Fundamental Tracker

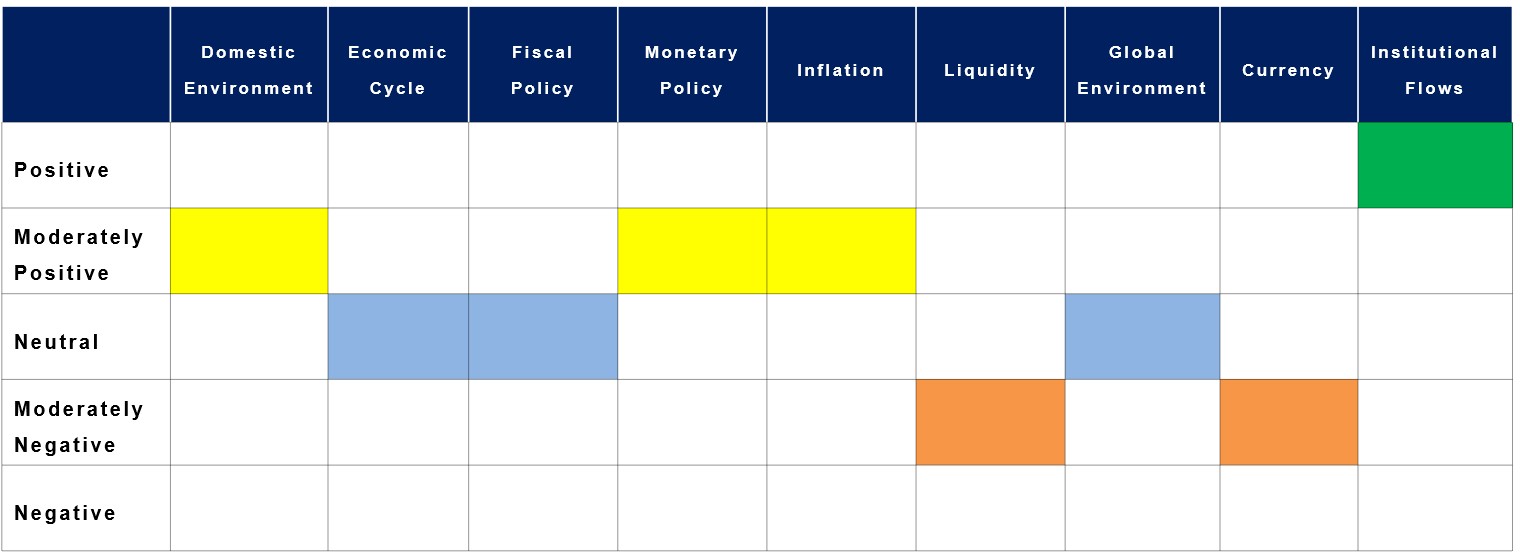

Key Themes to Navigate in the Economic Landscape

Key Themes/ideas

- Capex

- 5G Roll Out

- Make in India

- Cyclicals Over Defensives

- Growth Over Value

- Duration Over Accrual

Asset Class & Marketcap Views

Key Highlights

Key Themes/ideas

- Global Slowdown

- Rise in Inflation

- Geopolitical Uncertainties

- Moderation in earnings

- Rise in commodity prices

In 2023, despite common market challenges, the Indian markets exhibited resilience, surging to achieve a market capitalization of $4 trillion.

A Closer Look at Valuation Concern

Here’s the rationale behind justifying the current market valuations

Despite reaching new highs, the Indian market’s 82% PE premium indicates a comparatively less expensive valuation than last year.

Factors driving the market’s premium valuation relative to other nations:

- Robust economic growth compared to other countries. India has the highest real GDP growth at 7.6% among emerging markets.

- A promising outlook for strong corporate earnings.

- Witnessing robust demand across various sectors

- The banking sector exhibits improved stability and resilience.

