Company Background

Aadhar Housing Finance Limited is a housing finance company focusing on the lower-income segment. Their deep impact branches and sales offices are dedicated to serving customers in India’s tier 4 and tier 5 towns. As of September 30, 2023, the company has enrolled 12,221 Aadhar Mitras who receive referral fees for sourcing customers’ loans. They offer a range of mortgage loan products for residential and commercial property purchase, construction, home improvement, and extension. With a vast network of 471 branches, including 91 sales offices, spread across 20 states and union territories, the company operates in approximately 10,926 pin codes throughout India. As of September 30, 2023, the company has 3,695 employees, while its subsidiary, Aadhar Sales and Services Private Limited (ASSPL), employs 1,851 individuals. Having served 246,983 customers nationwide through their extensive branch and office network, Aadhar Housing Finance Limited continues to make strides in providing financial services to underserved communities.

Company Key Highlights

Established in 2010, Aadhar Housing Finance Limited is a prominent housing finance company in India, primarily focusing on the lower-income segment. Specializing in mortgage-related loans, it serves the low-income housing segment, with a notable emphasis on economically weaker and low-to-middle-income customers. The company has garnered recognition for having the highest Assets Under Management (AUM) and net worth among its peers. With a presence spanning 20 states and union territories, Aadhar Housing Finance caters to diverse geographic needs, effectively mitigating concentration risk.

- Seasoned business model with strong resilience through business cycles:

Throughout different business cycles, they’ve upheld their status as India’s premier HFC for low-income housing, utilizing their customer-centric model, expansive network, and proficient management. Despite obstacles like demonetization, GST, and the COVID-19 pandemic, their financial performance has stayed strong, showcasing the robustness of the business and leadership.

- Strong Geographical Distribution Network:

The bank has strategically positioned its business across 487 branches, which include 109 sales offices, spread across 20 states and union territories within the country. These branches and sales offices are strategically located in Tier II and Tier III cities and regions, allowing the bank to effectively serve customers in these areas while also expanding its reach and market presence.

- Social objectives are one of the core components of our business model:

They’ve made social goals a big part of their business, which helps them stand out. They focus on lending to people who don’t have much money, and a lot of their money and customers come from this group. They also help with government housing plans like Pradhan Mantri Awas Yojana. Plus, they create jobs through programs like ‘Aadhar Mitra’, especially in cities and towns, which helps improve the economy in those areas.

- Strong systems and processes for underwriting, collections, monitoring asset quality.

They’ve implemented a strong credit assessment, risk management, and collections framework to identify and handle inherent risks. Their primary focus is on financing retail customers, particularly salaried individuals buying residential properties. They follow an internal ‘risk appetite statement’ that outlines the level and types of risk they accept to achieve objectives, effectively balancing risk and return. Regular monitoring against qualitative and quantitative metrics, including capital, profitability, asset quality, and compliance, ensures alignment with this policy.

Key Business Strengths

- Aadhar Housing Finance is India’s leading low-income sector HFC with the highest net worth and AUM among competitors.

- The company boasts an expanding gross AUM and a comprehensive branch network tailored to serve its intended customer base effectively.

- It has robust systems for risk management, including credit evaluation and collections, which enhance profitability and asset quality.

- Technology-driven solutions facilitate efficient loan processing and accurate credit decisions.

- Operating across 20 states and union territories, Aadhar Housing Finance specializes in extending its reach to semi-urban areas, offering products like Aadhar Gram Unnati to facilitate broad market penetration.

Key Risks to Business

- Regulatory investigations into former promoters could negatively impact Aadhar Housing Finance and its share value.

- Strong promoter control may restrict shareholder influence and delay key decisions, affecting business outcomes.

- Reliance on external information could lead to inaccuracies in credit evaluations, increasing NPAs and risking financial stability.

- It operates in a highly competitive industry.

