Mutual Fund Highlights

| Key Highlights |

| Mutual Fund AUM at 46.6 Tn. Surges by 18.5% YoY Equity mutual funds have been pivotal in boosting AUM growth, with a notable surge in net inflows, reaching a five-month high of Rs. 20,245 crore. Additionally, the Nifty index has gained nearly 10% in the past year. Record-Breaking SIP Inflows: Rs. 15,814 Crore SIP inflows and AUM experienced a 25% and 24% year-on-year growth, respectively, with the number of newly registered SIPs also showing a 9% increase. Equity Inflows Rise, Debt Sees Outflows Net inflows into the equity category have surged by an impressive 230% YoY, with the Smallcap and midcap Smallcap categories experiencing significant inflow growth in FY24. |

| Trends |

| New Fund Offers Sees Highest Inflows In 5 Months A total of Rs. 7,531 crore was raised via new fund offerings, with UTI Balanced Advantage alone attracting inflows of Rs. 2,247 crore. Strong Sectoral/thematic Buying Significant buying activity has been noted in the construction, industrial, IT, healthcare services, and metals sectors, primarily year-on-year. Growing Retail Share in Total AUM; FII & Institutional share declined. The retail share in total AUM rose by around 7% YoY, while FIIs and institutional participation declined by 4% and 9%, respectively. |

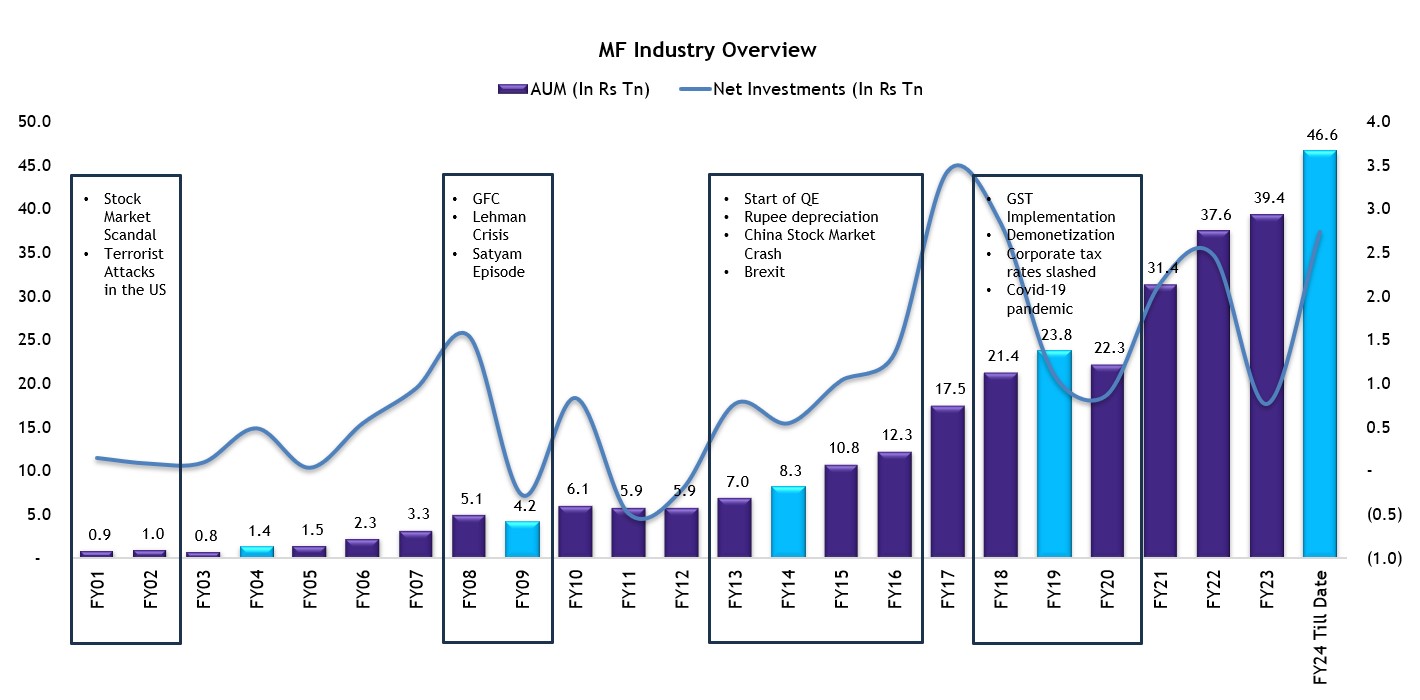

Mutual Fund Industry: AUM Journey

Despite past market challenges, mutual fund AUM has grown by a substantial 20% since FY01.

