GDP Growth Estimates Surpass Expectations

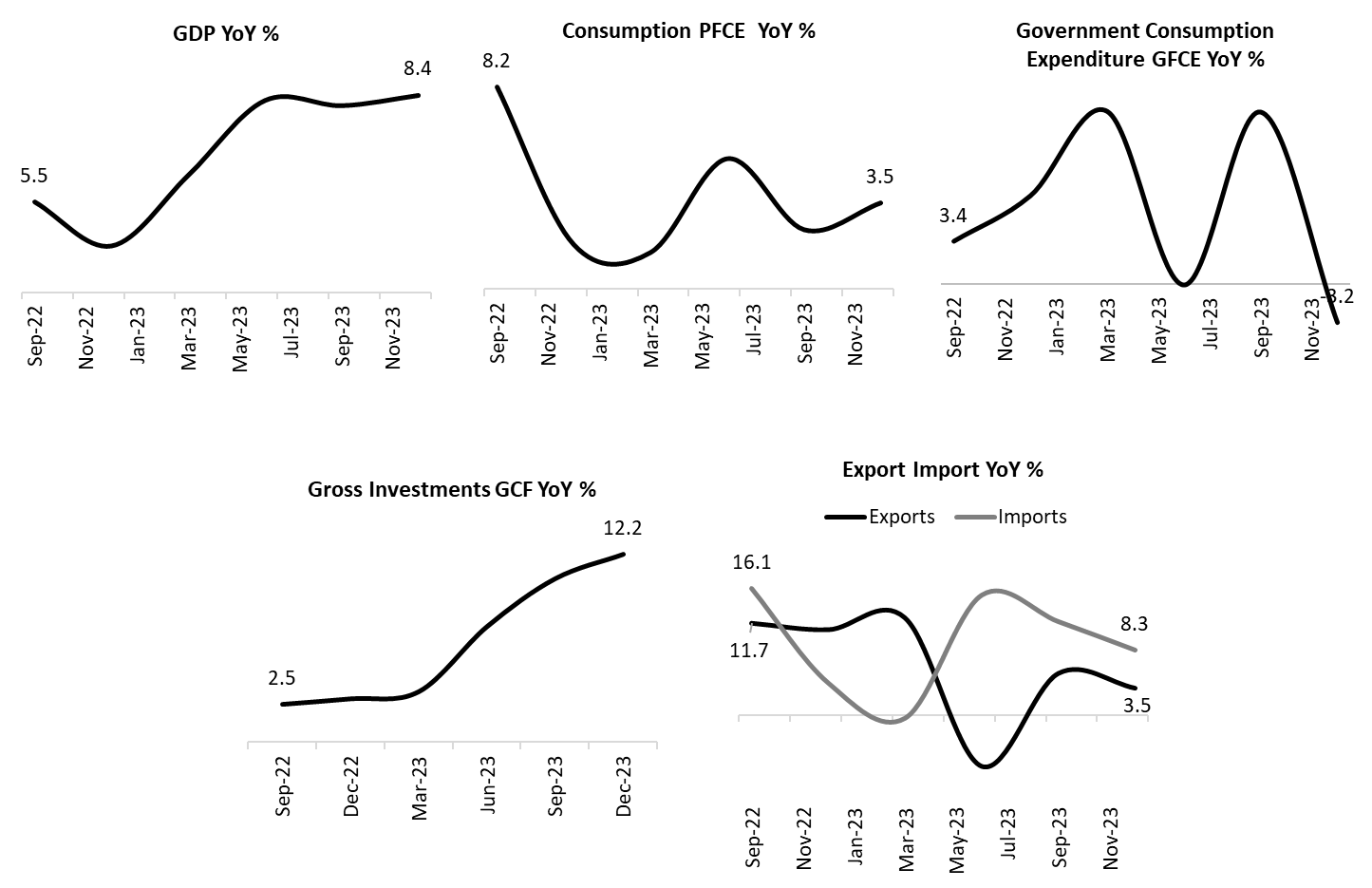

GDP growth for Q3FY24 is the highest growth witnessed in the last six quarters

GDP Estimates for Q3FY24:

