Letter to investors

Dear Investors,

We are writing this to provide you with an update on the performance of the overall market over the past month. Unfortunately, it has been a challenging month for the Indian market, with continued monetary tightening and concerns over rising prices leading to an overall bearish sentiment. Both benchmark indices Nifty 50 and S&P BSE Sensex ended the month in the red for the third consecutive month, with Nifty 50 posting returns of -2.0% and S&P BSE Sensex posting returns of -0.99%. The week of February 20 to 24 was particularly difficult, with both indices experiencing their highest weekly losses of the year.

Despite the market volatility, we are pleased to inform you that equity mutual funds in India have witnessed the highest inflows in nine months, and domestic institutional investors (DIIs) maintain their buying streak. However, foreign portfolio investors (FPIs) continue to show aversion towards Indian stocks.

On the macro front, India’s core eight industries have shown promising growth, with levels close to pre-covid times in Jan’23, while the manufacturing sector remains strong, with domestic demand being the primary source of growth. The Indian rupee has remained resilient due to the Reserve Bank of India’s active forex market intervention. India’s trade deficit also has narrowed as imports have seen a sharp decline compared to exports, and GST collections continue to surge, recording over Rs. 1.4 trillion for the 12th consecutive month.

On the commodity front, the prices of the Indian basket of crude oil increased for the second consecutive month. The trend of crude oil prices followed an inverted U-shape in the month, rising in the first half and declining in the latter. On the other hand, gold prices fell in February, reversing a three-month trend of rising prices. We recommend that investors in the energy and commodities markets closely monitor these trends to make informed investment decisions.

The overall market sentiment remains cautious, and investors should weigh the risks and opportunities before making any investment decisions. However, it is worth noting that the Indian market has historically shown resilience, and we believe that it will continue to be an attractive investment destination in the long run.

We understand that this news may be disappointing, but we want to assure you that our team is closely monitoring the market and will continue to make informed decisions to manage your investments. As always, we encourage you to stay focused on your long-term investment goals and not be swayed by short-term market fluctuations.