Source: CMIE, Fisdom Research

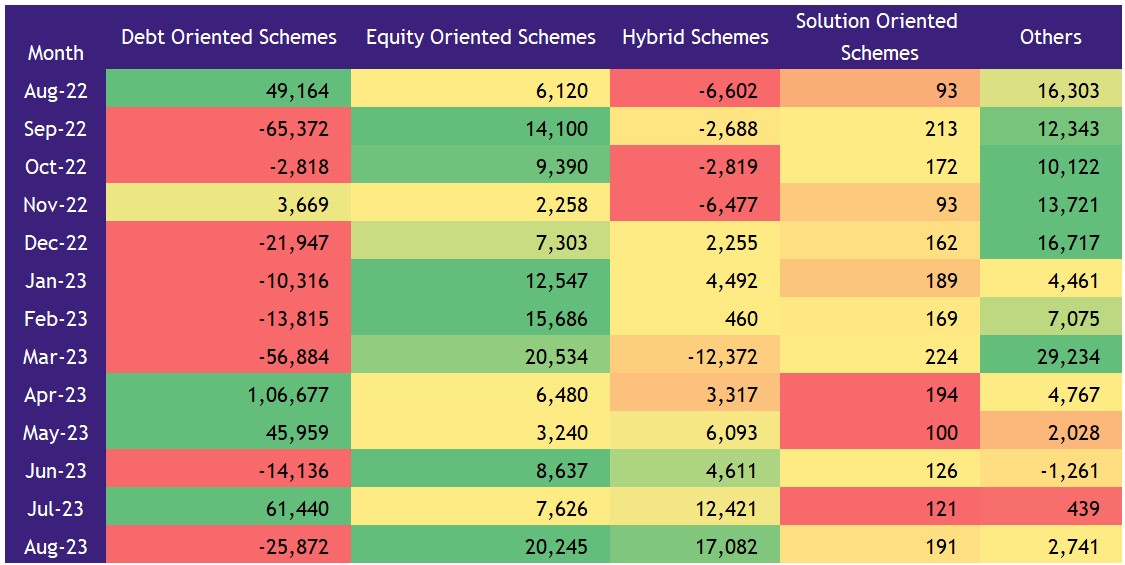

Industry Net Flows

Inflows surge for equities, debt categories decline following latest budget tax changes

Values in Rs Crore

Trends:

The hybrid category gaining newfound popularity post-April 2023. Changes in debt fund taxation possibly influence overall category flows.The tax efficiency of arbitrage funds and recent strong performance could drive redemptions from short duration debt funds.

