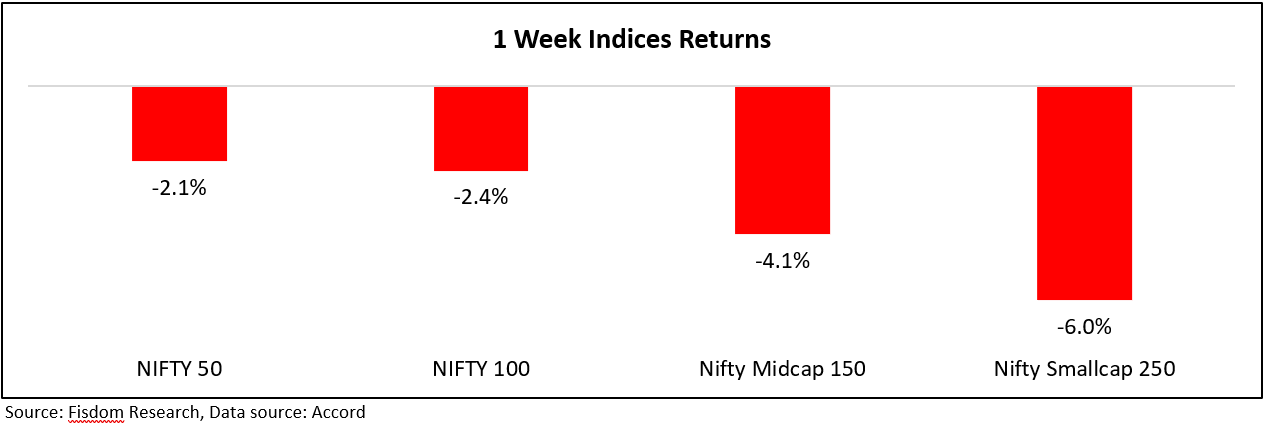

On March 13, many small companies faced significant challenges, although this isn’t always evident from overall market indices. While larger companies weren’t as severely affected, smaller companies experienced a sharp decline, with the small-cap index dropping by over 5 percent in a single day, a situation unseen in nearly two years.

Furthermore, when we broaden our perspective and compare current levels to the highs reached within the last 52 weeks, the struggles within the small-cap sector become even more apparent.

Amid concerns regarding excessive speculation in the small and mid-cap sectors, selling pressure targeted these segments, leading to significant corrections over the past week. Within this space, specific sectors have also witnessed substantial declines. Notably, the BSE PSU index has experienced a correction of nearly 8.5%, surpassing the declines seen in other broader indices.

Meanwhile, the BSE PSU Index staged a remarkable rally, soaring by a staggering 80 percent between January 1, 2023, and March 15, 2024. This surge was fueled by robust earnings growth and a favorable re-rating of stocks. However, post this remarkable ascent, market sentiment regarding PSU stocks became divided. Some foresee further upside potential driven by earnings growth and Price-to-Earnings (P/E) expansion, while others caution against rising speculative activity in certain counters.

PSU stocks have been on an upward trajectory since 2021, with the BSE PSU Index recording gains for three consecutive years: 41 percent in 2021, 23 percent in 2022, and a remarkable 55 percent in 2023. This surge in PSU stocks has outpaced broader market indices, with the BSE PSU Index skyrocketing by 102 percent over the past year, compared to a 30 percent gain in the Nifty.

