MF Industry At a Glance

Highlights

| Nov-23 | Nov-22 | Change | |

| Industry AUM (in Crores) | ₹ 49,04,992 | ₹ 40,37,561 | 21.48% |

| Equity Oriented AUM (in Crores) | ₹ 20,33,407 | ₹ 15,22,338 | 33.57% |

| Fixed Income Oriented AUM (in Crores) | ₹ 13,57,809 | ₹ 12,56,914 | 8.03% |

| MF Industry AUM Growth in last 5 years (% Growth) | 15.33% | 12.11% | ▲ |

| Nifty 50 Levels | ₹ 19,080 | ₹ 17,787 | 7.27% |

| 10 year G-sec Levels | 7.279 | 7.28 | -0.01% |

| SIP Flows (In Crores) | ₹ 17,073 | ₹ 13,306 | 28.31% |

| No. of Folios | 16,18,14,583 | 13,97,55,150 | 15.78% |

Source: AMFI, Fisdom Research.

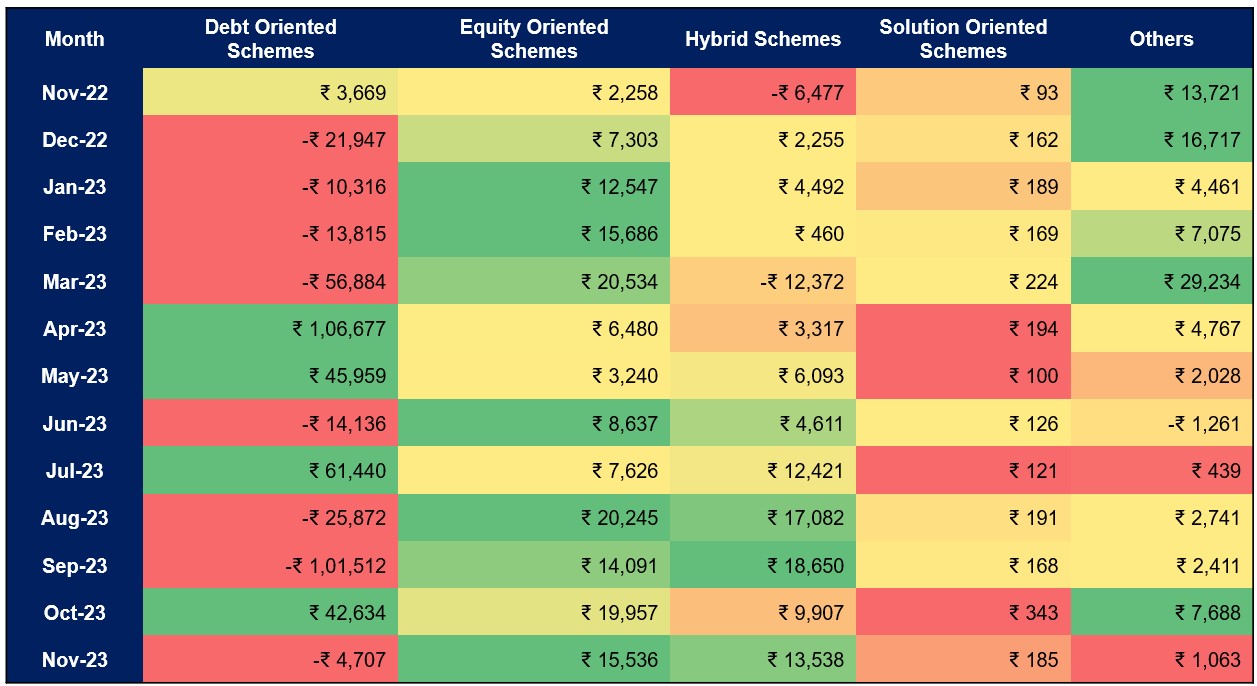

Industry Net Flows

Debt category witnesses outflows, Equity inflows continue

Values in Rs Crore

Trends:

- Debt funds experienced a net outflow of Rs. 4,707 crore, marking the eighth instance of negative flows in the past 12 months.

- Equity funds mark 33rd consecutive month of new inflows.