- Anticipating positive trends in private capital expenditure cycles

- The ruling party’s favourable performance in state elections contributes to market sentiment.

- Strengthening market confidence for political stability, anticipating continuity of macro policies in the 2024 general election.

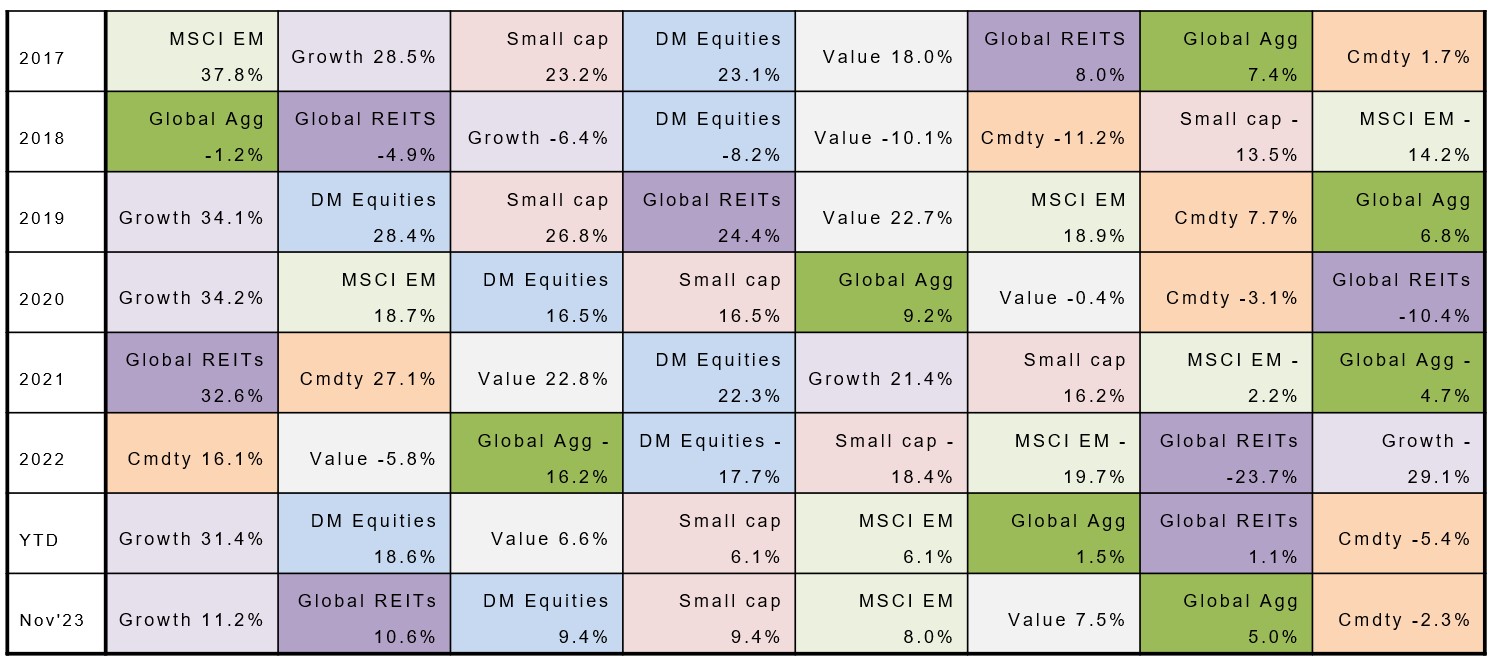

Asset Class & Style Returns

Equities Surge, Bond Yield Decline Amid Signs Of Economic Moderation

Source: Bloomberg Barclays, FTSE, LSEG Datastream, MSCI, J.P. Morgan Asset Management. DM Equities: MSCI World; REITs: FTSE NAREIT Global Real Estate Investment Trusts; Cmdty: Bloomberg Commodity Index; Global Agg: Bloomberg Global Aggregate; Growth: MSCI World Growth; Value: MSCI World Value; Small cap: MSCI World Small Cap. All indices are total returns in US dollars. Past performance is not a reliable indicator of current and future results. Data as of November 2023

