Hot stuff: The Indian government has signed defence contracts worth Rs. 44,000 crores in March 2023

The Indian government has signed contracts worth Rs. 44,000 crores in March 2023 with several public sector companies including Bharat Electronics, Bharat Dynamics, Cochin Shipyard, Goa Shipyard, and Garden Reach Shipbuilders and Engineers. These companies have a good track record of working on government projects. However, successful completion of these contracts depends on factors such as timely execution and quality of work. The contracts are expected to have a positive impact on the economy.

The following companies were major recipients of the contracts that were awarded in March 2023:

| Company | Allocation (In Rs Crore) | Order descriptionn |

| BEL | ₹ 16,244 | Electronic warfare systems, radars, and other electronic system |

| CSL | ₹ 9,805 | Six next generation missile vessels |

| BDL | ₹ 8,160 | Akash missile system |

| GSL | ₹ 4,891 | Seven next generation offshore patrol vessels – NGOPVs |

| BAPL | ₹ 1,700 | Bramhos Missile and BrahMos Aerospace |

| Total | ₹ 40,800 | — |

Source: Ministry of defense, Fisdom Research

India’s defence sector is currently witnessing a surge in domestic procurement by the government, leading to an increase in contracts being awarded to Indian companies. This trend is contributing to the government’s “Atmanirbhar Bharat” (self-reliant India) initiative, which aims to promote domestic production and reduce dependence on imports.

The fact that 13 percent of the national budget is allocated to defence spending further highlights the government’s commitment to strengthening the sector. With the government prioritizing domestic procurement, Indian companies in the defence sector are well-positioned to capitalize on the growing opportunities.

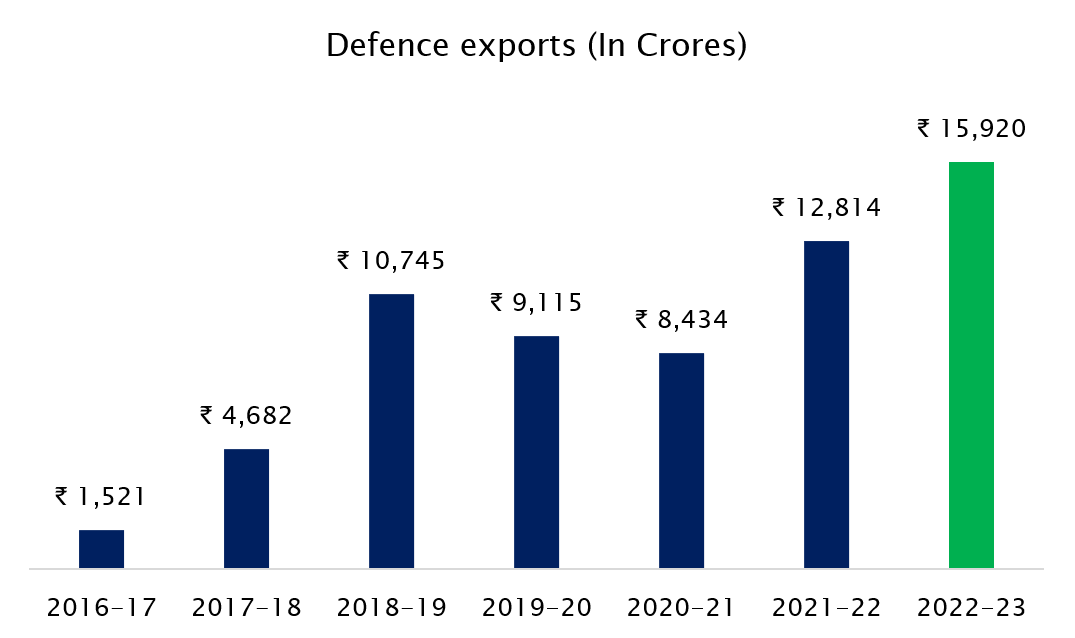

The export figures for the defence sector provide further evidence of how the industry is capitalizing on new opportunities.