- Within hybrid category Arbitrage funds and multi-asset funds have been driving robust net inflows, contributing to the sustained positive trend in hybrid funds.

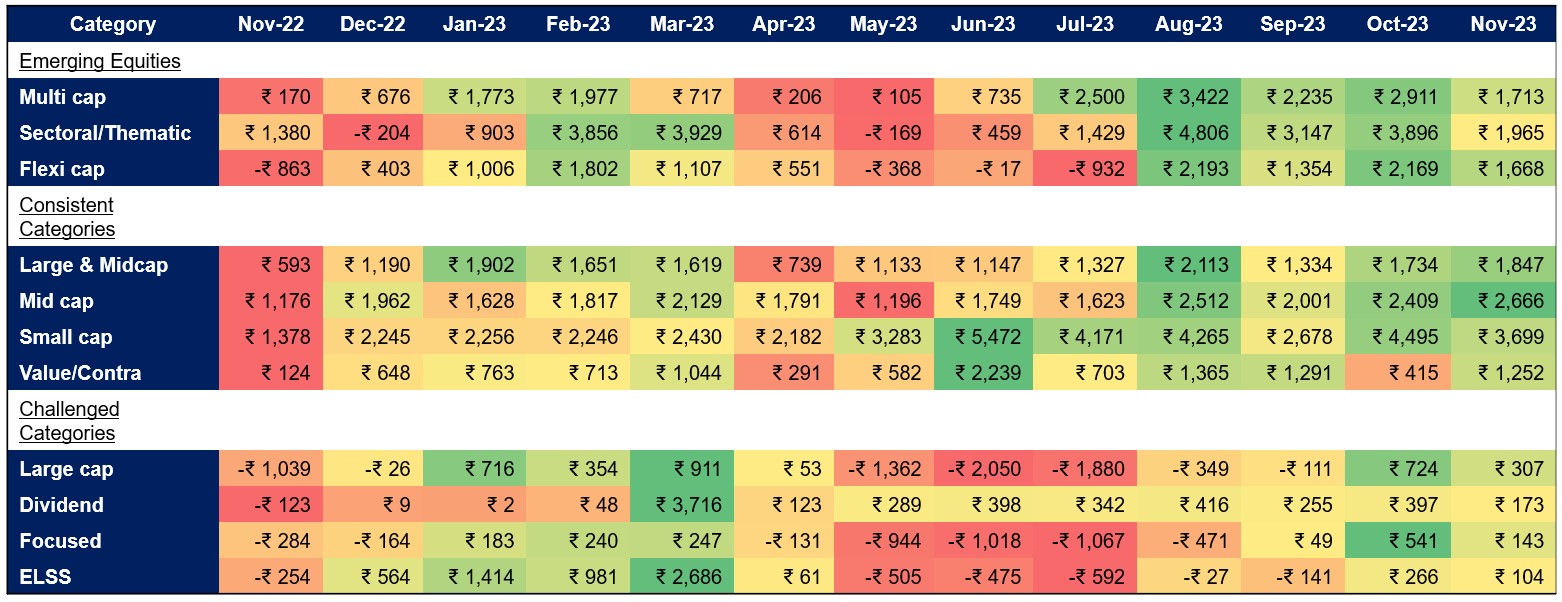

Equity Category: Net Flows

Inflows remain robust as markets perform; All categories witness inflows

Values in Rs Crore

Trends:

- In November 2023, equity funds across all categories experienced positive inflows, marking the 33rd consecutive month of such inflows. Although there has been a consistent trend low to negative inflows in large cap funds, focused funds, and ELSS over the last few months.

- The norm of small-cap funds dominating inflows continued in November. The majority of the inflows in thematic funds came from NFOs. The focus of significant categories receiving inflows, such as small-cap funds, flexi-cap funds, and mid-cap funds, indicates that investors are still hunting for alpha.

- The equity market saw its best performance of CY23 in November, with Nifty 50 gaining 5.5%, as S&P BSE 250 Small-cap and S&P BSE 150 Midcap indices witnessed gains of 9.4% and 9.6%, respectively. Equity as an asset class are still preferred by investors amid positivity around elections, FII inflows and strong economic fundamentals.

