The mutual fund industry AUM overview

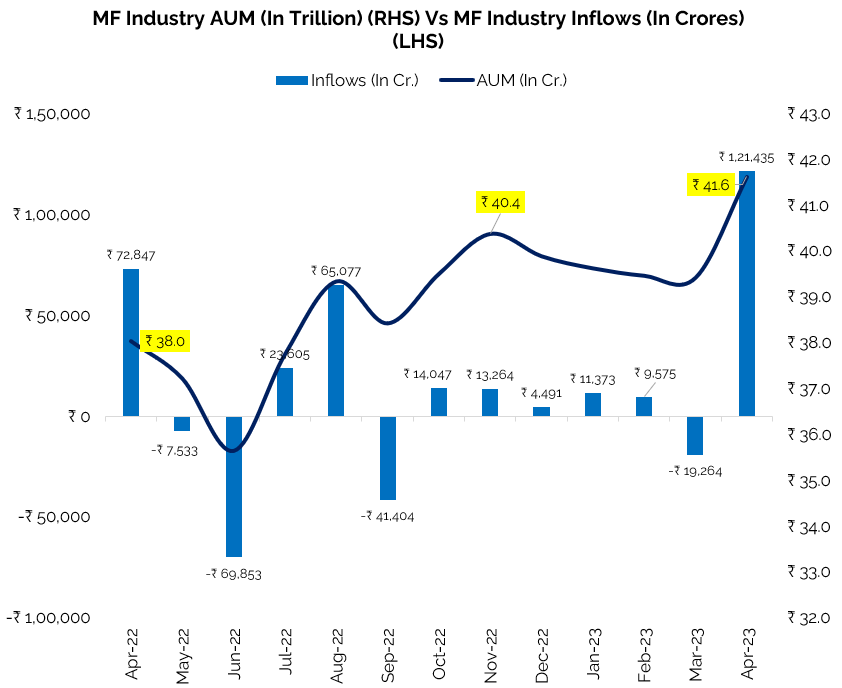

It hits a record high of over Rs. 41 trillion for the first time since November 2022

Source: ACE MF,AMFI Fisdom Research

- The Indian mutual fund industry has continued to demonstrate impressive growth by surpassing the milestone of Rs. 41 trillion in Net Assets Under Management (AUM) in April 2023. This growth is evident in a remarkable month-on-month increase of 5.6% and a year-on-year increase of 9.4%. These figures signify the industry’s robustness, primarily driven by two key factors.

- Firstly, the mutual fund industry experienced its highest inflows in the past 12 months, indicating strong investor confidence and interest in mutual funds. This trend is a positive sign for the industry and reflects the growing awareness of mutual fund investments among Indian investors.

- Secondly, after four months of declining benchmark indices, the equity markets displayed an impressive performance, leading investors to flock towards equity-linked mutual funds. Despite the overall positive trend across broader categories, debt categories drove the overall inflows.

- Moreover, specific categories such as multi-asset, small-cap, mid-cap, and value/contra have shown positive trends in equity and hybrid categories.

- Looking forward, the industry’s growth trajectory is expected to be driven by the movement in the broader market indices and the Monetary Policy Committee (MPC) meeting scheduled in June. Currently, we are cautiously optimistic about the industry’s AUM growth.