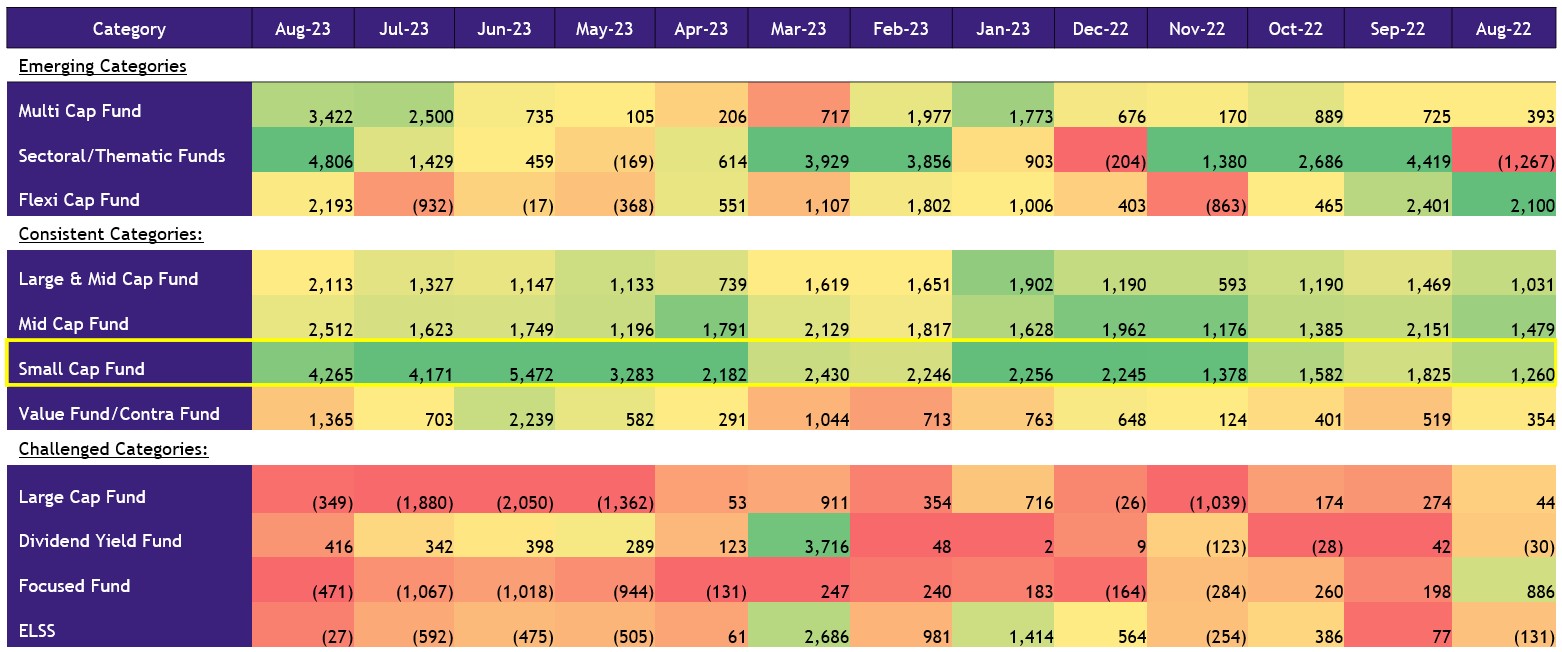

Equity Category: Net Flows

Transformative surge: net flows soar from 28% to 82% of total redemptions

Values in Rs Crore

Trends:

- SIPs and new fund offerings are experiencing a rise in fund mobilization, contributing to the overall net flows.

- There’s a concentration of inflows in prominent categories like Smallcap, Midcap, Large & Midcap, and Multicap.

- A significant shift in the net flows is evident, with net flows as a percentage of total redemptions increasing from 28% in August 2022 to 82% in August 2023.