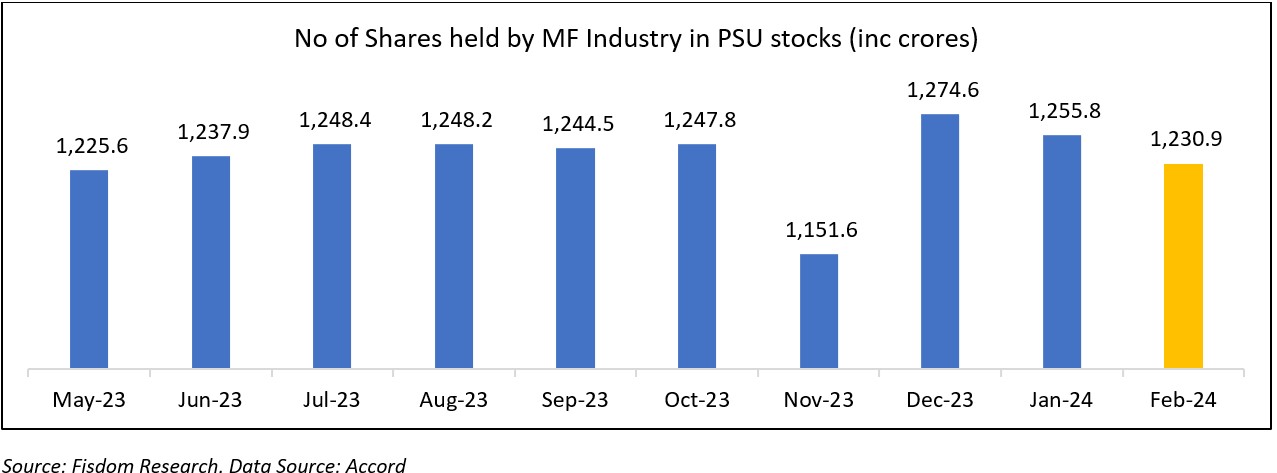

Leading the charge in the PSU rally are sectors such as capital goods (including defense), electric utilities, oil, gas, consumable fuels, and banks, with gains of up to 98 percent. However, despite the buoyant performance, institutional investors have not significantly participated in the PSU rally. Mutual funds, in particular, have maintained a modest overweight stance but have trimmed their positions in certain stocks.

While the share of PSU stocks has remained relatively stable over the past 10 months, mutual funds have begun to decrease their allocations to PSUs since December 2023.

Below is the list of the top 15 PSU stocks where mutual funds have reduced their allocations.

| Company name | No. of Shares | % Change in no. of shares | |

| Feb-24 | Jan-24 | ||

| SJVN Ltd. | 6,24,90,677 | 13,44,51,487 | -53.5% |

| Chennai Petroleum Corporation Ltd. | 3,31,254 | 6,52,692 | -49.2% |

| National Fertilizers Ltd. | 1,74,567 | 2,67,126 | -34.6% |

| Engineers India Ltd. | 3,41,50,456 | 4,41,16,001 | -22.6% |

| NMDC Ltd. | 19,33,87,364 | 24,78,47,658 | -22.0% |

| Punjab National Bank | 38,60,51,954 | 49,27,98,069 | -21.7% |

| NHPC Ltd. | 62,04,77,441 | 75,07,55,672 | -17.4% |

| Bharat Heavy Electricals Ltd. | 19,28,26,354 | 21,98,62,702 | -12.3% |

| Canara Bank | 9,32,02,275 | 10,42,92,569 | -10.6% |

| Steel Authority Of India Ltd. | 19,06,49,655 | 21,12,46,044 | -9.7% |

| Mangalore Refinery And Petrochemicals Ltd. | 2,47,54,807 | 2,68,10,837 | -7.7% |

| Bank Of Maharashtra | 2,94,86,441 | 3,15,26,713 | -6.5% |

| Hindustan Copper Ltd. | 5,63,37,920 | 6,01,24,942 | -6.3% |

| National Aluminium Company Ltd. | 23,64,94,051 | 24,49,33,562 | -3.4% |

| NTPC Ltd. | 1,73,59,82,566 | 1,79,14,08,319 | -3.1% |

In February 2024, mutual funds reduced their positions by half in SJVN and Chennai Petro Chem, both small-cap PSUs.

While MFs have reduced their stakes in mid and small cap PSU there are certain large cap names where MFs have increased their allocation in Feb 24:

| Company name | No. of Shares | % Change in no of shares | |

| Feb-24 | Jan-24 | ||

| Indian Oil Corporation Ltd. | 33,40,96,486 | 24,24,14,540 | 37.8% |

| Oil India Ltd. | 8,99,79,421 | 7,74,39,323 | 16.2% |

| Union Bank Of India | 25,90,65,285 | 22,33,36,828 | 16.0% |

| MOIL Ltd. | 1,06,72,483 | 95,72,959 | 11.5% |

| Hindustan Petroleum Corporation Ltd. | 21,11,10,374 | 19,34,80,743 | 9.1% |

| Balmer Lawrie & Company Ltd. | 92,486 | 85,021 | 8.8% |

| Rashtriya Chemicals and Fertilizers Ltd. | 2,91,794 | 2,70,766 | 7.8% |

| GAIL (India) Ltd. | 65,51,06,341 | 62,49,06,462 | 4.8% |

| Gujarat Mineral Development Corporation Ltd. | 1,17,679 | 1,13,191 | 4.0% |

| Power Finance Corporation Ltd. | 39,39,93,078 | 37,90,75,764 | 3.9% |

| IDBI Bank Ltd. | 16,39,210 | 15,84,492 | 3.5% |

| Power Grid Corporation Of India Ltd. | 1,00,42,30,874 | 97,13,45,747 | 3.4% |

| The Jammu & Kashmir Bank Ltd. | 5,72,69,215 | 5,54,36,609 | 3.3% |

| Coal India Ltd. | 66,65,43,215 | 65,05,12,615 | 2.5% |

| Oil & Natural Gas Corporation Ltd. | 93,13,38,310 | 91,19,75,661 | 2.1% |

In February 2024, some large-cap names such as Indian Oil Corporation and Union Bank witnessed significant buying activity by mutual funds.