Fisdom Research Assessment:

Aadhar Housing Finance leads the low-income housing sector among HFCs with a nationwide presence and strong financials. With competitive valuations, low NPAs, and high RoE, it’s poised for growth, boasting a comprehensive nationwide presence through its 498 branches, it’s extensive branch network, diversified product offerings, healthy margins and stable asset quality are the key driving factors for the company. Investors can consider investing in this IPO from a long-term perspective.

Offer Details

| Offer period | |

| Bid/Offer Opens On: | Wednesday, May 08, 2024 |

| Bid/Offer Closes On: | Friday, May 10, 2024 |

| Issue Size | Price Band | Bid Lot |

| ~ Rs.2,857 – Rs.3,000 Cr | Rs. 300 – Rs.315 | 47 |

| Particulars | Lots | Shares | Amount |

| Retail | |||

| Minimum | 1 | 47 | RS. 14,805 |

| Maximum | 13 | 611 | Rs. 1,92,465 |

| S-HNI | |||

| Minimum | 14 | 658 | Rs. 2,07,270 |

| Maximum | 67 | 3,149 | Rs. 9,91,935 |

| B-HNI | |||

| Minimum | 68 | 3,196 | Rs. 10,06,740 |

Issue Structure

| QIB Shares Offered | Not more than 50% of the offer size |

| Retails Shares Offered | Not less than 35% of the offer size |

| NII (HNI) Shares Offered | Not less than 15% of the Net Issue |

Indicative IPO Timeline

| Bid/Offer Opening Date | Wednesday, May 8, 2024 |

| Bid/Offer Closing Date | Friday, May 10, 2024 |

| Finalization of the basis of allotment with The designated stock exchange | Monday, May 13, 2024 |

| Initiation of refunds | Tuesday, May 14, 2024 |

| Credit of equity shares to depository Accounts | Tuesday, May 14, 2024 |

| Listing Date | Wednesday, May 15, 2024 |

Other Details

| Book Running Lead Managers | ICICI Securities Limited, Citigroup Global Markets India Private Limited, Kotak Mahindra Capital Company Limited, Nomura Financial Advisory and Securities (India) Private Limited, SBI Capital Markets Limited |

| Objects of the Issue | 1) To meet future capital requirements towards onward lending 2) General corporate purposes. |

