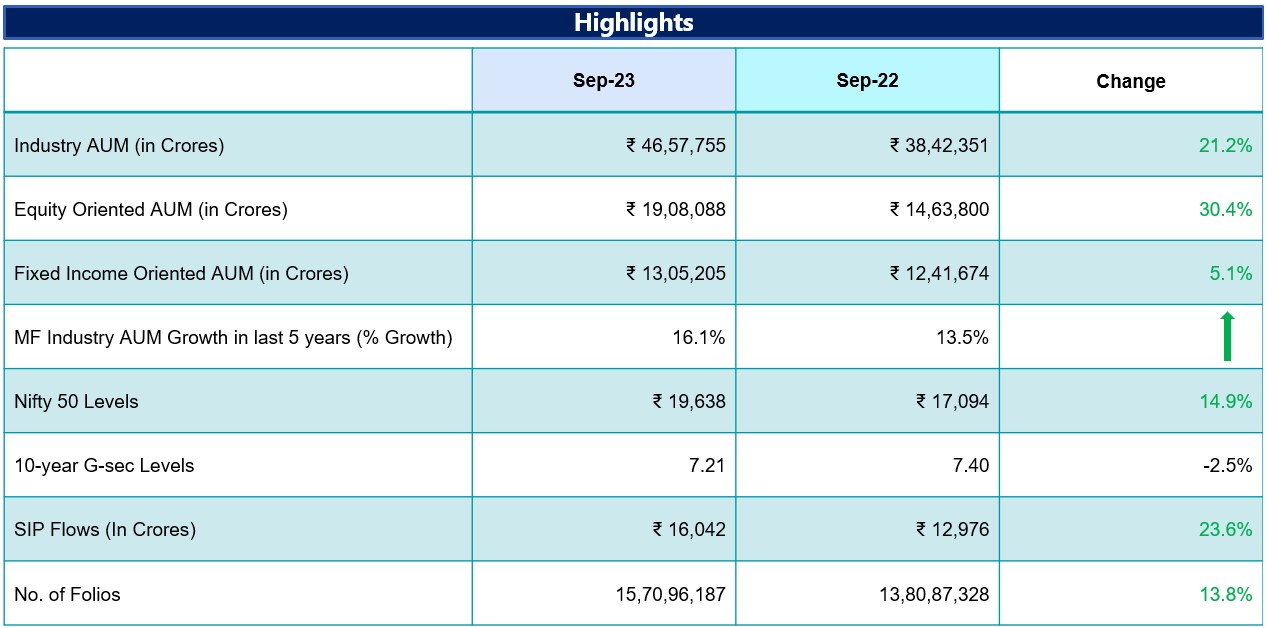

MF Industry At a Glance

Source: AMFI, Fisdom Research.