Looking ahead, which segments of PSU stocks are expected to perform?

While there is there concerns around the valuations of PSUs, power companies hold promising prospects from a medium-term perspective. Additionally, power-generating companies are deemed more reasonably valued compared to other sectors. Another area of optimism lies in upstream oil companies, where the Price-to-Earnings ratio remains favorable compared to other PSU sectors.

What should investors do?

For investors navigating the complex landscape of PSU stocks, here are some actionable insights:

- Diversification: Given the volatile nature of PSU stocks, diversification across sectors and market caps can help mitigate risks.

- Research and Due Diligence: Conduct thorough research and due diligence before investing in PSU stocks. Analyze financial metrics, earnings growth potential, and sectoral outlooks.

- Stay Informed: Stay updated with market developments, regulatory changes, and company-specific news to make informed investment decisions.

- Seek Professional Advice: Consider seeking advice from financial advisors or fund managers who can provide personalized investment recommendations based on your financial goals and risk appetite.

In conclusion, while PSU stocks have experienced significant volatility and corrections, they continue to offer opportunities for discerning investors.

Market this week

| 11th Mar 2024 (Open) | 15th Mar 2024 (Close) | %Change | |

| Nifty 50 | ₹ 22,518 | ₹ 22,023 | -2.2% |

| Sensex | ₹ 74,176 | ₹ 72,643 | -2.1% |

- The Indian equity market experienced significant losses, breaking a four-week streak of gains, marking the largest weekly decline in five months by the week ending March 15.

- This downturn occurred amidst volatility, influenced by mixed domestic and global data, along with cautious sentiment surrounding midcap and smallcap stocks.

- Notable sectoral declines included the Nifty Realty index, which dropped by 9.4 percent, the Nifty Media index fell by 8.3 percent, and the Nifty PSU Bank slipped by 8 percent.

- Additionally, the Nifty Metal Index shed 6.8 percent, while the Nifty Information Technology index managed to add 1 percent.

- Foreign institutional investors (FIIs) reduced their selling activities during the week, selling equities worth Rs 816.91 crore.

- Conversely, domestic institutional investors (DIIs) maintained their support by purchasing equities worth Rs 14,147.5 crore

Weekly Leaderboard

| NSE Top Gainers | NSE Top Losers | ||||

| Stock | Change (%) | Stock | Change (%) | ||

| TCS | ▲ | 2.69 % | NTPC | ▼ | 10.19 % |

| Britannia Ind | ▲ | 1.74 % | TATA Steel | ▼ | 9.89 % |

| Bharti Airtel | ▲ | 1.69 % | Coal India | ▼ | 9.45 % |

| Nestle India | ▲ | 1.67 % | Power Grid Corporation | ▼ | 9.12 % |

| HDFC Life | ▲ | 1.67 % | TATA Motors | ▼ | 8.99 % |

Stocks that made the news this week:

- Biocon witnessed a decline of over 4 percent following the acquisition of its subsidiary, Biocon Biologics’ India-branded formulation business, by Eris Lifesciences, a firm specializing in chronic therapy-focused drugs. The transaction, valued at Rs 1,242 crore, represents a favorable multiple of 3.4 times revenue and 18 times EBITDA. As part of the agreement, more than 430 employees linked with the business are set to transition to Eris.

- Larsen and Toubro Technology Services saw a rise of over 2 percent, reaching Rs 5,385, following the announcement of securing an Rs 800-crore order. The order entails the provision of advanced cyber security solutions for Maharashtra, aimed at bolstering public safety against cyber threats. In collaboration with KPMG Assurance and Consulting Services LLP as the forensics partner, the company is set to deliver these solutions as per an exchange filing statement.

- The US Food and Drug Administration (FDA) identified procedural and cleanliness concerns at Aurobindo Pharma subsidiary Eugia Pharma SEZ unit in Telangana. Following an inspection from February 19 to 29, the facility received seven observations in its Form 483, citing lapses in contamination prevention procedures and lack of maintenance of written records, resulting in unexplained discrepancies.