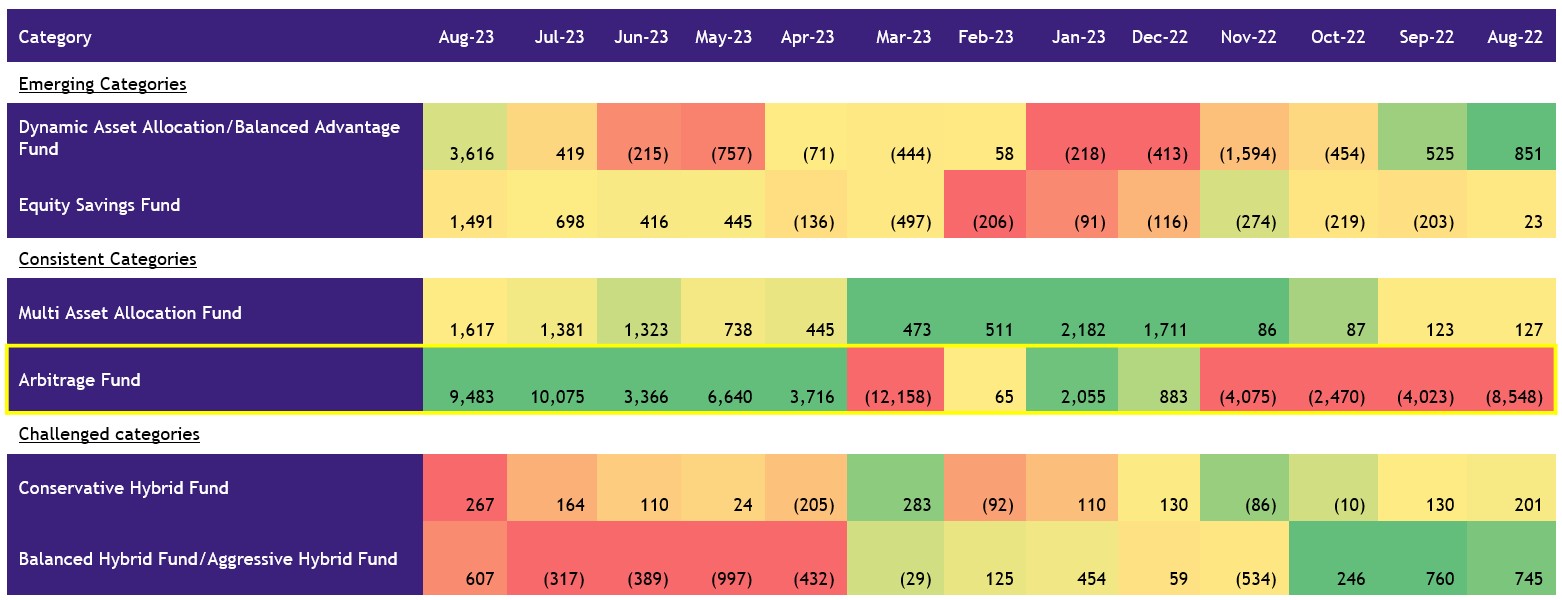

Hybrid Category: Net Flows

Arbitrage funds have seen a remarkable uptick

Values in Rs Crore

Trends:

- Arbitrage funds have seen a remarkable uptick in interest from debt investors following tax changes in April 2023. This shift marks a departure from previous trends, with sustained flows into the category. The recent tax-adjusted solid performance of these funds has further fueled their appeal among investors.

- While we’ve placed multi-asset funds under a unified category, this categorization is partly due to the introduction of new fund offerings within this segment.

- As the market pushes towards new heights and valuation concerns begin to surface, the balanced advantage category is once again gaining momentum, though in Augsut NFO helped garnered flows

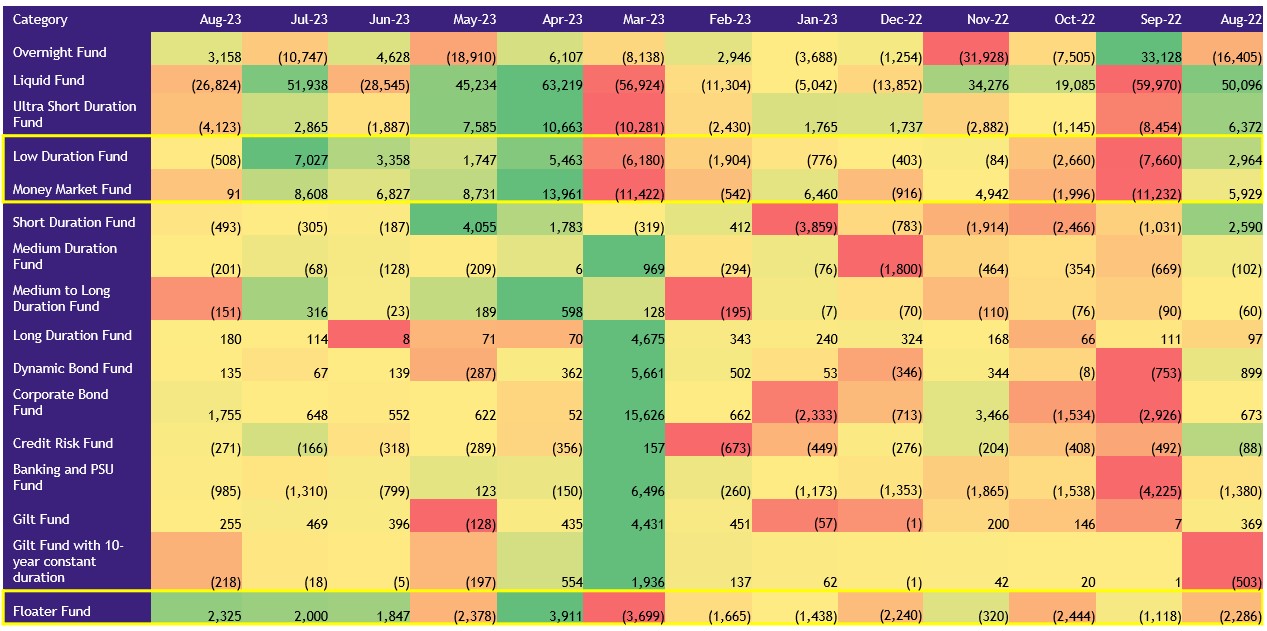

Debt Category: Net Flows

With the exception of short-duration, floater funds, and money market categories, the remaining categories did not exhibit consistent flows

Values in Rs Crore