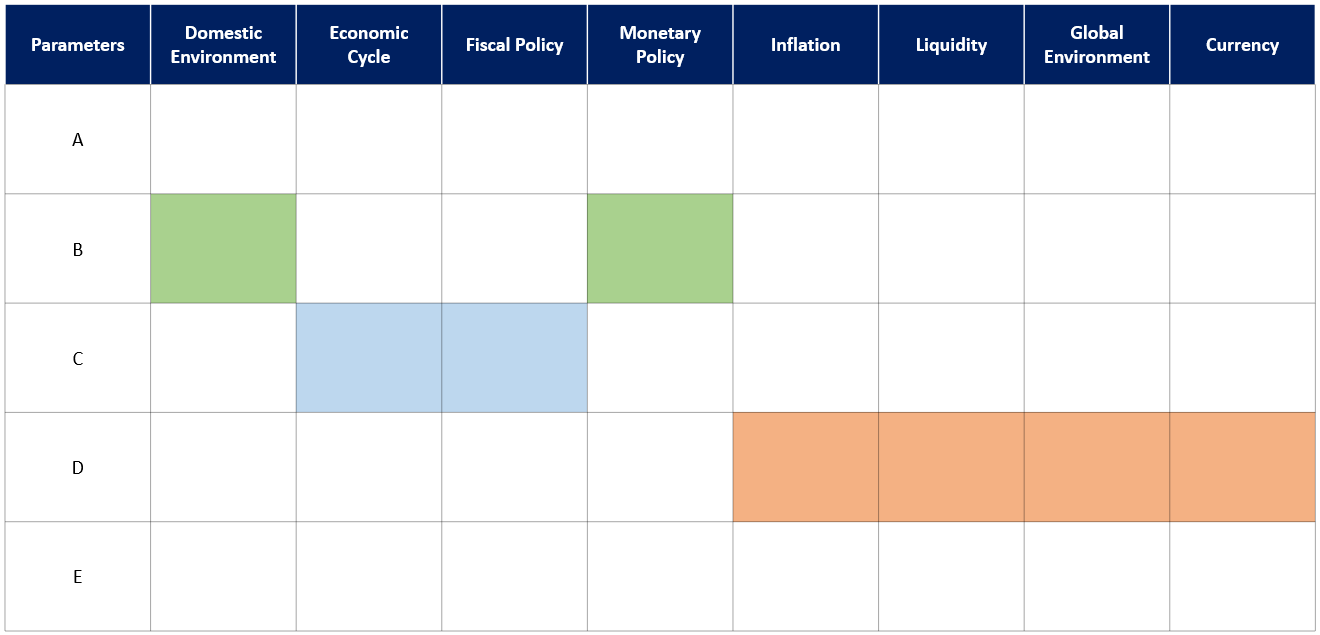

Fundamental Tracker

Scale represents: – A: Positive, B: Moderately Positive, C: Neutral, D: Moderately Negative and E: Negative>

Source: Fisdom Research.

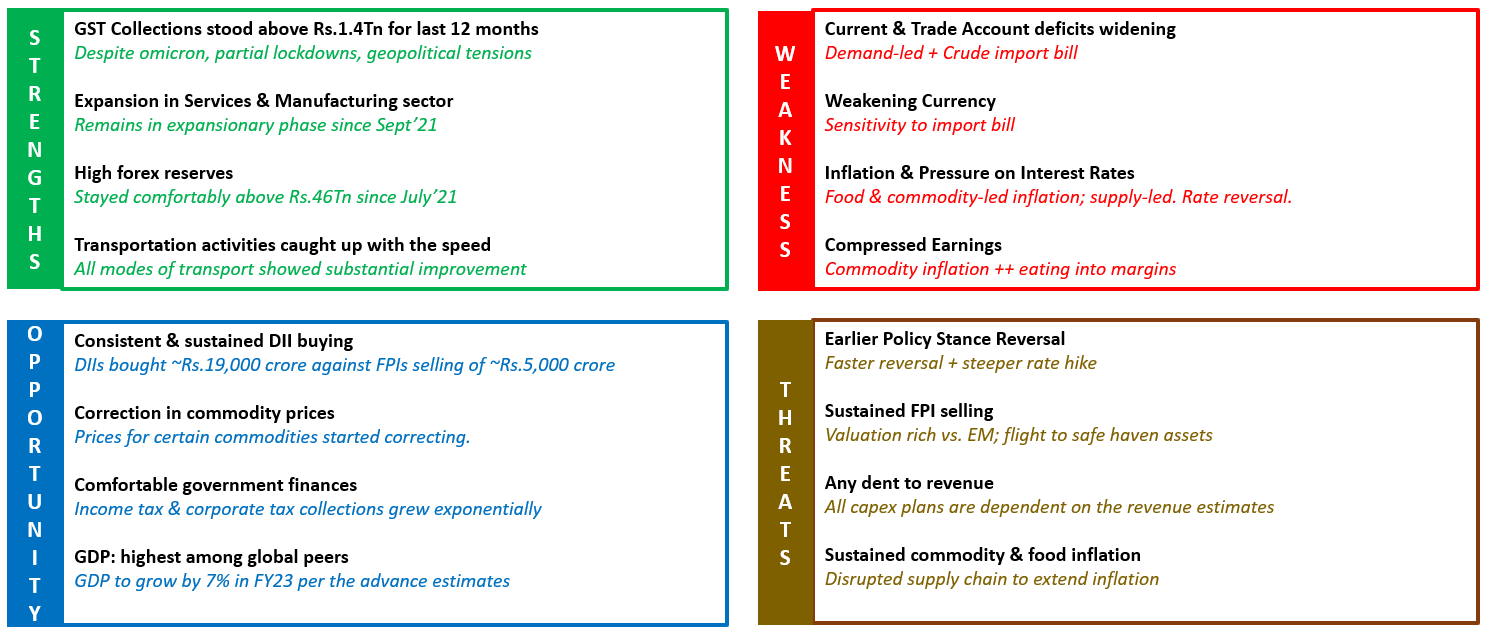

SWOT: Indian Economy

Key Themes for CY2023:

- Capital Expenditure(Capex)

- Energy Transition/De-carbonization

- 5G Roll Out

- Re-rating for banks

- Value over growth

- Quality fixed income over credit