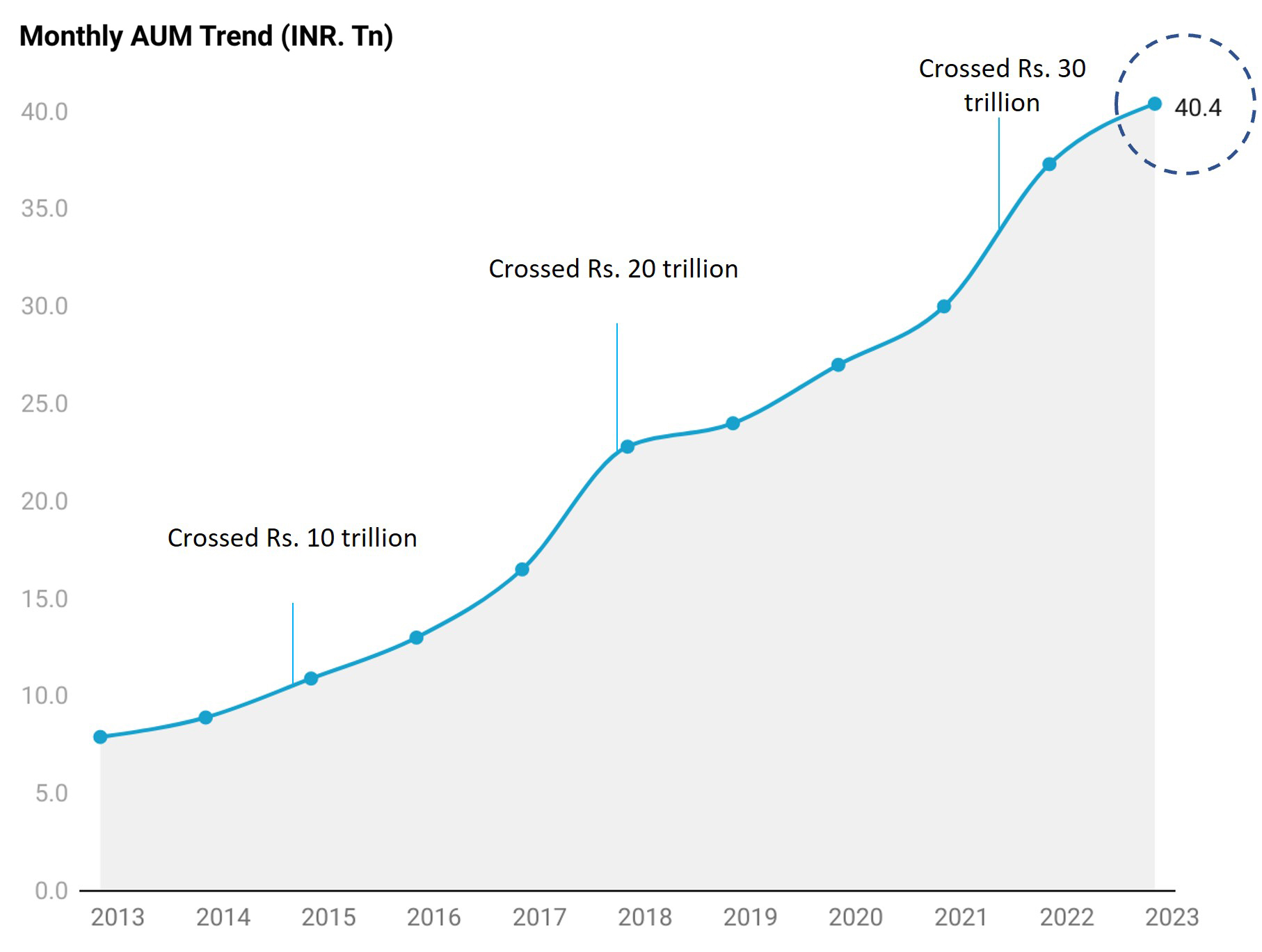

Mutual Fund Industry Asset Under Management

AUM crossed INR. 40 Tn mark in Nov’22

Latest Data poin as on November 2022.

Chart: Fisdom Research • Source AMFI •Created with Datawrapper

| Date | AUM (INR Tn) | Trillion Growth | Milestone | Years Taken |

| Nov-12 | ₹ 7.90 | |||

| Nov-13 | ₹ 8.90 | |||

| Nov-14 | ₹ 10.90 | ₹ 3.00 | Crossed Rs. 10 Trillion | 2 |

| Nov-15 | ₹ 13.00 | |||

| Nov-16 | ₹ 16.50 | |||

| Nov-17 | ₹ 22.80 | ₹ 11.90 | Crossed Rs. 20 Trillion | 3 |

| Nov-18 | ₹ 24.00 | |||

| Nov-19 | ₹ 27.00 | |||

| Nov-20 | ₹ 30.00 | ₹ 7.20 | Touched Rs. 30 Trillion | 3 |

| Nov-21 | ₹ 37.30 | |||

| Nov-22 | ₹ 40.40 | ₹ 10.40 | Crossed Rs. 40 Trillion | 2 |

The Mutual Fund industry’s AUM hit a lifetime high at INR 40.4 Tn in Nov’22. This amounts to a >5x growth in just a decade.

Such AUM growth is accompanied by robust growth in number of folios, the bifurcation of which, reflects increasing retail participation. Total number of folios stood at 13.98 Crore for the period ended Nov’22.