AUM overview: Core Equity Categories

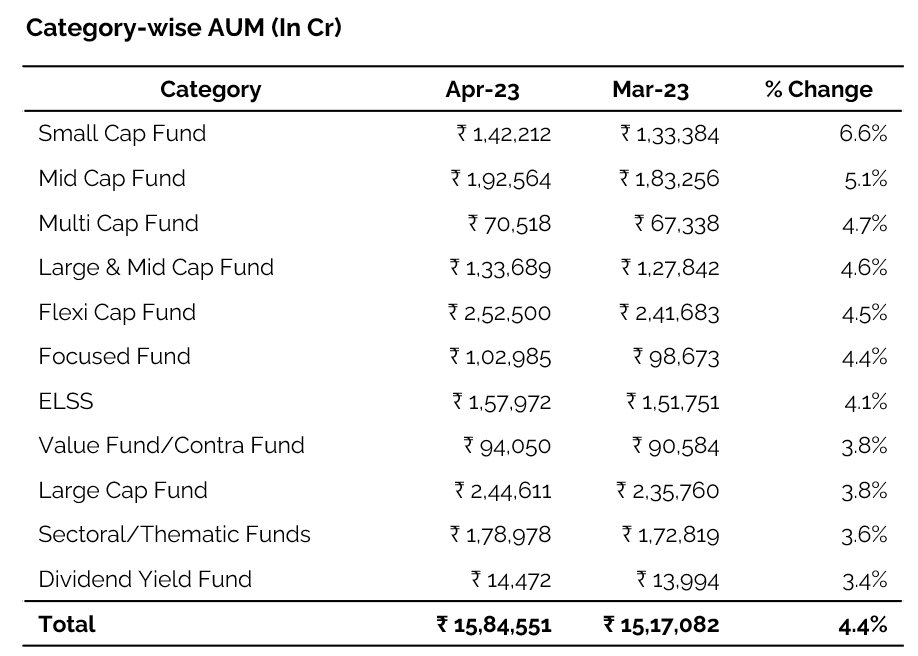

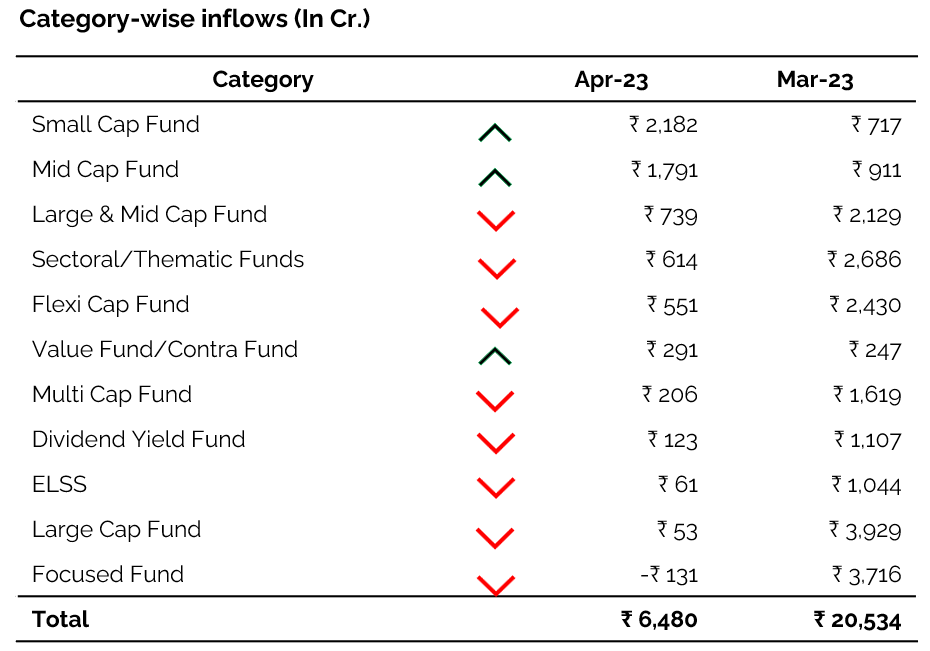

Equity funds see AUM growth in April 2023, but investors remain hesitant

Source: ACE MF, Fisdom Research

Source: ACE MF, Fisdom Research

- In April 2023, India’s equity mutual fund industry witnessed a 4.4% growth in assets under management (AUM) due to market performance, with key indices like Nifty 50, Nifty 100, Nifty Midcap 150, and Nifty Small Cap 250 trending upwards. However, inflows in equity categories were minimal, amounting to only Rs. 6480 crores, a significant decrease from March 2023. The drop in inflows indicates investor dissatisfaction with returns.

- Retail investors took a cautious approach amid the rebound in the stock market, preferring to adopt a wait-and-see strategy. While all equity categories received inflows except for Focused funds, only smallcap, midcap and value/contra categories saw an increase in flow. We expect this trend to continue unless there is a sustainable trend in the equity markets that investors see.