| Agency/Institution | GDP Estimates For Q3FY2024 |

| RBI Monetary Policy Committee (MPC) | 6.5 |

| RBI Forecasters Survey (Median) | 6.5 |

| Barclays | 6.7 |

| ICRA | 6.0 |

| India Ratings | 6.5 |

| CARE Ratings | 6.9 |

| Morgan Stanley | 6.5 |

| Deutsche Bank | 7.0 |

GDP Numbers By NSO for Q3FY24:

| Indicators | Q3FY2024: YoY Growth % | % Share in Total |

| Gross Domestic Product | 8.4 | 100.0 |

| Consumption PFCE (C) | 3.5 | 58.6 |

| Gross Investments GCF (I) | 12.2 | 35.2 |

| Government Expenditure GFCE (G) | -3.2 | 7.8 |

| Export (X) | 3.5 | 22.2 |

| Import (I) | 8.3 | 23.9 |

India’s Q4 2023 GDP Surge

Strong Q4 2023 GDP growth showcases India’s economic resilience and future optimism.

- India’s real GDP surged by a remarkable 8.4% year-on-year in the October-December 2023 quarter, exceeding expectations and marking the highest growth rate in six quarters. This growth was underpinned by robust investments, particularly driven by government capital expenditure, coupled with a substantial improvement in the trade deficit and a pickup in consumption demand. Despite sluggish private sector investments, the economy benefited from strong government spending and expanding exports.

- Looking ahead, sustaining this momentum will depend on continued government support, especially in the form of infrastructure spending and investment-friendly policies. Additionally, efforts to stimulate private sector investments and enhance consumption demand will be crucial for maintaining growth momentum.

- Overall, while challenges remain, the strong performance in the December 2023 quarter indicates resilience in the Indian economy, suggesting a cautiously optimistic outlook for the coming quarters.

GDP Forecast: Expected Growth of 6.4% in FY25

Revised estimates signal stronger domestic demand and trade prospects

| Quarter | 2020-21 (%) | 2021-22 (%) | 2022-23 (%) | 2023-24*(%) | 2024-25*(%) |

| GDP | -5.8 | 9.7 | 7.0 | 7.8 | 6.4 |

| PFCE | -5.3 | 11.7 | 6.8 | 3.6 | 5.2 |

| GFCE | -0.8 | 0.0 | 9.0 | 0.9 | 3.5 |

| GCF | -7.4 | 21.1 | 5.5 | 8.2 | 4.5 |

| GFCF | -7.1 | 17.5 | 6.6 | 8.2 | 4.4 |

| Exports | -7.0 | 29.6 | 13.4 | 2.7 | 5.6 |

| Imports | -12.6 | 22.1 | 10.6 | 12.2 | -0.4 |

- India’s GDP is expected to grow by 6.4% in fiscal year 2024-25, reflecting a slight upward revision from earlier projections. This growth is underpinned by the resilience of domestic demand and improved trade prospects. However, the pace of growth is anticipated to be slower compared to the previous fiscal year. This moderation is attributed to sluggish global growth expectations for 2024 and 2025.

- Looking ahead, GDP growth is projected to be more broad-based. A mild acceleration in consumption expenditure is expected, driven by improved rural demand. Additionally, the drag from the trade deficit is forecasted to decrease substantially, supporting overall GDP growth. Investment activity, led by government capital spending, is anticipated to sustain, albeit at a slower rate.

- Domestic consumption, especially in rural regions, is set to rise due to favorable weather and consistent urban demand. Government spending is also projected to increase moderately. Additionally, foreign trade is expected to improve, marked by a reduced trade deficit and strong export performance.

- Yet, stimulating private sector investments poses challenges, with capacity utilization rates still below ideal levels and corporate indicators signaling hesitancy toward substantial capital expenditure. Thus, while GDP growth appears promising, initiatives to boost private sector investment may be crucial for achieving stronger economic expansion in the upcoming fiscal year.

