In the words reminiscent of Sherlock Holmes, “the game is on.” The Indian media and entertainment landscape witness a seismic shift as Reliance Industries and Walt Disney officially announce their joint venture, marking a significant milestone in the industry. Nita Ambani, the esteemed chairperson of Reliance Industries, will helm the merged entity alongside former Walt Disney executive Uday Shankar, who assumes the role of Vice Chairperson.

This momentous $8.5 billion deal, after four months of intense negotiations, signifies the convergence of two entertainment giants, creating an unparalleled force in the Indian market. With an array of media assets spanning television channels like Colours, Star Plus, Star Gold, and sports channels such as Star Sports and Sports 18, this collaboration aims to redefine the entertainment experience for millions of Indian households.

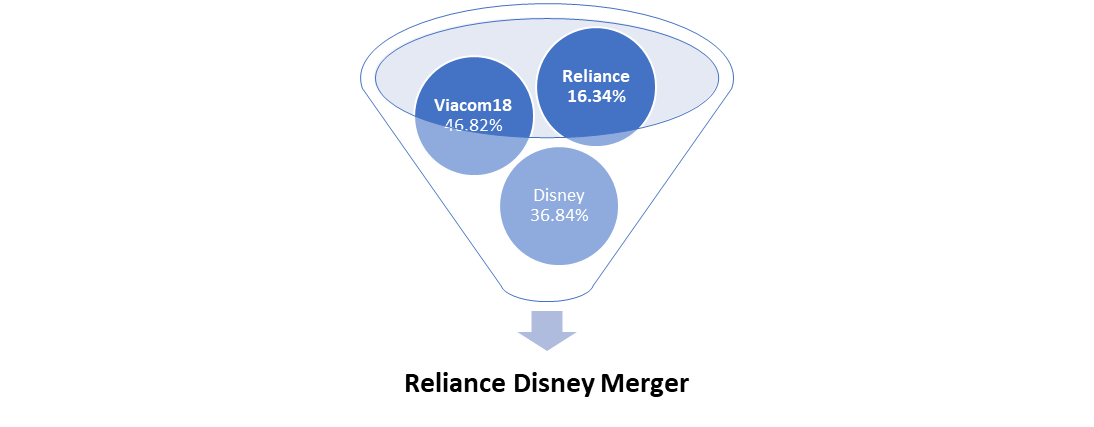

Shareholding details in the merged entity:

Reliance and affiliates will hold 63.16% of the merged entity, with Disney owning the remaining 36.84%. Valued at ₹70,352 crore (USD 8.5 billion), the joint venture will see Reliance controlling 16.34%, Viacom18 holding 46.82%, and Disney with 36.84%. Pending approvals, Disney plans to introduce more assets to the venture. Completion of the deal is expected between late 2024 and early 2025, marking a significant shift in India’s media landscape.

RIL Chief and Managing Director Mukesh Ambani remarks on merger “The composition of the new board, consisting of ten members, highlights the mutual vision of Reliance and Disney. Reliance will nominate five members, Disney three, and two independent members will ensure a fair representation of all stakeholders in the joint venture.”

Reliance Disney Merger Entity Structure

Impact on Media Industry:•Reliance Disney Merger

- Reliance Industries saw a 1% surge in stock price, reaching ₹2,957.95 on the NSE, emerging as the top gainer among Nifty50 stocks. Zee Entertainment Enterprises experienced a decline of over 4% in share value following the announcement of the merger. Network18 Media & Investments Ltd witnessed a significant drop of around 5% in share value, hitting the lower circuit at ₹107 on the NSE. The company’s market capitalization also declined to ₹11,202 crore. TV18 Broadcast Ltd, a subsidiary of Network18 Media, experienced a similar decline of 5% in share value, hitting the lower circuit at ₹59.55 apiece on the NSE.

- Experts predict that the merger between Reliance Industries and Disney will result in a larger entity with a portfolio of 115 channels and a substantial share (40-45%) in advertising revenue, intensifying competition within the media industry. As per the deal announced by Reliance and Disney, the media operations of Viacom18 will merge with Star India Pvt Ltd (SIPL), creating a joint venture valued at more than ₹70,000 crore.

- Viacom18, a subsidiary of Reliance Industries, and Disney’s Indian arm, Star India, signed an agreement to merge their businesses, forming a TV and digital streaming joint venture entity.

- Viacom18 Media, a subsidiary of TV18, holds a diverse portfolio of entertainment channels, sports channels, and digital platforms.

Reliance’s investment in OTT Business:

At the heart of this partnership lies the synergy between Reliance’s Jio Cinema and Disney’s Hotstar, promising an extensive OTT platform. Moreover, the joint venture secures exclusive distribution rights for Disney’s renowned films and productions within India, further bolstering its content portfolio.

One of the most notable implications of this merger is the consolidation of cricket broadcasting rights, including marquee events like the Indian Premier League (IPL). With Disney Star India and Viacom 18 commanding a combined viewership exceeding 750 million across India, the merged entity establishes itself as an unrivaled powerhouse in the industry.

Analysts predict that Reliance and Disney’s collaboration will dominate the Indian sports market, controlling approximately 80% of both television and digital sports properties.