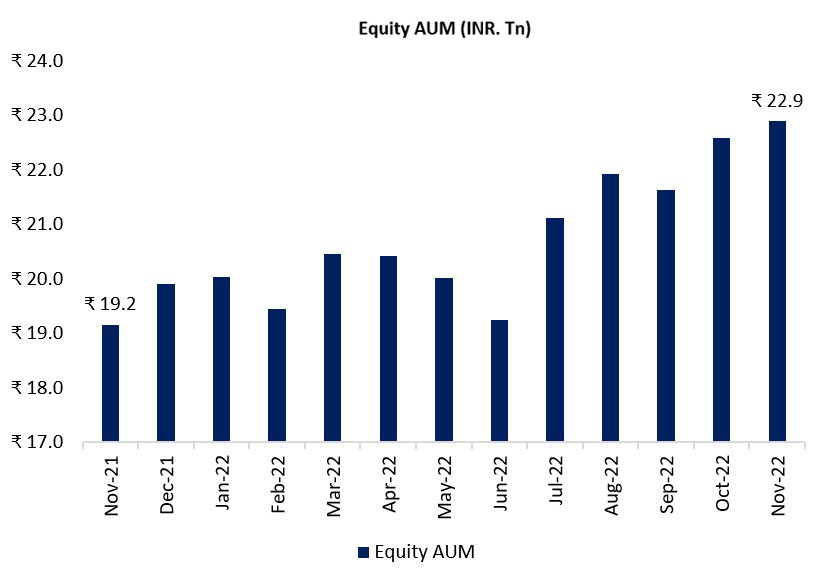

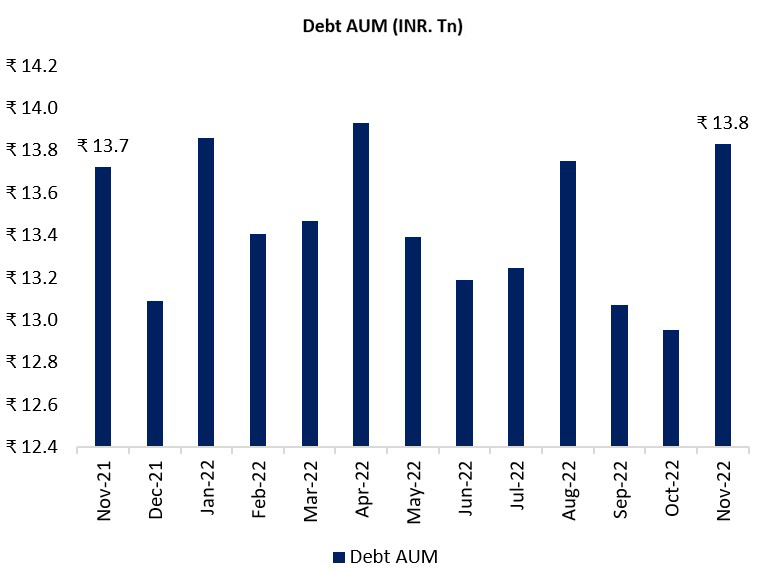

Equity & Debt Asset Under Management

Equity AUM uptick continues; Debt AUM surges

Source: ACE MF. Fisdom Research

Source: ACE MF. Fisdom Research

Equity MF AUM stood at INR 22.9 Trillion in Nov’2022 with a MoM increase of INR 0.3 trillion. Favourable market conditions, strong SIP book and FII inflows were key reasons for the uptick in equity AUM.

Debt AUM stood at INR 13.8 Trillion in Nov’2022. Indications of less aggressive rate hikes by global central banks and softening of yields across the board rekindled investor interest in the category.

Top 10 AMC Level AUM

SBI AMC remains at the top; Mirae Asset AMC sees highest month on month change within top 10 AMCs.

| AMC Name | M-o-M% | Total AUM Rank | Total AUM In Oct’22 (Cr.) | Total AUM In Nov’22 (Cr.) |

| Mirae Asset Investment Managers (India) Private Limited | 5.30% | 9 | ₹ 1,16,142 | ₹ 1,22,324 |

| HDFC Asset Management Company Limited | 3.70% | 3 | ₹ 4,40,933 | ₹ 4,57,186 |

| ICICI Prudential Asset Management Company Limited | 2.20% | 2 | ₹ 5,05,771 | ₹ 5,17,087 |

| Nippon Life India Asset Management Limited | 2.10% | 4 | ₹ 2,91,204 | ₹ 2,97,216 |

| Aditya Birla Sun Life AMC Limited | 1.60% | 6 | ₹ 2,77,144 | ₹ 2,81,594 |

| SBI Funds Management Limited | 1.50% | 1 | ₹ 7,12,173 | ₹ 7,22,788 |

| IDFC Asset Management Company Limited | 0.70% | 10 | ₹ 1,18,837 | ₹ 1,19,618 |

| UTI Asset Management Company Private Limited | 0.10% | 8 | ₹ 2,42,870 | ₹ 2,42,999 |

| Axis Asset Management Company Ltd. | -0.40% | 7 | ₹ 2,51,159 | ₹ 2,50,237 |

| Kotak Mahindra Asset Management Company Limited | -0.70% | 5 | ₹ 2,88,269 | ₹ 2,86,183 |

Source: ACE MF. Fisdom Research