Letter To Investor

With the onset of the festive season in October 2023 Indian equity markets faced resistance due to global factors. Volatility has been fueled by multiple factors, including the uptick in US treasury yields, escalating geopolitical tensions between Israel and Hamas, the strength of the US dollar impacting emerging market equities, and substantial divestment by Foreign Institutional Investors (FIIs).

The sentiment in the market leaned towards a bearish tone, with equity markets in various market cap indices closing in the red. Despite this downturn, the realty sector demonstrated resilience. Foreign Portfolio Investors (FPIs) persisted in their selling activities on the institutional front, while Domestic Institutional Investors (DIIs) adhered to a buying stance, creating fluctuations in the market.

Simultaneously, there was a notable retreat in commodity prices, indicating a cooling trend within the market. Despite the rupee hitting new lows against the USD, it remained stronger compared to other global currencies, showcasing relative resilience in challenging times. On the global front, central banks seem to be approaching the peak of their interest rate cycles, signifying potential shifts in the near future. Domestically, indicators such as the monsoon season falling below anticipated levels and industrial production surging to new heights paint a mixed picture of economic stability and growth.

In light of looming elections, historical trends suggest robust FPI inflows during election years, with an incumbent party win often translating into a positive market sentiment due to expected continuity and stability.

On the fixed income front, the global scenario regarding interest rates remained steady, with most central banks maintaining their current rates. Anticipations of declining US interest rates by year-end might influence global market dynamics, as indicated by the convergence of yields on 10-year US bonds and Government Securities (G-Secs) in 2023.

Our central bank, the Reserve Bank of India (RBI), adopted a pause on interest rate adjustments, historically signalling an advantageous time for investments. Their inflation outlook points toward a potential near-term uptick but remains stable for the long term. Notably, historical data reveals that the optimal trade-off between risk and returns typically occurs within a 5–7-year investment horizon.

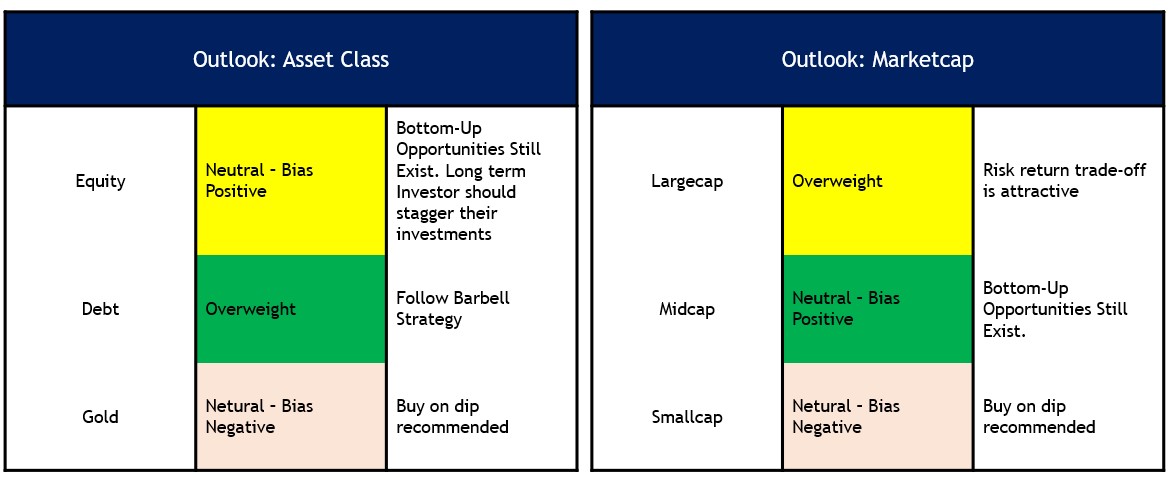

Going ahead, it seems we’re in for a bit more uncertainty before things become clearer, and this transition might take some time. What’s causing the market’s ups and downs are the big economic factors. We’re grappling with challenges like the direction of rising oil prices, increasing interest rates on bonds, changes in the strength of the dollar, and how global tensions are evolving. Additionally, current market valuations don’t offer much room for further expansion. The key to driving market returns in the future is an increase in corporate earnings. We maintain a positive outlook on stocks for the long term, specifically over 3 to 5 years and beyond However, it’s worth acknowledging that we may encounter short-term volatility along the way.

There is so much that has happened and much more than we anticipate. This is effectively captured in Fisdom Research’s latest edition of its monthly outlook on the Indian economy and capital markets – CapView. This month, the report is titled – “Maintain Caution”. You may have already caught onto the reason, but there is much more.

Please feel free to reach out for any queries or clarifications.