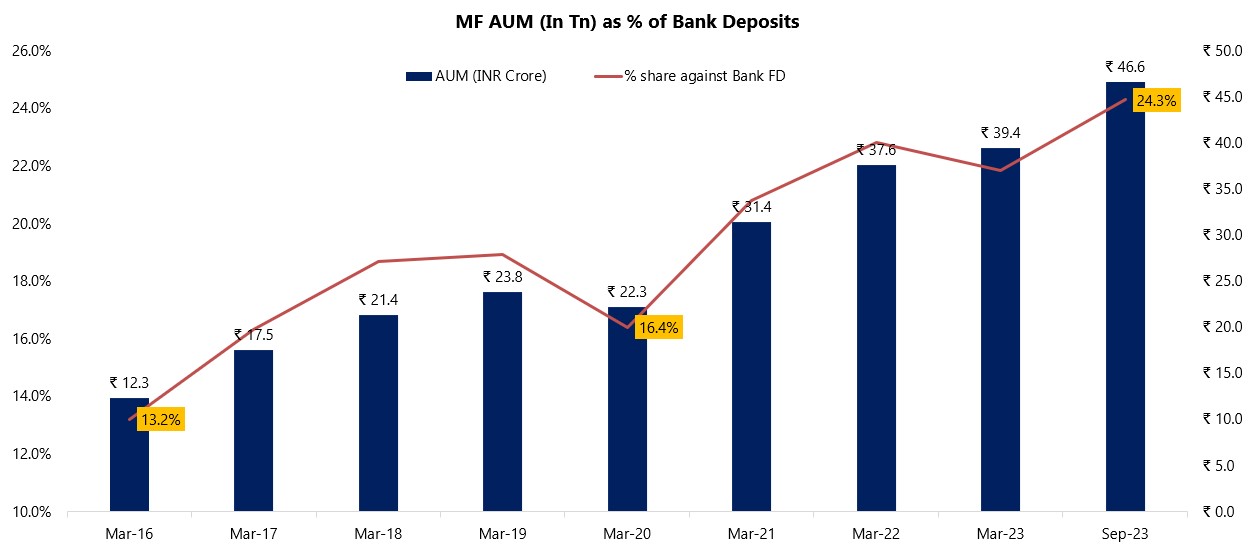

Mutual Fund Industry AUM To Bank Deposits

MF AUM is now almost 1/4th of Bank deposits and % share against FD has doubled in the past 7 years

Source: RBI, AMFI, Fisdom Research. Bank FD data available till July 2023

Highlight:

- Certainly, there has been a notable shift in investor preference towards mutual funds. After the pandemic, there was a significant transformation in the financial landscape. Central banks worldwide maintained historically low interest rates, leading to a substantial surge in the growth of Assets Under Management (AUM) for mutual funds over the subsequent three years.

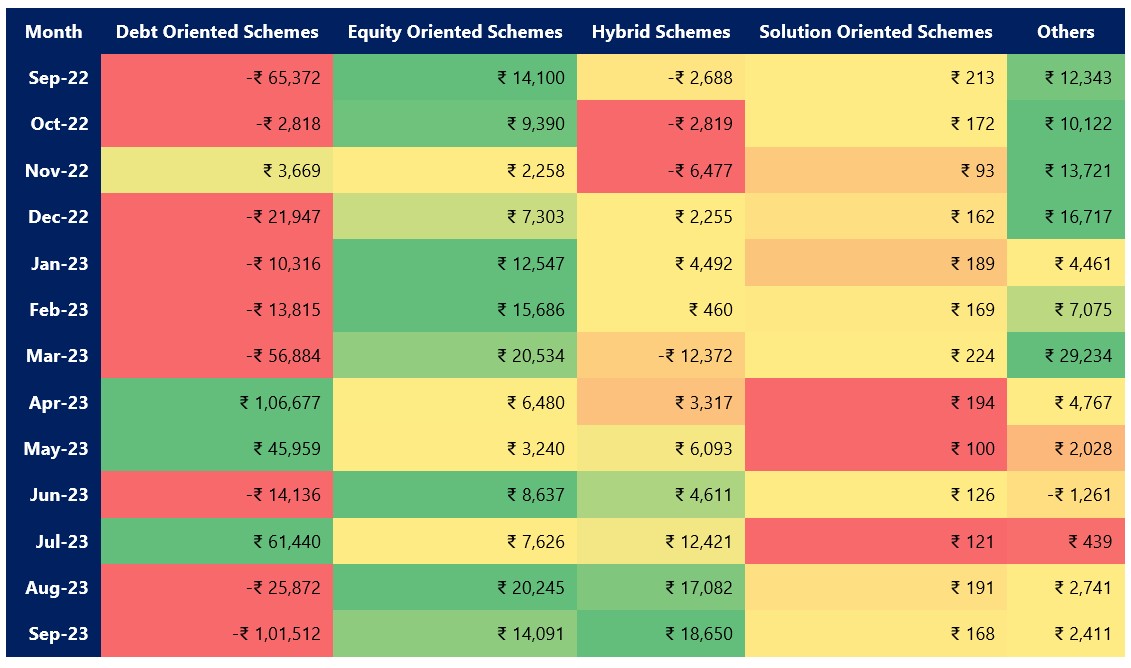

Industry Net Flows

Inflows surge for hybrid, debt categories witness decline

Values in Rs Crore

Trends:

- The hybrid category continued its new found popularity in September 2023 as well with highest net inflows. Equity category net inflows moderated majorly on account of profit taking as redemptions also surge across categories. Debt categories witness massive outflow on account of advance tax payments for corporates in September 2023.