In conclusion, the merger holds the promise of enhanced profitability for the combined entity, potentially driven by reduced employee, production, and marketing costs in the TV and content segments. However, the consolidation of JioCinema and Hotstar presents a formidable challenge for global OTT platforms, given India’s penchant for bundled offerings and price sensitivity. Moreover, in the realm of sports, the merged entity is poised to establish a virtual monopoly, with Disney and Jio jointly commanding around 75-80% of the Indian sports market across both traditional television and digital platforms.

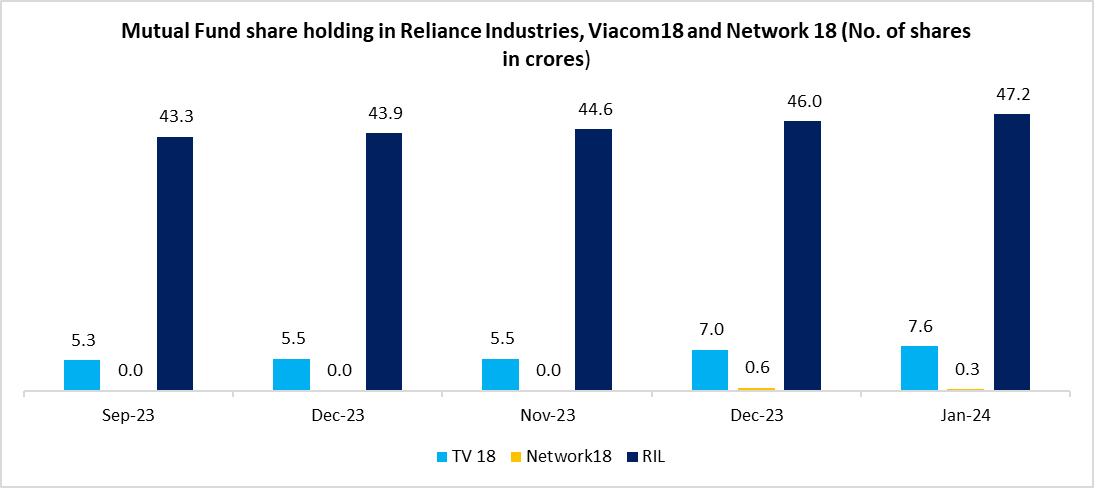

Meanwhile, mutual funds have been increasing their stake in all of the listed entities ahead of the merger.

Source: Trendlyne, Fisdom Research

Market this week

| 26th Feb 2024 (Open) | 01st Mar 2024 (Close) | %Change | |

| Nifty 50 | ₹ 22,169 | ₹ 22,378 | 0.9% |

| Sensex | ₹ 73,045 | ₹ 73,806 | 1.0% |

- The market surged to record highs on Friday, buoyed by impressive GDP numbers.

- Third-quarter GDP growth stood at an impressive 8.4%, surpassing expectations.

- The full-year estimate for 2023-24 GDP growth is projected at 7.6%, far exceeding earlier forecasts.

- Revised projections show a 0.6% increase in GDP growth and a 0.3% rise in GVA growth compared to previous estimates.

- Market euphoria stems from this remarkable performance amid global economic challenges, including sluggish growth, tightened monetary policies, high policy rates, receding globalization, and escalating geopolitical tensions.

- Notably, GDP growth in the December quarter of 2019, pre-pandemic, was a mere 3.26%, indicating significant progress since then.

Weekly Leaderboard

| NSE Top Gainers | NSE Top Losers | ||||

| Stock | Change (%) | Stock | Change (%) | ||

| L&T | ▲ | 8.02 % | Apollo Hospitals | ▼ | (9.24) % |

| TATA Motors | ▲ | 5.58 % | Bajaj auto | ▼ | (4.56) % |

| TATA Steel | ▲ | 4.54 % | Asian Paints | ▼ | (4.45) % |

| TATA Consumer | ▲ | 4.02 % | LTIMindtree | ▼ | (4.27) % |

| IndusInd Bank | ▲ | 3.22 % | Divi’s Lab | ▼ | (3.70) % |

Stocks that made the news this week:

- The Financial Intelligence Unit-India has levied a penalty of Rs 5.49 crore on Paytm Payments Bank for breaching money laundering regulations. This decision follows closely on the heels of the board of the parent company, Paytm, approving the termination of multiple inter-company agreements with Paytm Payments Bank..

- PROG Holdings, Inc. and Infosys have unveiled a partnership aimed at enhancing and expanding PROG Holdings’ technology operations. This agreement, integral to PROG’s ongoing modernization and innovation endeavors focusing on cloud and AI technologies, will leverage Infosys’ digital services to drive progress and efficiency.

- Hero MotoCorp, the global leader in motorcycle and scooter manufacturing, recorded robust sales figures for February 2024. With a total of 4,68,410 units sold, the company experienced a remarkable 19% growth compared to the same period last year, when it sold 3,94,460 units. Domestic sales saw a substantial increase of 16.5% year-on-year, reaching 4,45,257 units, while exports surged by an impressive 90.66% to 23,153 units during the month.