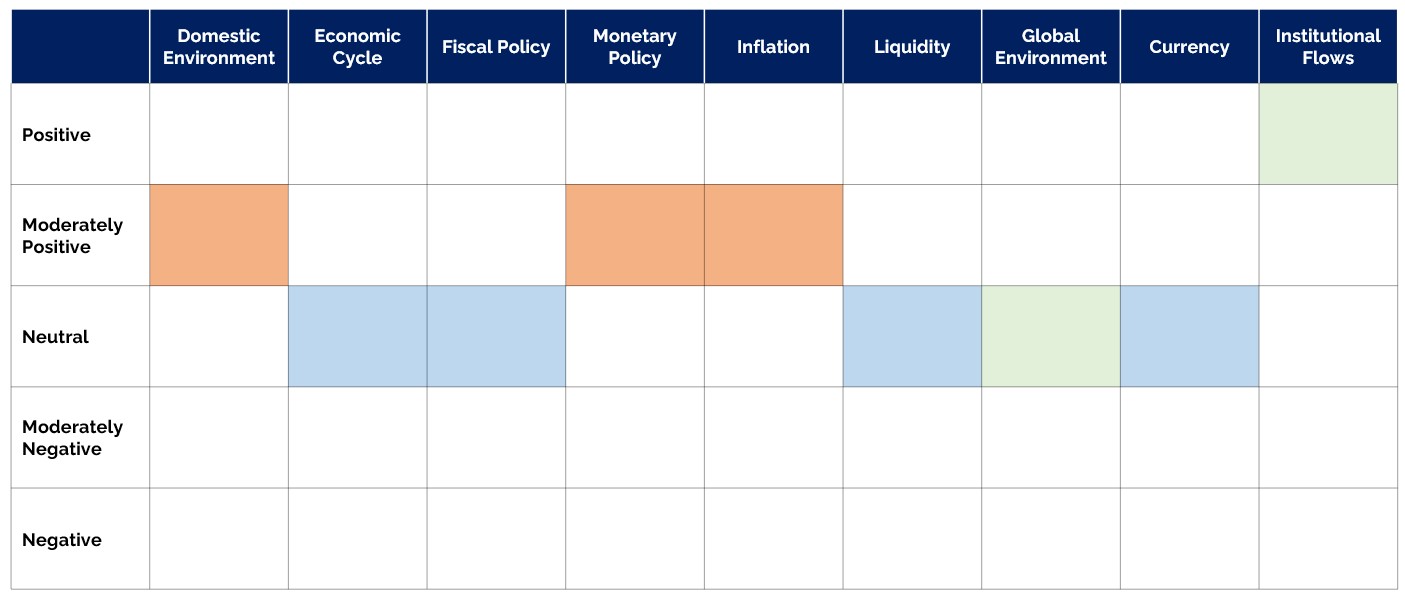

Fundamental Tracker

Key Themes for FY24:

- Capital Expenditure(Capex)

- Energy Transition/De-carbonization

- 5G Roll Out

- Re-rating for banks

- Mix of value & growth

- Quality fixed income over credit

Media is cluttered; clear before you consume! If you can’t clear it, stop consuming the clutter at all!

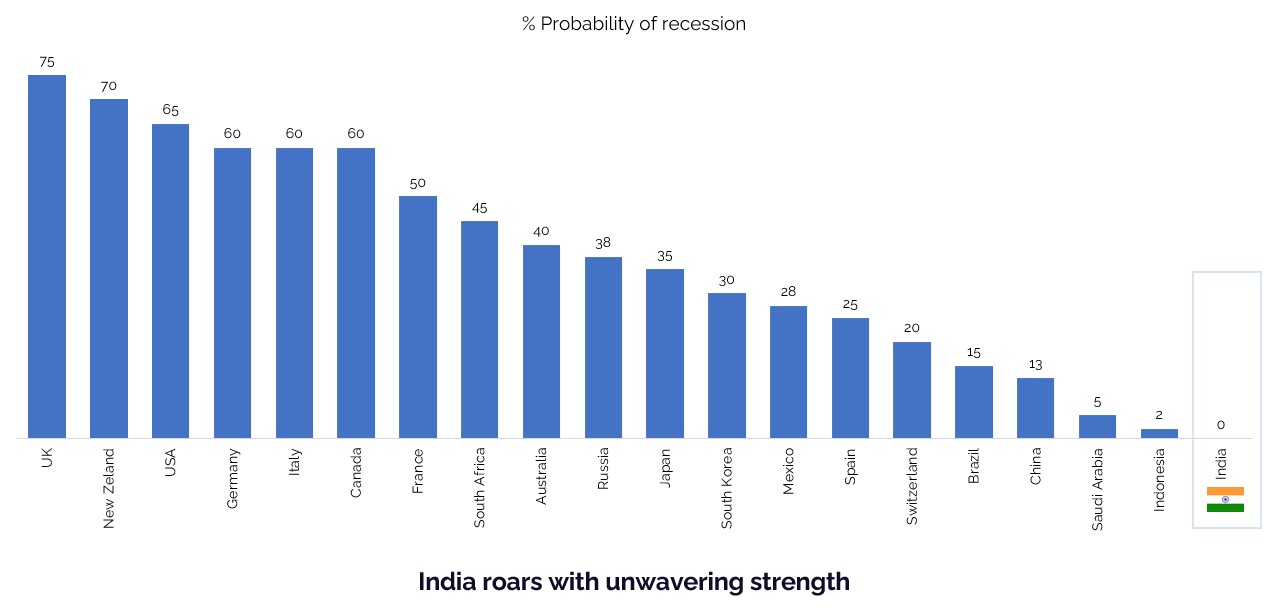

Indian economy shows no signs of recession.

Source: Bloomberg, Kotak AMC, Fisdom Research

India’s forex reserves stand strong vs. global pack

Source: Wikipedia, Fisdom Research. The latest available number for each country has been considered