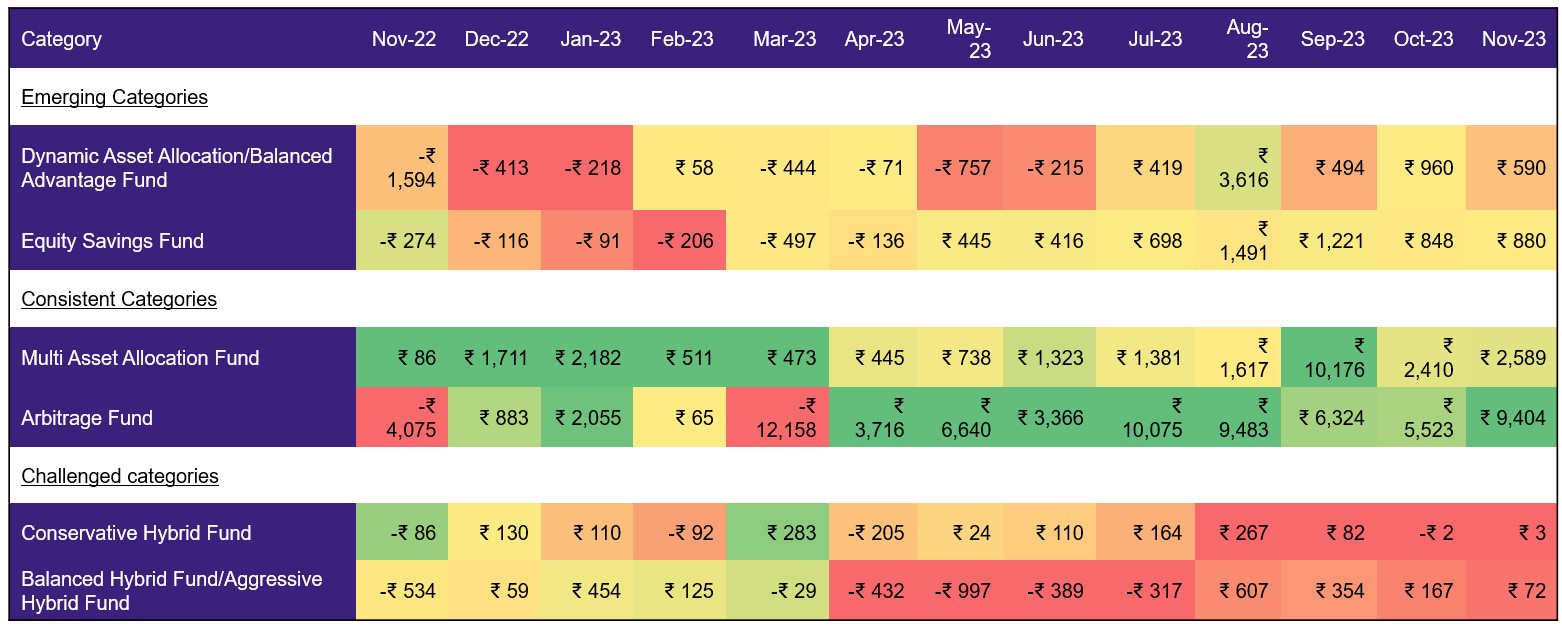

Hybrid Category: Net Flows

Arbitrage and Multi asset allocation leading the way

Values in Rs Crore

Higher redemptions indicate Red

Trends:

- In November 2023, the hybrid category witnessed significant net inflows of Rs. 13,538 crore, indicating an emerging trend in the industry. However, broader picture suggests that two fund categories dominated the total flows, accounting for 85% of the net flows in this category.

- The hybrid category’s inflow story was mainly driven by arbitrage funds, which witnessed net inflows of Rs. 9,404 crores, and multi-asset allocation funds, which saw net inflows of Rs. 2,589 crore. Additionally, equity savings funds, balanced advantage funds (BAFs), and aggressive hybrids also saw net inflows. The increasing popularity of arbitrage funds is reducing the share of the liquid fund space.