Key MPC Announcements

Though the RBI MPC retained its stance and held rates constant, this may not be indicative of any new trend.

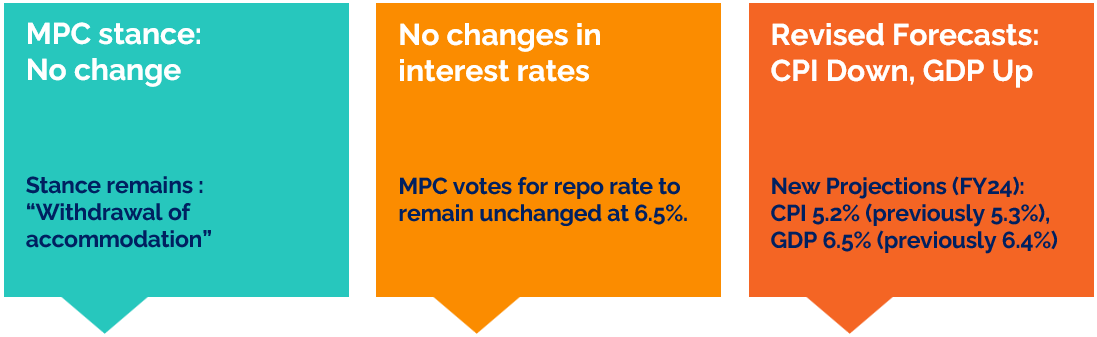

Highlights

Takeaways

- Stance and policy rates held constant

- Inflation expected to ease; GDP to grow faster vs. previous expectation

- Robust consumer demand; rural demand to grow at a fast clip

- Inflationary risk on account of food and energy prices

- Buoyant investment activity due to infrastructure spending, high-capacity utilization, and revival in corporate investment in key sectors

Views

- Fixed Income

- Three to Five Years looking attractive from a duration standpoint. Conservative allocation towards longer end

- Stick to Sov/AAA-rated papers. Minimal and cautious allocation to AA-rated instruments

- Accrual (Active + Passive) + Duration (Active) as strategy

- Equity

- Large-cap portfolio orientation; build midcap exposure selectively. Smallcap exposure if required by target portfolio.

- Sectoral Winners: Auto & Ancillaries, Banks, Capital Goods, Industrials, IT, FMCG

Continue allocation to gold in line with target asset allocation.

Why Pause the Hikes?

The RBI plans to assess the combined impact of previous increases in interest rates

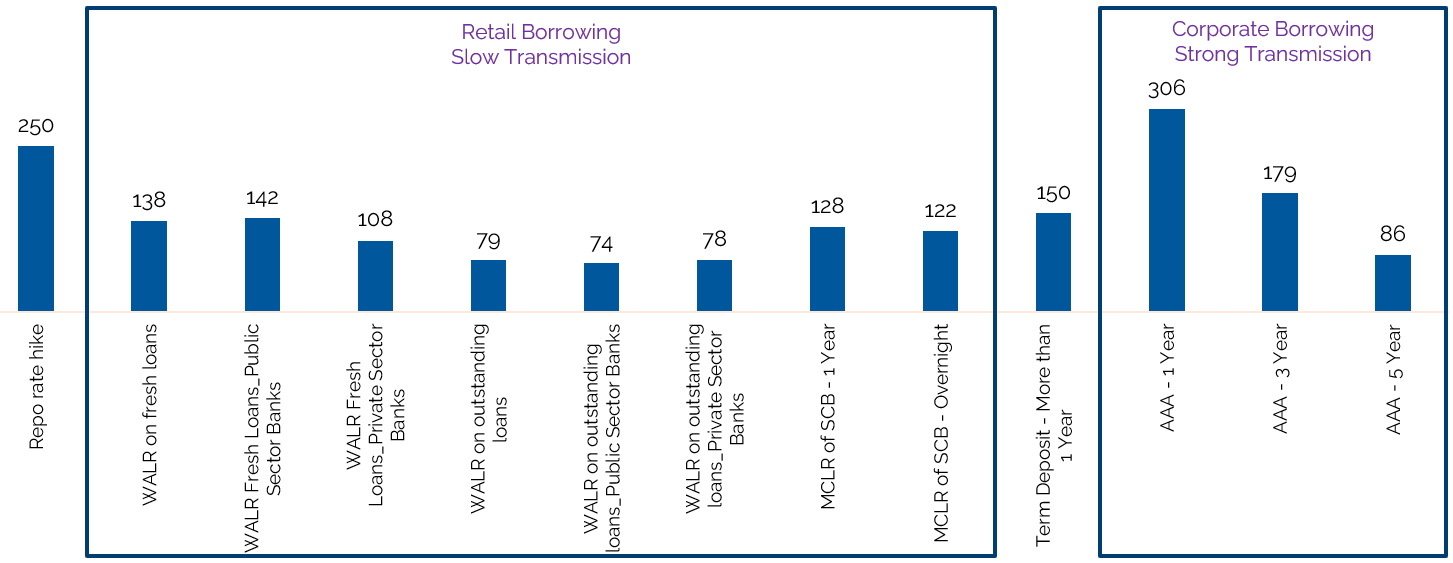

- The successful implementation of policy measures has not percolated effectively through the system. One example is the difference in interest rates between banks’ retail loans and repo rate hikes.