| Listing At | BSE, NSE |

Financial Elements

| Particulars | Dec-23 | Mar-23 | Mar-22 | Mar-21 |

| Total Asset (Cr.) | ₹ 18,036 | ₹ 16,618 | ₹ 14,376 | ₹ 13,630 |

| Revenue from Operation (Cr.) | ₹ 1,895 | ₹ 2,043 | ₹ 1,729 | ₹ 1,575 |

| PAT (Cr.) | ₹ 548 | ₹ 545 | ₹ 446 | ₹ 340 |

| Basic EPS | ₹ 13.9 | ₹ 13.8 | ₹ 11.3 | ₹ 8.6 |

| Diluted EPS | ₹ 13.5 | ₹ 13.4 | ₹ 10.9 | ₹ 8.4 |

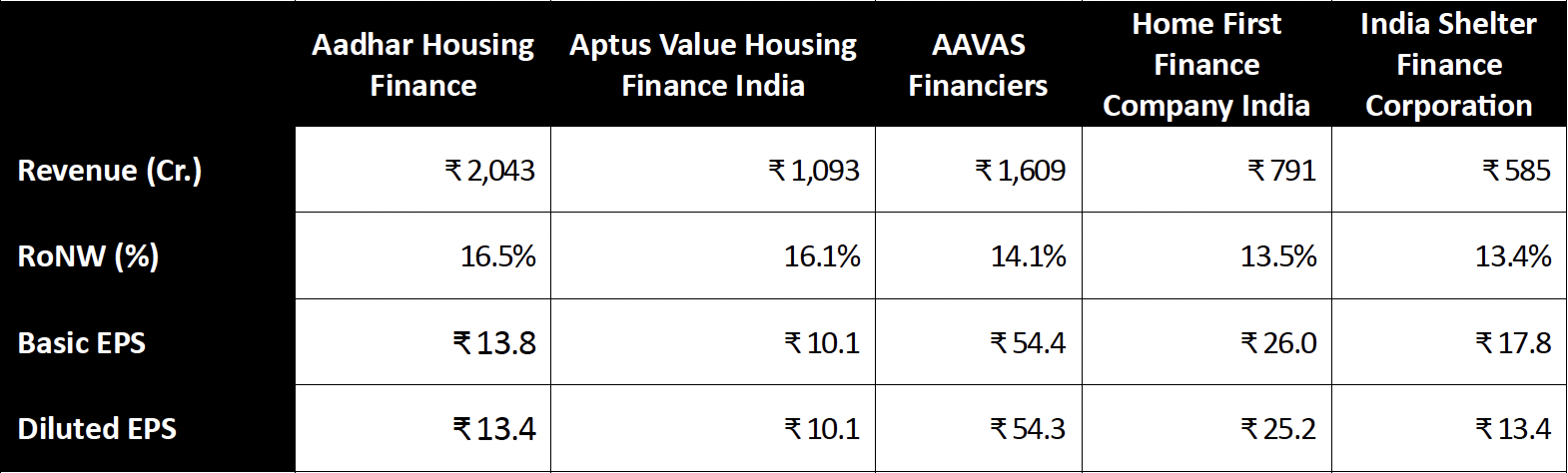

Comparison with Listed Industry Peers (Fiscal 2023)

Disclaimer

This document is not for public distribution and is meant solely for the personal information of the authorized recipient. No part of the information must be altered, transmitted, copied, distributed, or reproduced in any form to any other person. Persons into whose possession this document may come are required to observe these restrictions. This document is for general information purposes only and does not constitute investment advice or an offer to sell or solicitation of an offer to buy/sell any security, and is not intended for distribution in countries where distribution of such material is subject to licensing, registration, or other legal requirements.

The information, opinions, and views contained in this document are as per prevailing conditions and are of the date appearing on this material only and are subject to change. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Neither Finwizard Technology Private Limited (“Fisdom”), its group companies, its directors, associates, employees, nor any person connected with it accepts any liability or loss arising from the use of this document.

The views and opinions expressed herein are based solely on the past performance of the schemes and/or securities and do not necessarily reflect the views of Fisdom. Past performance is no guarantee and does not indicate or guide future performance. The information set out herein may be subject to updating, completion, revision, verification, and amendment, and such information may change materially.

Investing in securities markets involves risks, including the potential loss of principal amount in part or in full. The recommendations are based on the past performance of schemes and/or securities, which is not necessarily indicative of future performance. The recommendations do not guarantee future results, and the value of the invested principal amount and investment returns may fluctuate over time. Therefore, it is essential to review your investment objectives, risk tolerance, and liquidity needs before making any investment decisions.

While the information and data contained in this document have been obtained from sources believed to be reliable, Fisdom does not guarantee its accuracy, adequacy, completeness, timeliness, reliability, or availability of any information provided in this document. Fisdom is not responsible for any errors or omissions, regardless of the cause, or for the results obtained from the use of information contained in this document. Fisdom accepts no liability for any losses or damages arising directly or indirectly (including special, incidental, or consequential losses or damages) from the use or reliance placed on any information or data contained in this document, including, without limitation, any lost profits, trading losses, or damages resulting from any errors, omissions, interruptions, deletions, or defects in any manner contained herein.

Readers/Investors should be aware that this document may not be suitable for all types of investors. Investors should independently evaluate any investment or strategy discussed herein. Any decision(s) based on the information contained in this report shall be the sole responsibility of the Reader/Investor.

Fisdom is a SEBI Registered Investment Advisor (RIA) [Registration No: INA200005323] and Research Entity [Registration No: INH000010238]. This document is prepared and distributed in accordance with the SEBI (Investment Advisers) Regulations, 2013, and other relevant regulations. Please read all relevant offer documents, risk disclosure documents, and terms and conditions related to the services provided by Fisdom before making any investment decision. For more details, please visit our official websites at www.fisdom.com and www.Finity.in.