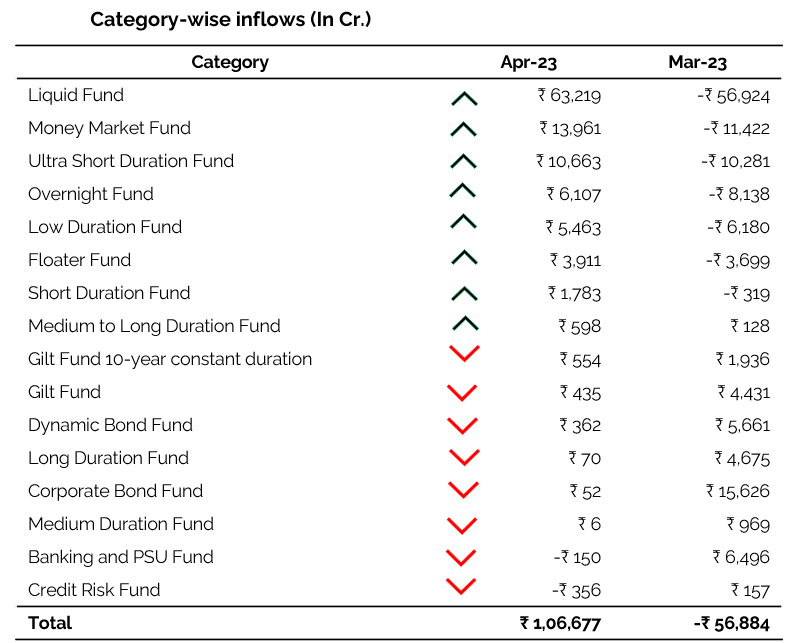

AUM overview: Core Debt Categories

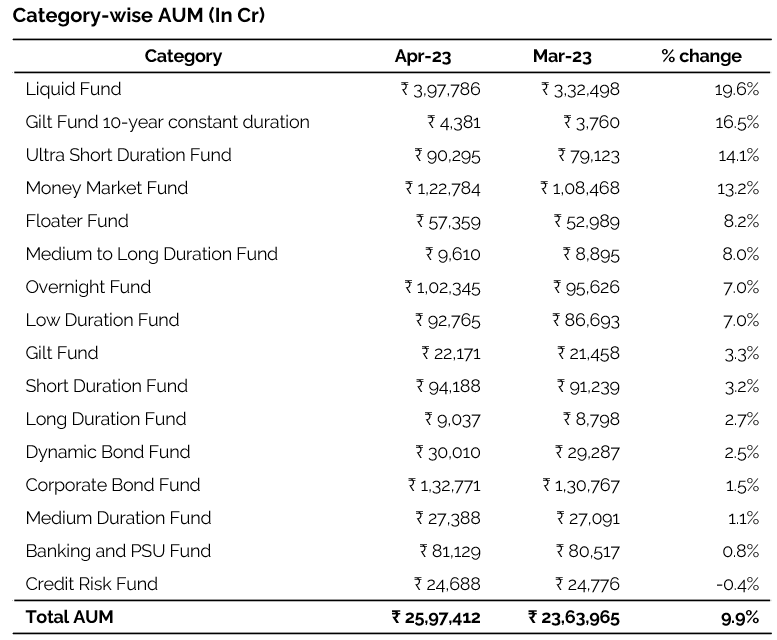

RBI’s decision to maintain policy rates boosts inflows and AUM in Debt Funds

Source: ACE MF, Fisdom Research

Source: ACE MF, Fisdom Research

- In March 2023, investors preferred long-duration debt categories, resulting in a considerable outflow from short-term debt categories due to eliminating existing tax rules starting from FY24. However, in April 2023, the trend reversed, with negligible inflows in long-duration categories compared to significant inflows in short-term categories, primarily due to corporations allocating surplus funds at the beginning of the new financial year. Institutional money has not been diverted to traditional instruments other than debt mutual funds.

- It will be interesting to see if this trend continues in the coming months, with liquid and money market categories expected to drive the flows.

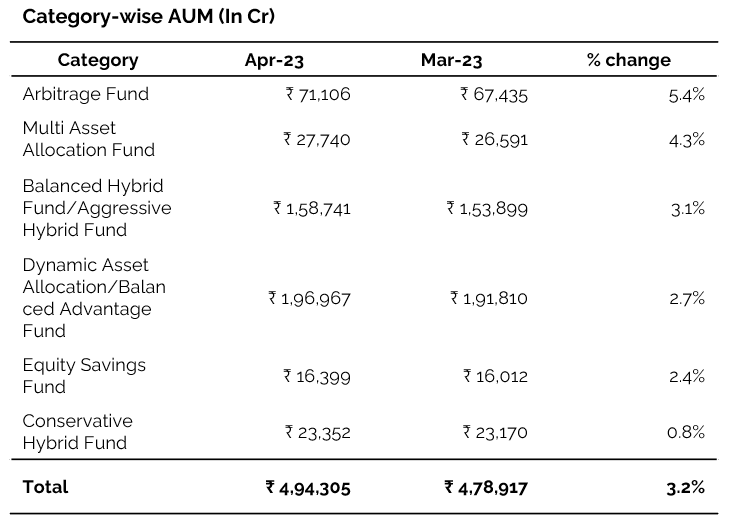

AUM overview: Hybrid Categories

The rise of equity-heavy hybrid subcategories driven by tax changes and gold performance in April 2023″

Source: ACE MF, Fisdom Research