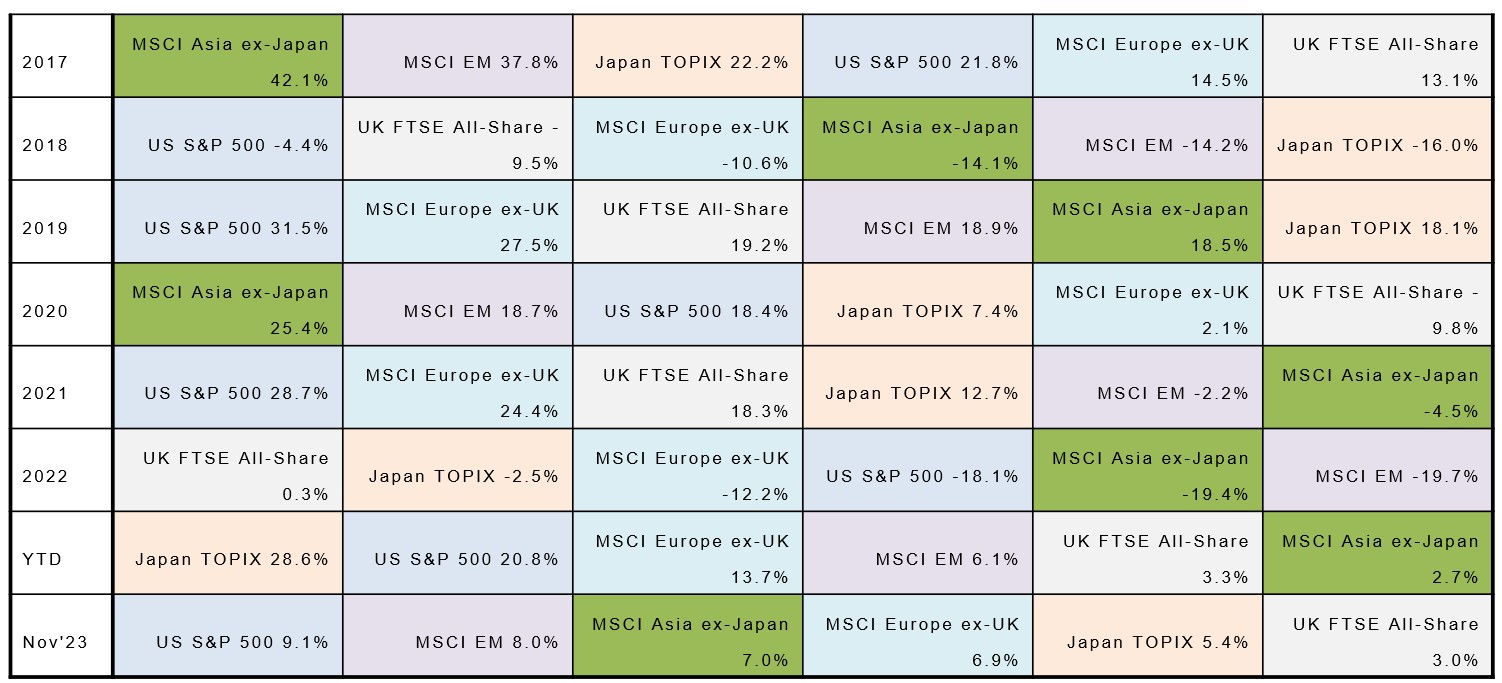

Overview: Global Markets

Equities Thrive on Economic Resilience, Small Caps Rally

Source: FTSE, LSEG Datastream, MSCI, S&P Global, TOPIX, J.P. Morgan Asset Management. All indices are total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of November 2023