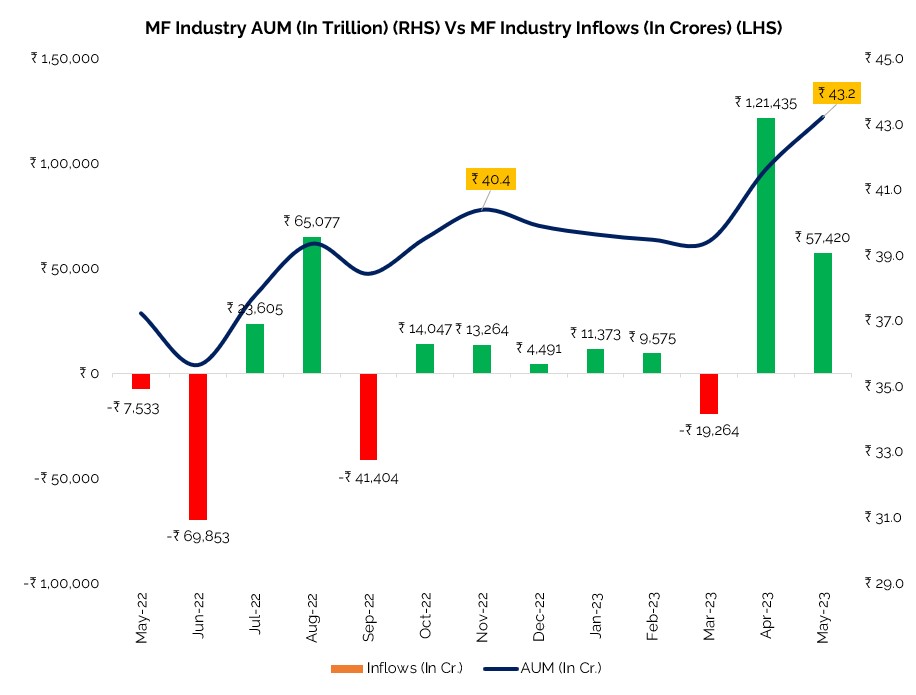

The mutual fund industry AUM overview

MF AUM hits a record high of over Rs. 43 trillion for the first time

Source: ACE MF,AMFI, Fisdom Research

- The mutual fund industry has achieved yet another significant milestone, surpassing the Rs. 43 trillion assets under management (AUM) mark for the very first time. This noteworthy accomplishment reflects a year-on-year growth of 16.1 percent, accompanied by a quarterly increase of 3.8 percent.

- The impressive expansion of AUM can be attributed to two key factors. Firstly, a remarkable rally in the equity markets has played a pivotal role in driving this growth. The buoyant performance of stocks has garnered to the overall expansion of AUM.

- Secondly, the inflow into the debt category has also played a substantial part in bolstering the industry’s growth. This steady influx of capital into debt instruments has added to the overall expansion of AUM.

- However, it is worth noting that the flow of funds into the equity category has shown signs of moderation. While the overall growth in AUM remains robust, the pace of inflows into equity funds has tapered off, suggesting a possible shift in investor preferences and market dynamics.

- Looking forward, the industry’s growth trajectory is expected to be driven by the movement in the broader market indices. Currently, we are cautiously optimistic about the industry’s AUM growth.