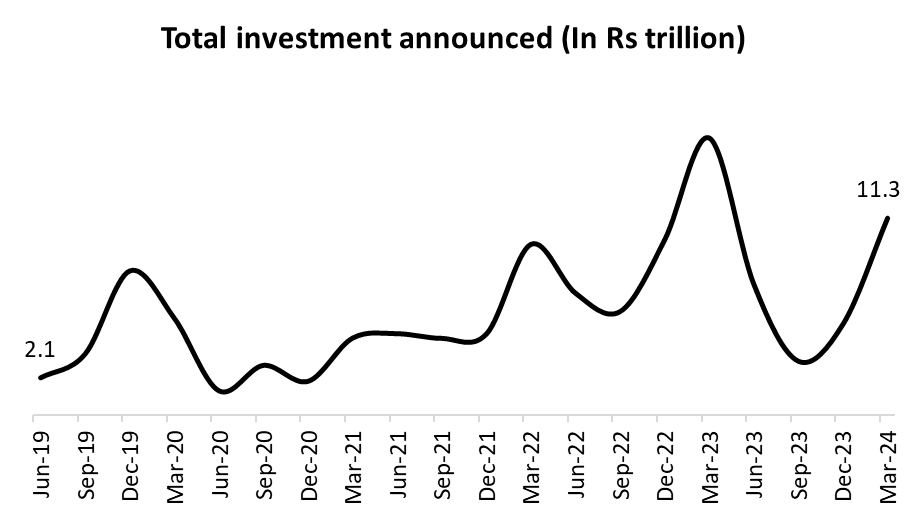

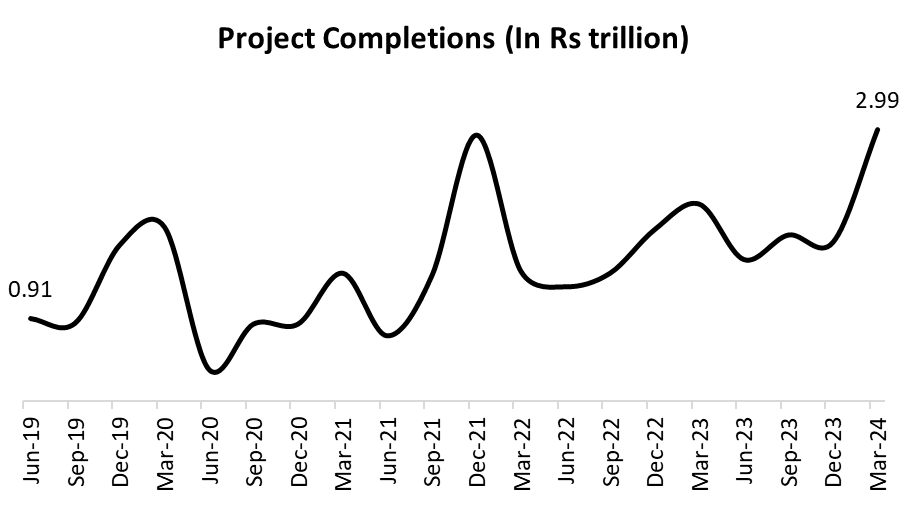

Project Completions Reach Their Zenith

Sharp rise in project completions, contributing to a record Rs.8.1 trillion worth of completions for fiscal 2023-24.

Source: CMIE, Fisdom Research

- Investments worth Rs.3 trillion were completed in March 2024, marking the highest-ever quarterly completion of projects. The momentum in project completions has been on the rise since the pandemic-induced slowdown, indicating a robust recovery and an uptick in economic activity.

- This surge signals a robust recovery from previous quarters, with project completions averaging at Rs.1.7 trillion. The acceleration in completions, typical of March, was further fueled by political activities preceding the Lok Sabha elections.

- This remarkable performance contributed significantly to fiscal 2023-24 ending with a record Rs.8.1 trillion worth of completions, indicating a notable surge in investment activity. However, challenges persist, with many projects experiencing time and cost overruns, highlighting the need for improved project management.