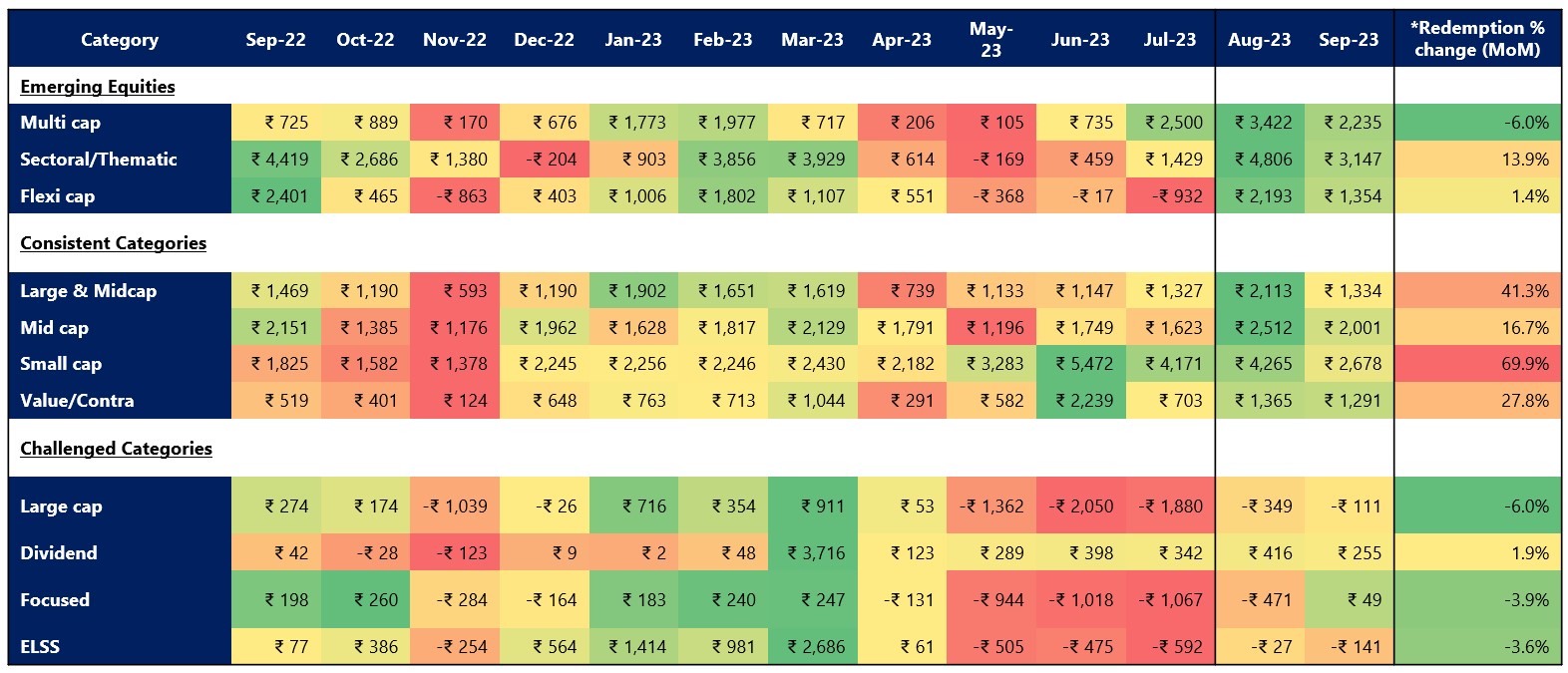

Equity Category: Net Flows

Inflows moderated: Redemption surged on m-o-m basis

Values in Rs Crore

Trends:

- Sectoral thematic category witnessed highest inflows in September 2023. 4 new funds were launched in the sectoral/thematic category garnering Rs. 1,629 crore.