- The current situation featuring limited systemic liquidity and promising offtake in credit demand warrants faster and effective transmission of policy rate hikes into deposit rates. Effective transmission could pave way for a neutral stance and/or longer pause in the rate hike regime.

- There is a greater likelihood of the RBI holding rates through the next policy cycles as well. However, the possibility of another round of rate hikes in the range of 25-35 bps remains if the inflation print reflects persistent stickiness.

Why Retain Stance?

To achieve a gradual convergence of inflation towards the target while also promoting economic growth.

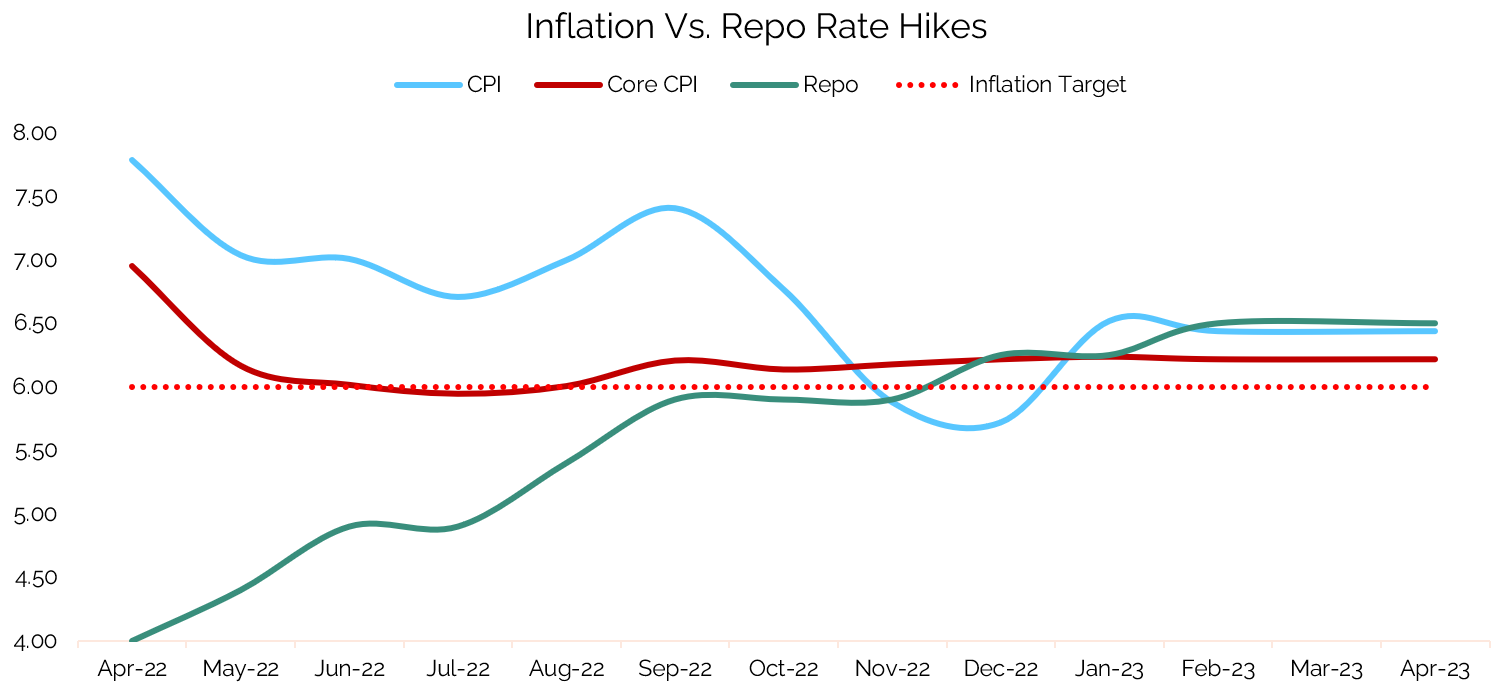

- Despite softening CPI, it remains above the central bank’s threshold of 6%. This remains the case even as core inflation remains sticky since over two quarters now. Additionally, the recent rise in crude oil prices following OPEC’s surprise production cut may aggravate inflation.

- As a result, the RBI has emphasized the need to be vigilant regarding the evolving situation and stressed that the fight against inflation must continue until a sustainable reduction in inflation towards the target is achieved.

- We do not anticipate a changes in the RBI’s stance unless there is significant reason to believe that inflationary pressure is easing sustainably.