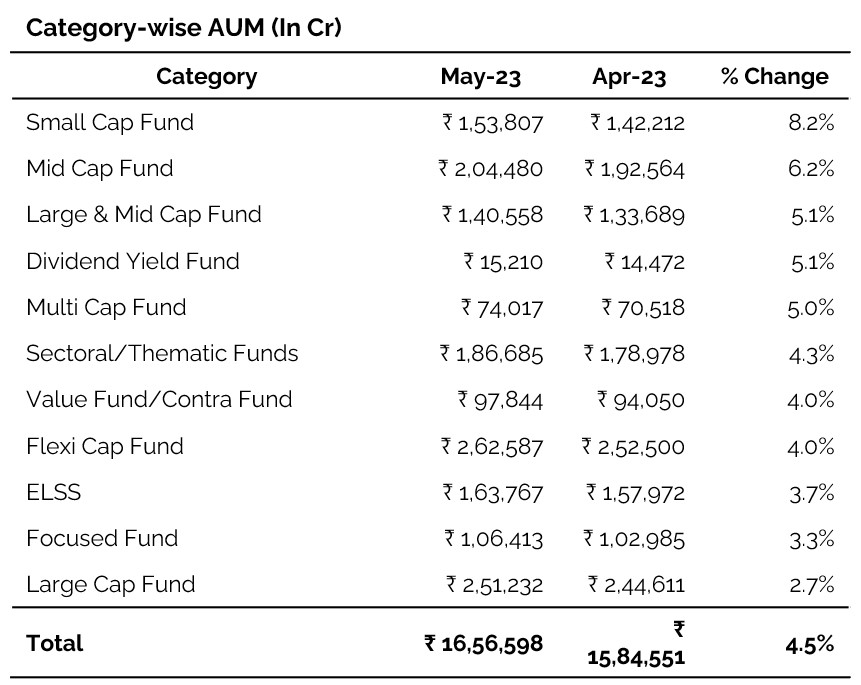

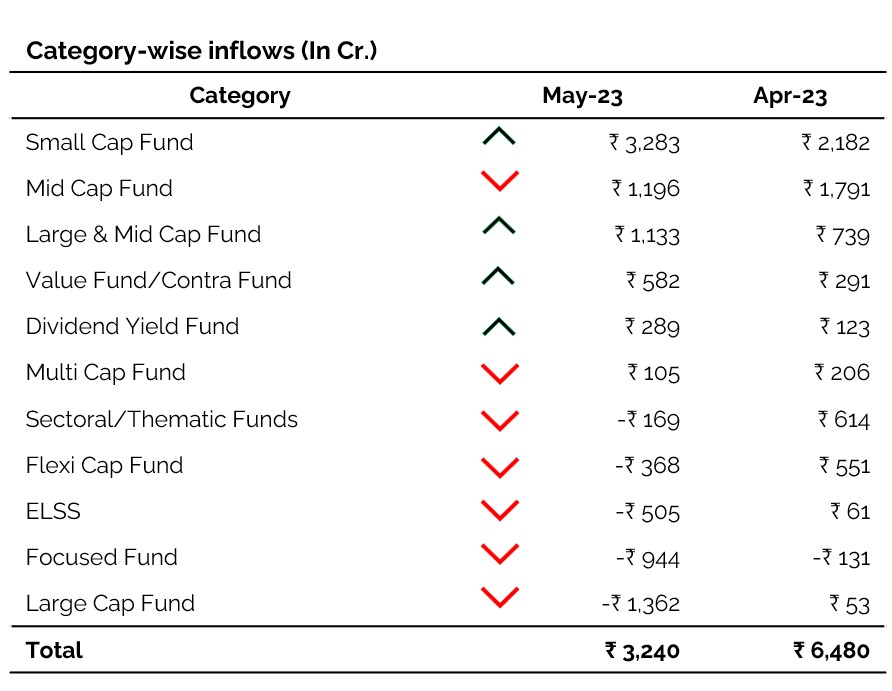

AUM overview: Core Equity Categories

Equity funds see AUM growth in May 2023, Inflows moderate

Source: ACE MF, Fisdom Research

- Equity assets under management (AUM) experienced a growth of 4.5% on a month-on-month basis from April 2023. In May 2023, equity inflows showed a further moderation. This suggests that the rise in AUM was not primarily driven by new investor contributions but rather by overall market performance. Sectoral/thematic, Flexi Cap, ELSS Focused, and Large Cap categories witnessed outflows. Investors continued their optimism around small cap, mid cap, large & midcap, and value/contra funds, leading to a shift in investment preferences.

- The growth in equity AUM during May 2023 can be attributed to the performance of broader market indices. Notably, the Nifty Midcap 150 and Nifty Small Cap 250 indices saw significant increases of 5.7% and 5.6%, respectively, compared to the Nifty 50 and Nifty 100 indices, which rose by 2.6% and 3%. Further decline in equity inflows can be attributed to profit booking by investors as equity markets approaches new highs.

