Daily Snippets

Date: 14th September 2023 |

|

|

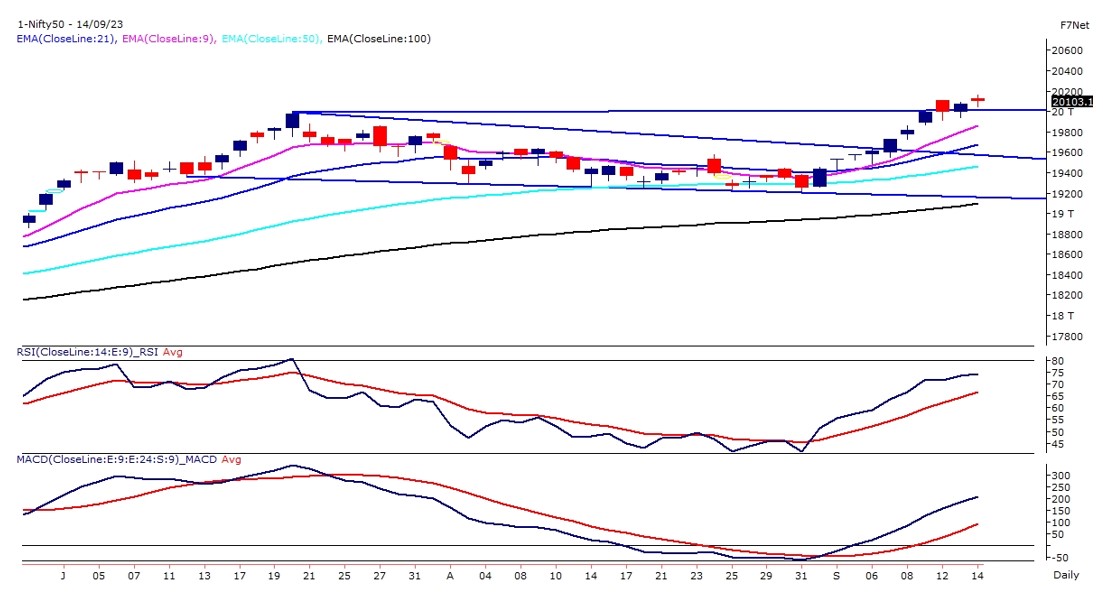

Technical Overview – Nifty 50 |

|

The Nifty50 on its weekly expiry day traded with less volatility and was capped within the very narrow range. The index witnessed a gap-up opening and recorded an intraday high at 20,167 levels and post that index drifted below 20,150 levels and closed with marginal gains towards the end.

The Benchmark index continues to trade above its horizontal trend line which is placed at 20,000 levels. The positive takeaway from today’s trading session was that Nifty bulls were not seen giving up despite the benchmark flirting with its uncharted territory and most importantly, shrugging off sluggish global cues.

The momentum oscillator RSI (14) has rebounded sharply from the 40 levels and presently closed above 70 levels with a bullish crossover. The MACD indicator has shifted higher above its line of polarity with a bullish crossover.

The technical landscape continues to be positive as long as Nifty trades above the 19,900 mark. Technically speaking, immediate bullish targets or resistance are seen at Nifty’s next psychological 20,200 mark.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty on 14th Sept traded with less volatility and was capped within the very narrow range. The Banking index witnessed a gap-up opening and recorded an intraday high at 46,143 levels and post that index drifted below 46,050 levels and closed with marginal gains near 46,000 levels towards the end.

The Bank Nifty on the daily chart has formed a Doji candle stick pattern but continues to hold a bullish status as prices are trading above the breakout levels. The broader trend for the Banking index remains bullish as prices are trading in a higher high higher bottom formation. The momentum oscillator RSI (14) is steady above 60 levels with a bullish crossover. The MACD indicator has shifted higher above its line of polarity with a bullish crossover.