Source: Ministry of defense, Fisdom Research

India’s growing defence manufacturing capabilities are evident from the increasing number of countries it exports to, currently over 85 countries. Over 100 Indian firms export defence products globally, showcasing India’s design and development capabilities.

The rising exports and global participation in Aero India 2023, with 104 countries participating, are a testament to India’s growing prowess in defence manufacturing. Per the ministry, India, once known primarily as an importer, now exports significant platforms like the Dornier-228, 155mm Advanced Towed Artillery Guns (ATAGs), Brahmos Missiles, Akash Missile System, Radars, Simulators, Mine Protected Vehicles, Armoured Vehicles, PINAKA Rockets & Launchers, Ammunitions, Thermal Imagers, Body Armours, Systems, Line Replaceable Units, Parts & Components of Avionics, and Small Arms.

The growing global demand for Indian-made products such as LCA-Tejas, Light Combat Helicopters, Aircraft Carriers, and MRO activities is a testament to India’s increasing reputation as a reliable and competent defence manufacturer.

Having established the positive developments taking place in the defence sector, it is crucial to comprehend the government’s reasons for prioritizing this industry.

1. Global defence budgets on the rise

Several countries worldwide are increasing their defence budgets, with Japan setting a record of $863 billion for 2023, including the purchase of long-range cruise missiles. Meanwhile, France has announced a budget of $447 billion from 2024-2030 to adapt its military to high-intensity conflicts. Germany has also approved its defence budget for 2023 at $55.4 billion and has supplied Leopard-2 tanks to Ukraine. In addition, many countries are assisting Ukraine by replenishing their military equipment and increasing their defence budgets. These developments come amid rising tensions and conflicts across the globe, prompting governments to strengthen their military capabilities.

Given the developments in other countries, India is also taking steps to ensure that its defence sector is well-equipped and funded. The Indian government has consistently shown a focus on defence budgets, with a Year-on-Year increase of 16% in FY23 and a projected increase of 13% in FY24(BE). Additionally, the government has raised the Research and Development (R&D) budget by 7.3% to a record high of Rs129 billion. By increasing the defence budget and focusing on R&D, India aims to develop its domestic defence industry and become more self-reliant in the long term.

2. India’s China challenge

India is facing security and strategic challenges from China, which spends massive amounts on its military. However, India cannot match China’s defence spending dollar-to-dollar. To address this disparity, India is renewing its focus on building defence and security partnerships with like-minded countries opposed to Chinese belligerence, such as the Quad.

India aims to seek a coalition of partners in the Indo-Pacific and beyond to deter Chinese hegemony. To achieve this, India is deepening its security and strategic partnerships with these countries.

| What is Quad: The Quad is an informal strategic forum comprising four nations, namely — United States of America (USA), India, Australia, and Japan. One of the primary objectives of the Quad is to work for a free, open, prosperous, and inclusive Indo-Pacific region.

Source: Business Standard |

3. Self-reliance

India’s reliance on Russian weapons and military equipment has been a long-standing issue, with more than 90% of its armored vehicles, 69% of its combat aircraft, and 44% of its submarines and warships being of Russian origin. However, the recent Russian invasion of Ukraine has caused disruptions in the global arms trade, impacting India’s supplies. The Russian defence industry is struggling to resupply its own forces and meet export demands, leading to delays in the delivery of key equipment, spare parts, and ammunition to India. Additionally, global financial sanctions have caused payment issues.

To address this, India has been focusing on enhancing its indigenous design capabilities while also diversifying its equipment suppliers through joint ventures between foreign and Indian companies. To further this effort, the percentage of armed forces capital procurement from domestic industry has been increased from 68% to 75%, with Indian entities or joint ventures based in India being prioritized for procurement orders. This move is aimed at reducing India’s dependence on foreign suppliers and boosting the domestic defence industry.