Fundamental Tracker & Key Themes For FY24

Key Themes for FY24:

- Capital Expenditure(Capex)

- Energy Transition/De-carbonization

- 5G Roll Out

- Re-rating for banks

- A mix of value & growth

- Quality fixed income over credit

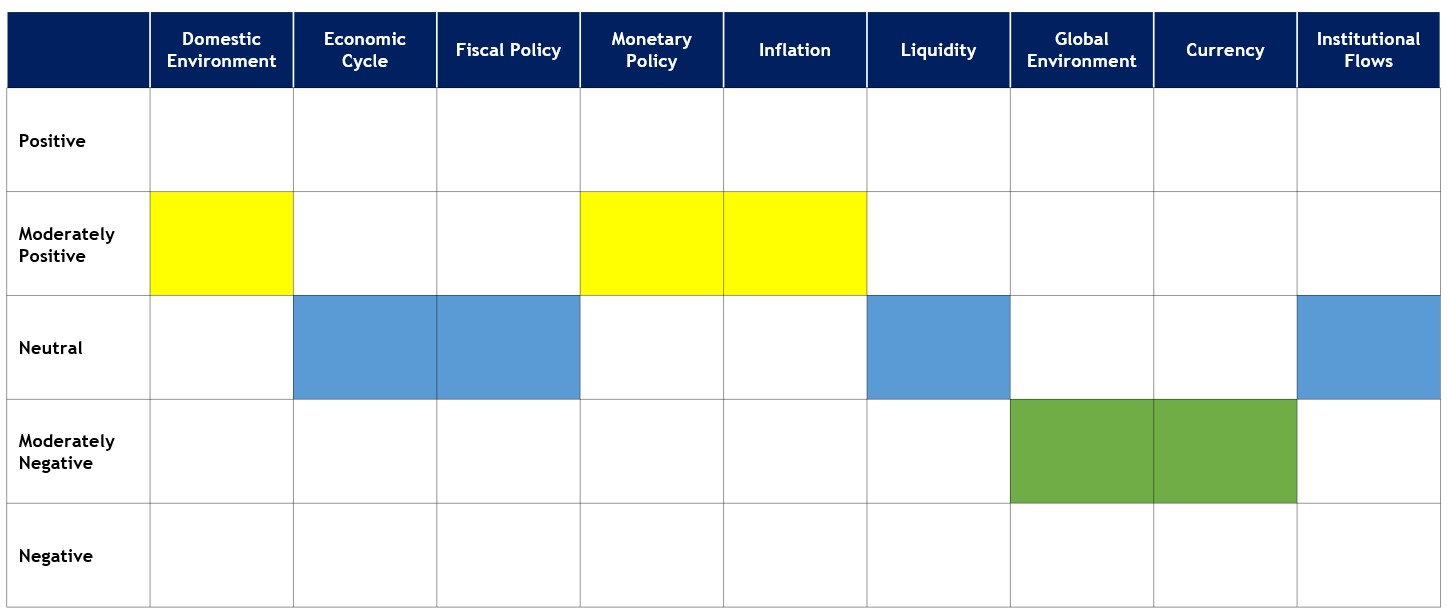

Asset Class & Marketcap Views

Key Headwinds:

- El Nino resulting in poor rainfall

- Elections and Government Stability in 2024

- Geopolitical uncertainties and sluggish growth in Europe and the USA

- Rise in Crude oil prices

- Higher US bond yields sustaining for longer

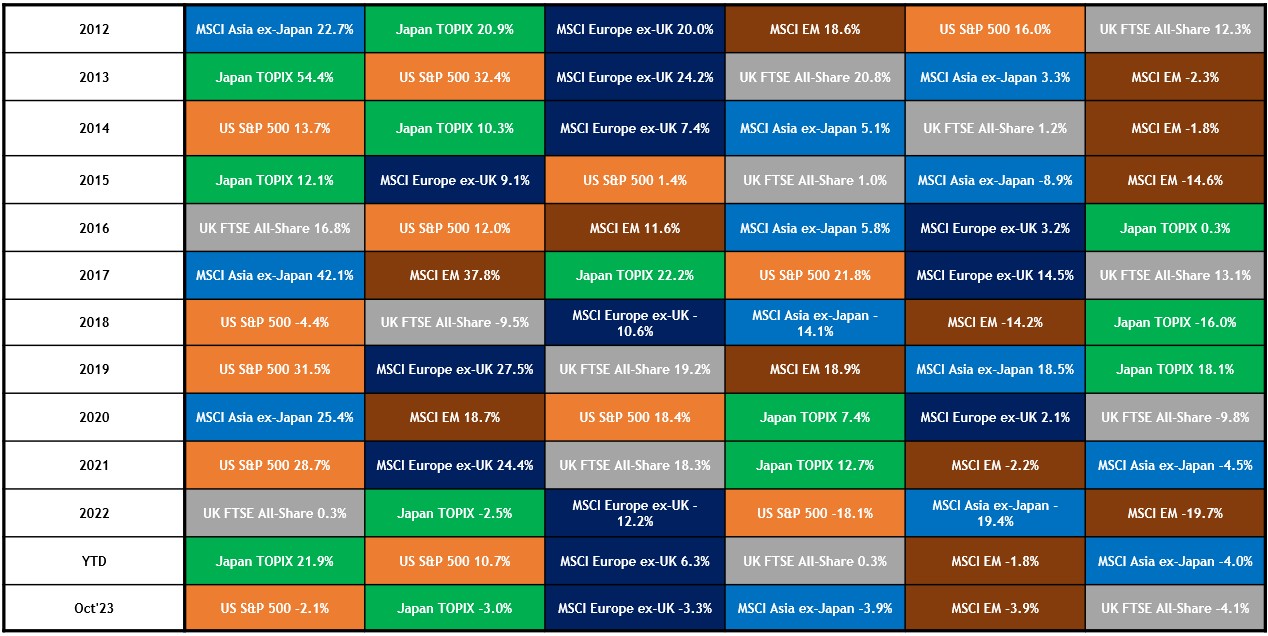

Asset Class & Style Returns

Bonds and Stocks Tumble Amid Rising Yields and Geopolitical Uncertainty in October

Source: FTSE, LSEG Datastream, MSCI, S&P Global, TOPIX, J.P. Morgan Asset Management. All indices are total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 October 2023.

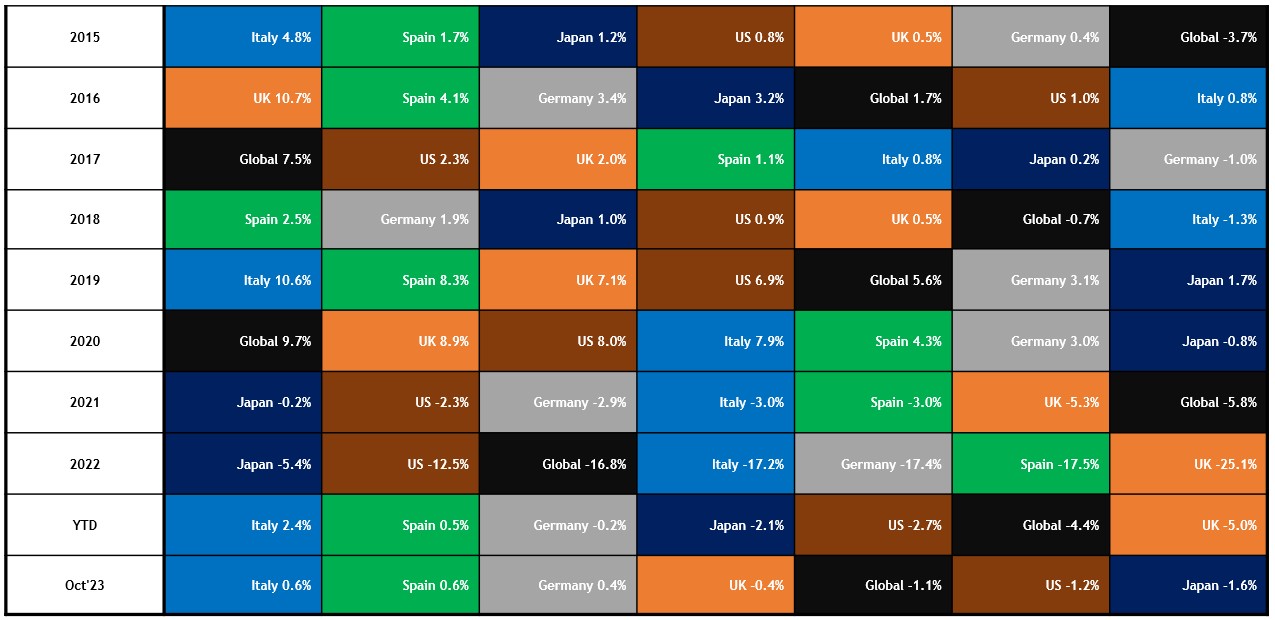

Fixed Income Government Bond Returns

Rising Tide: Multi-Year Highs in Yields Dominate the Month

Source: Bloomberg Barclays, LSEG Datastream, J.P. Morgan Asset Management. All indices are Bloomberg Barclays benchmark government indices. All indices are total return in local currency, except for global, which is in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 October 2023

Global Economic Outlook: A Glimpse of Optimism

World Economy Expanding Nearly 50% More Rapidly Than Anticipated A Year Ago.