The technical landscape continues to be positive as long as Bank Nifty trades above the 45,300 mark. Technically speaking, immediate bullish targets or resistance are seen at Bank Nifty’s next psychological 46,500 mark.

|

Indian markets:

- Domestic stock barometers experienced a rebound on Wednesday. Tracking mixed global signals, the market initially stumbled but found its footing as the session progressed.

- The Nifty 50 index started the day with a low of 19,944.10 but managed to close above the 20,050 level, its record closing high.

- The rally was supported by the metal, oil & gas, and banking shares. The broader indices too took a breather and ended in the green.

|

Global Markets

- Markets in Europe and Asia declined on Wednesday as investors awaited key U.S. inflation data.

- Chinese property stocks logged strong gains as embattled developer Country Garden clinched more extensions on its debt payments.

- US stocks ended lower on Tuesday as Oracle shares tumbled more than 13% after a weak forecast and surging oil prices deepened worries about persistent price pressures ahead of crucial inflation readings this week. Oracle shares dived to their lowest since June after the cloud-services provider forecast current-quarter revenue below targets and narrowly missed first-quarter expectations.

- Investors are awaiting August consumer price index data due on Wednesday and producer prices reading scheduled for Thursday to gauge the outlook for U.S. interest rates. Investors will also monitor the European Central Banks policy decision on Thursday, when it is seen holding rates after nine consecutive hikes.

|

Stocks in Spotlight

- Bajaj Healthcare Shares gained 1% higher after the company received an Establishment Inspection Report (EIR) from the US Food and Drug Administration (FDA) for its plant in Savli, Vadodara, Gujarat. The pre-approval inspection (PAI) for the plant was carried out by the USFDA in November 2022. The company received no 483 observations in the inspection. Stock most of it gains as it was trading over 8 percent higher in today’s session.

- IRCTC shares surged 1.5% after partnering with MSRTC to enable online bus bookings on its portal. CMD Smt. Seema Kumar highlights the MOU’s significance in simplifying travel arrangements and ensuring seamless last-mile connectivity via the IRCTC Bus Booking Portal.

- NBCC shares were up 8% after the company signed a quadripartite MoU with Ministry Of Steel, RINL & NLMC and receiving order worth Rs 180 crore. The company has signed a quadripartite MoU with Ministry of Steel (MoS) Govt. of India, Rashtriya Ispat Nigam Limited (RINL) and National Land Monetization Corp. Ltd. (NLMC) for monetization of the non-core assets of RINL at Vishakhapatnam. As per MoU, NBCC would act as technical cum transaction advisor and assist Ministry of Steel (MoS), RINL and NLMC in monetization of the non-core assets.

|

News from the IPO world🌐

- Sai Silks fixes IPO price band at Rs 210-222/share

- EMS IPO subscribed 25.6x so far on Day 3

- IPO tracker: RR Kabel issue fully subscribed on Day 2

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | UPL | ▲ 3.90% | | HINDALCO | ▲ 3.30% | | M&M | ▲ 2.40% | | ONGC | ▲ 2.20% | | DIVISLAB | ▲ 2.00% |

| Nifty 50 Top Losers | Stock | Change (%) | | ASIANPAINT | ▼ -1.20% | | HDFCLIFE | ▼ -1.00% | | COALINDIA | ▼ -0.90% | | BRITANNIA | ▼ -0.70% | | LTIM | ▼ -0.70% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY PSU BANK | 1.64% | | NIFTY METAL | 1.49% | | NIFTY REALTY | 1.39% | | NIFTY OIL & GAS | 1.10% | | NIFTY AUTO | 1.09% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2387 | | Declines | 1275 | | Unchanged | 142 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 34,576 | (0.2) % | 4.3 % | | 10 Year Gsec India | 7.1 | -0.90% | 4.00% | | WTI Crude (USD/bbl) | 89 | (0.4) % | 15.1 % | | Gold (INR/10g) | 58,510 | -0.20% | 8.00% | | USD/INR | 82.82 | (7.0) % | 0.2 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|