Key Takeaways:

As the Indian government takes initiatives to increase domestic procurements for the armed forces and reduce the risk of supply chain issues, it is expected to result in significant orders worth Rs 5-6 lakh crore for Indian defence players in the next four to five years. This shift, which includes increasing the share of domestic procurement budget to 75% for FY24, is set to benefit both private and public sector defence players. With a strong order backlog and a healthy pipeline of orders, the Indian defence industry is expected to perform well. This is reflected in the positive performance of the stocks over the past year, indicating a promising outlook for the industry.

| Stock name | Order Book (In Crore) | Order book times revenue (x) | FY23 Returns |

| HAL | 82,000 | 3.1 | 79.0% |

| BEL | 60,500 | 3.5 | 36.1% |

| BDL | 24,021 | 7.5 | 73.2% |

| CSL | 20,500 | 7.2 | 56.9% |

| MDL | 40,600 | 5.6 | 163.9% |

| GRSE | 25,300 | 9.9 | 97.8% |

| GSL^ | 14,605 | 20.6 | Not listed |

| BAPL* | 14,000 | 3.6 | Not listed |

| DPIL | 1,014 | 2.5 | 84.2% |

Source: ICICI Securities, Fisdom Research. *BAPL order book as on 31st Dec 2022. Revenue as of 31st March 2022. ^GSL order book as of Sep 2022, Revenue as on 31st March 2022.

Markets this week

| 03rd April 2023 (Open) | 07th April 2023 (Close) | %Change | |

| Nifty 50 | 17,428 | 17,599 | 1.0% |

| Sensex | 59,131 | 59,833 | 1.2% |

Source: BSE and NSE

- Markets witnessed ended on a positive note.

- In the week ended April 6, the Indian equity market extended its winning streak for a second consecutive week.

- The market was supported by several positive factors including foreign institutional investors’ (FII) buying, higher direct tax collection for FY23, the second highest monthly GST collection and strong manufacturing PMI data.

- Additionally, the decision by the Reserve Bank of India (RBI) to pause the rate hike came as a surprise and further boosted market sentiment.

- Foreign institutional investors (FIIs) continued their buying spree for the second week in a row, purchasing equities worth Rs 1,604.56 crore.

- However, in a surprising turn of events, domestic institutional investors preferred to book profits and sold shares worth Rs 2,272.53 crore.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Bajaj Finance | ▲ +5.62% | BPCL | ▼ -3.57% |

| L&T | ▲ +5.09% | Apollo Hospitals | ▼ -2.53% |

| TATA Motors | ▲ +4.00% | Tech Mahindra | ▼ -0.83% |

| HDFC | ▲ +3.95% | Cipla | ▼ -0.79% |

| Bajaj Auto | ▲ +3.83% | JSW Steel | ▼ -0.78% |

Source: BSE

Stocks that made the news this week:

?The Reserve Bank of India’s decision to maintain its key policy rate, after six consecutive hikes since May 2022, is expected to provide some respite to home loan borrowers and boost the growth momentum in the housing sector. However, the RBI Governor continuously emphasized that it was only a temporary pause and not a pivot. The move comes as home loan EMIs have increased by 15-17 percent since April 2022 and home prices have risen by 4-12 percent during the same period. The decision strikes a balance between containing inflationary pressures and supporting economic growth.

?Larsen & Toubro (L&T) jumped in the week that went by, after the company announced that its hydrocarbon business, L&T Energy Hydrocarbon (LTEH) has secured mega orders from a prestigious client in the Middle East. As per L&T classification the value of the orders is more than Rs 7,000 crore.

?TATA Motors announced its partnership with Inchcape plc, a leading global automotive distributor, as their distributor for their commercial vehicles in Thailand. Through this partnership, Tata Motors will commence the sales and service of its commercial vehicles (CVs) across Thailand.

?Coal India Ltd’s shares rallied during the week, following the release of positive data indicating the company’s production and offtake figures for March. Coal India and its subsidiaries recorded a 4 percent YoY increase in production in March. Furthermore, the company’s output for the current fiscal year 2022-23 has seen an impressive growth rate of 12.9 percent, amounting to a total of 703.2 million tonnes. This outstanding performance has resulted in Coal India surpassing its annual production target of 700 million tonnes for the first time since the fiscal year that ended in March 2006.