- Actual redemption figures from equity categories went up across the board.

- A moderation in inflows and increase in redemptions month over month indicates profit booking by investors with uncertainties around heightened valuations in Consistent Categories.

Higher redemptions indicate Red

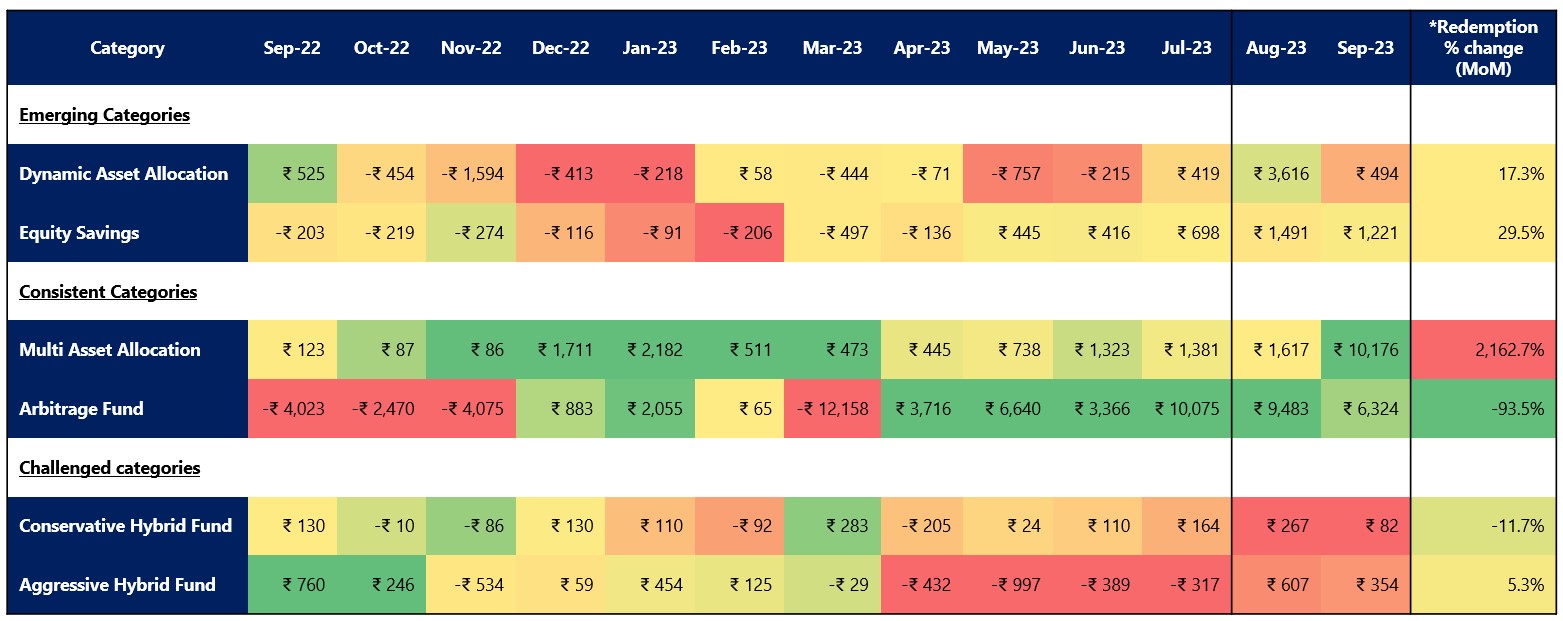

Hybrid Category: Net Flows

Hybrid category gets NFO boost

Trends:

- Hybrid category received higher net inflows vis-a-vis equity oriented categories. Net inflows were concentrated on Multi-asset allocation category which also saw 3 NFOs mobilizing ~Rs. 4,800 crore. Aggressive hybrid and Arbitrage got 1 NFO each.

- Except multi asset allocation category, rest all other categories witnessed decline in net inflows across the board.

- The trend of outflows and higher redemptions similar to that of equity category was witnessed here as well reflecting risk-off sentiments by investors

Higher redemptions indicate Red