| GDP | CPI | |||||

| 2022 | 2023F | 2024F | 2022 | 2023F | 2024F | |

| Global | 3.3 | 3 | 2.4 | 6.3 | 3.9 | 2.7 |

| Advanced | 2.6 | 1.5 | 0.8 | 7.6 | 4.7 | 2.7 |

| Emerging | 3.8 | 4 | 3.6 | 4.6 | 2.8 | 2.7 |

| US | 1.9 | 2.4 | 1 | 8 | 4.1 | 2.6 |

| Eurozone | 3.4 | 0.4 | 0.3 | 8.4 | 5.6 | 2.8 |

| UK | 4.3 | 0.5 | 0.4 | 9.1 | 7.3 | 3 |

| China | 3 | 5.1 | 4 | 1.9 | 0.5 | 1.6 |

| Japan | 1 | 2.2 | 1.3 | 2.5 | 3.2 | 2.8 |

| Brazil | 2.9 | 3 | 1.9 | 9.3 | 4.6 | 3.8 |

| India | 6.8 | 6.3 | 6.4 | 6.7 | 5.5 | 5 |

| Russia | -1.9 | 1.7 | 1 | 13.7 | 5.6 | 5.5 |

- Resilient Economies: Despite initial concerns, leading economies (excluding China) have displayed unexpected resilience, suggesting a more positive economic performance.

- Inflation Prospects: Expectations of inflation coming closer to the target rates, suggest a potential positive development, as it aligns with central banks’ goals and may contribute to economic stability.

- Twelve months prior, forecasts indicated a global growth rate of 2% for 2023. Presently, the rate stands at 2.8%, marking a seemingly modest adjustment that translates to the world economy expanding nearly 50% more rapidly than anticipated a year ago. This resilience can be ascribed primarily to consumers relying on amassed savings and wage growth to offset inflation risks, while businesses have maintained profitability through strong pricing power and adept balance sheet management. Certain challenges such as widening fiscal deficits & and geopolitical risk remain, emphasizing the need for cautious optimism.

Source: Bloomberg Barclays Investment Bank, November 2023, Fisdom Research

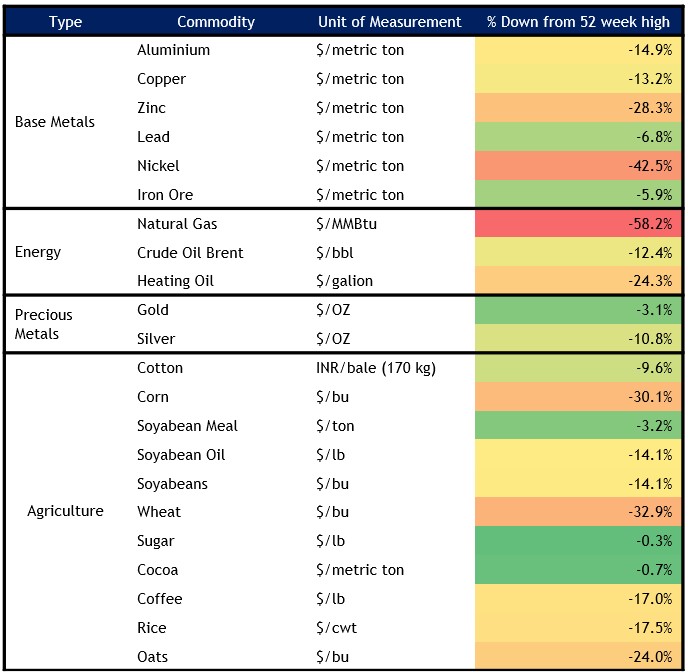

Commodity Price Retreat: A Cooling Trend in the Market

Commodity Prices Cool As Geopolitical Tensions Persist, Impacting Inflation Concerns

Amidst a backdrop of tightening policies and global growth concerns, the once-heated commodity market is now cooling off.

- Base Metals Correction: Zinc and nickel experience substantial declines of 28% and 42%, reflecting cooling sentiments in base metals.

- Oil’s Geopolitical Rollercoaster: Despite falling below $100 per barrel, recent Middle East conflicts contributed to a 12% resurgence, maintaining oil prices below their peak.

- Natural Gas Plummet: A sharp correction of 58% in natural gas prices underscores the broader trend of commodity market cooling.

- Precious Metals Retreat: Gold and silver prices declined by 3% and 11% respectively, following their proximity to 52-week highs.

- Mixed Agricultural Dynamics: While general declines are noted in corn, wheat, and rice prices, sugar and cocoa surge, approaching their 52-week highs

With this correction in major commodities, there’s an anticipation of easing inflation in the coming months. However, persistent geopolitical tensions and a concerning spike in food prices remain key challenges

Source: Bloomberg NSE, Axis Securities, 06th November 2023, Fisdom Research