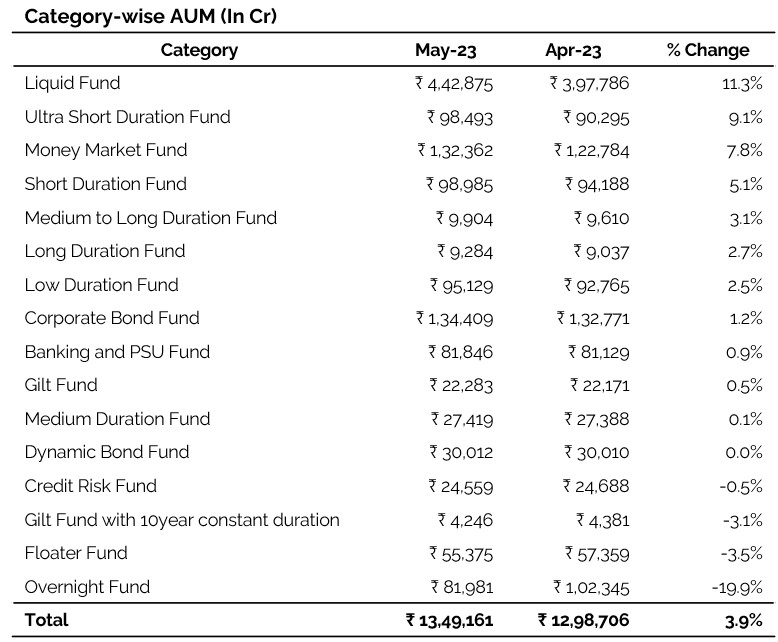

AUM overview: Core Debt Categories

Debt AUM increases; Inflows remain robust in May 2023

Source: ACE MF, Fisdom Research

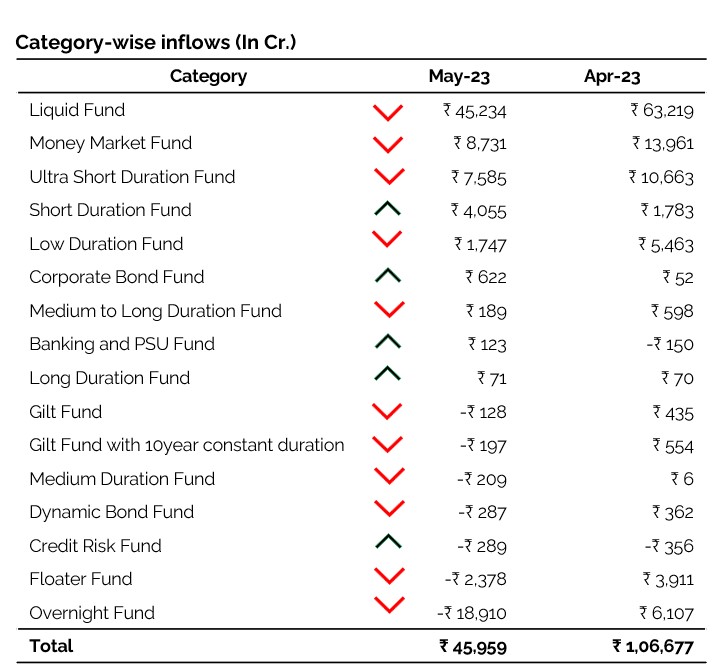

Debt assets under management (AUM) experienced a growth of 3.9% on a month-on-month basis from April 2023. The increase in debt AUM during May 2023 can be largely attributed to significant inflows into debt funds. Allocation of institutional funds in short term categories continued in May 2023 as well.

Similar to April 2023, the focus in May was primarily on the short end of the yield curve with heavy inflows in liquid, money market and ultra short duration funds. Amid expectations around interest rates peaking out within India and globally longer duration and medium to long duration category saw modest inflows where as both gilt categories saw outflows as focus is seen shifting towards corporate credit papers.